Chinese cash is set to fuel Europe’s green mobility challenge. More than one in five cars sold in the continent last year was electric, making the region the world’s second largest market for e-vehicles after China. That offers an enticing new opportunity for the battery makers from the People’s Republic, which already supply European brands such as Volkswagen , BMW and Stellantis , as well as globetrotting compatriots like Volvo-owner Geely. Over-reliance on Chinese market leader CATL and its peers could be a risk. But rival European battery groups are still scarce, and global carmakers have more to gain than lose.

of EU carmakers facing tit-for-tat measures in the Chinese car market, the world’s largest.

first announced its mega factory in Shanghai in 2018, the plant’s mooted output of 500,000 vehicles per year was equivalent to nearly half of the entire country’s annual electric-car sales at the time, making it a formidable competitor for smaller Chinese brands. Indeed by 2020, a year after the first car rolled off its new production line, Elon Musk’s company sold more than twice that target and its flagship Model 3 was China’s best-seller. But Tesla’s giant factory also offered benefits for.

Given the chance, Chinese battery makers can power up Europe’s own supply chains, and its auto companies too.China’s global investments into the supply chain for electric car batteries rose to 14.2 billion euros in 2022, up from 3.4 billion euros a year earlier, according to a report published by the Mercator Institute for China Studies on May 9. Hungary and Spain together accounted for 8.2 billion euros of total investments.

The report also showed that Chinese greenfield investment into Europe's battery segment grew by 55% to 4.5 billion euros last year, driven by a series of large-scale investments into manufacturing sites by manufacturers CATL, Envision AESC and SVOLT.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

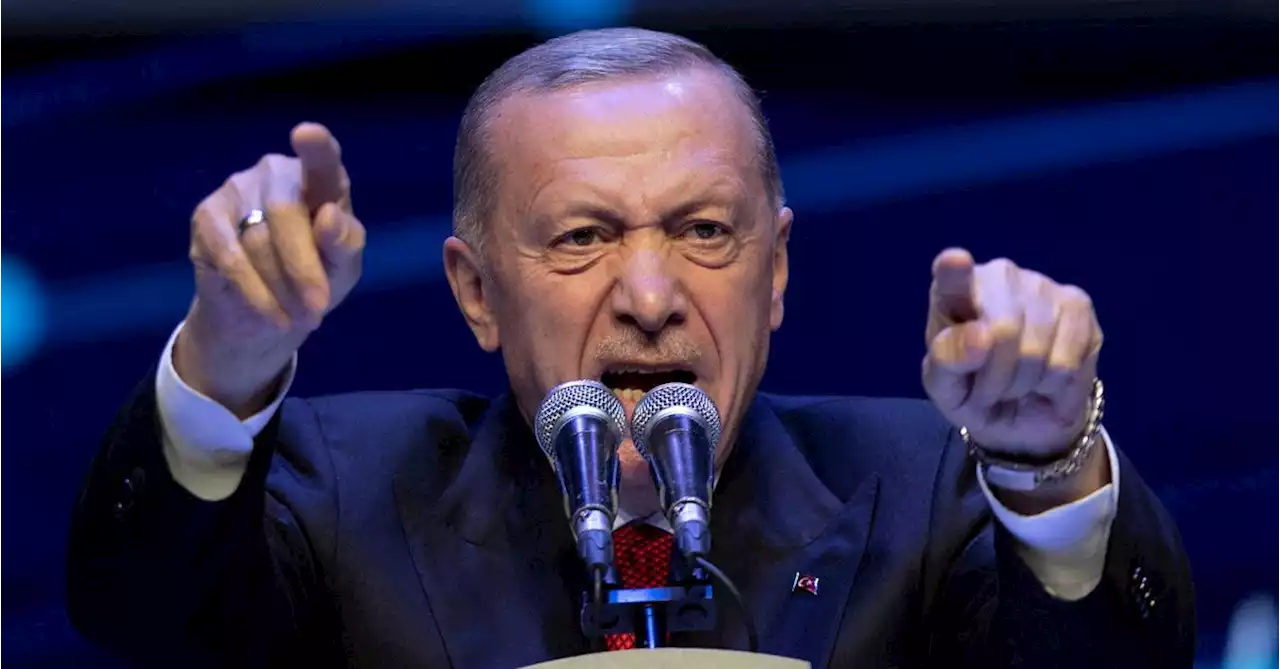

Breakingviews - Erdogan win sends stark note on economy and votesTayyip Erdogan’s re-election in Turkey sends a sharp message to leaders around the world: politics is trumping sound economics.

Breakingviews - Erdogan win sends stark note on economy and votesTayyip Erdogan’s re-election in Turkey sends a sharp message to leaders around the world: politics is trumping sound economics.

Read more »

Breakingviews - Saudi is a BRIC in crumbling East-West money wallMiddle East money is the answer to plugging the growing financial gaps created in Asia by Western investment restrictions, or at least that’s the very wishful thinking of the regions’ financiers and governments.

Breakingviews - Saudi is a BRIC in crumbling East-West money wallMiddle East money is the answer to plugging the growing financial gaps created in Asia by Western investment restrictions, or at least that’s the very wishful thinking of the regions’ financiers and governments.

Read more »

Breakingviews - How US allies can mitigate Trump 2.0A return to the White House by Donald Trump would create challenges for the world’s other rich democracies. After all, the former President likes Russia's Vladimir Putin, is sceptical about climate change and favours “Make America Great Again” protectionism. The best insurance policy for remaining members of the Group of Seven wealthy nations is to ramp up support for Ukraine, promote free trade and speed up action on global warming.

Breakingviews - How US allies can mitigate Trump 2.0A return to the White House by Donald Trump would create challenges for the world’s other rich democracies. After all, the former President likes Russia's Vladimir Putin, is sceptical about climate change and favours “Make America Great Again” protectionism. The best insurance policy for remaining members of the Group of Seven wealthy nations is to ramp up support for Ukraine, promote free trade and speed up action on global warming.

Read more »

Breakingviews - Syngenta’s IPO is more relief than triumphSyngenta’s $9 billion Chinese market listing finally looks ripe. Concerns about its share sale size forced the Switzerland-based agrichemical giant to opt for a last-minute venue change. Sadly, few foreign investors are likely to join its Shanghai debut party.

Breakingviews - Syngenta’s IPO is more relief than triumphSyngenta’s $9 billion Chinese market listing finally looks ripe. Concerns about its share sale size forced the Switzerland-based agrichemical giant to opt for a last-minute venue change. Sadly, few foreign investors are likely to join its Shanghai debut party.

Read more »

Breakingviews - India’s moment is obfuscated by its jobs deficit: podcastThe country is establishing itself on the global investment map. In this Exchange podcast, author and ex-IMF director Ashoka Mody talks about why executives should look at India’s underemployment problem instead of focusing on its 7% GDP growth as they size-up the opportunity.

Breakingviews - India’s moment is obfuscated by its jobs deficit: podcastThe country is establishing itself on the global investment map. In this Exchange podcast, author and ex-IMF director Ashoka Mody talks about why executives should look at India’s underemployment problem instead of focusing on its 7% GDP growth as they size-up the opportunity.

Read more »

Breakingviews - Toyota governance fight gets stuck in trafficGovernance campaigns against Japanese companies have a hard enough time gaining traction as it is. ValueAct Capital’s two-year campaign against Seven & i culminated last week with at best just a third of shareholders backing its four board candidates. Now proxy advisory firms are targeting Toyota’s board. But they are hamstrung by their own differing recommendations for the $232 billion carmaker’s shareholders.

Breakingviews - Toyota governance fight gets stuck in trafficGovernance campaigns against Japanese companies have a hard enough time gaining traction as it is. ValueAct Capital’s two-year campaign against Seven & i culminated last week with at best just a third of shareholders backing its four board candidates. Now proxy advisory firms are targeting Toyota’s board. But they are hamstrung by their own differing recommendations for the $232 billion carmaker’s shareholders.

Read more »