Carlyle boss Kewsong Lee stepped down at the $14 bln asset manager and co-founder Bill Conway will be in charge as they look for a replacement. That’s a step back in Carlyle’s transition, argues TheRealLSL:

, Carlyle blazed the path for private equity. Founders of other firms, including KKR’s Henry Kravis and Apollo’s Leon Black, all led them until recently. Steve Schwarzman still sits atop the $123 billion Blackstone, the largest of its competitors by market capitalization.

Lee was the start of a transition away from the people who opened Carlyle’s doors. He took up his role in 2018 alongside co-head Glenn Youngkin. In July , Youngkin stepped down, and later won a bid to become Virginia’s governor. Lee has been running the firm solo since then.Lee made strides to diversify Carlyle away from being too heavily into private equity, including taking a stake in insurance company Fortitude Re and expanding the credit practice. But shareholders haven’t seen a whole lot by way of results. Since the start of 2018, Carlyle’s shares including dividends have returned around 90%, about half that of KKR.

The stock fell 6% in midday trading on Monday, suggesting shareholders were annoyed that Lee and Carlyle couldn’t at least have come to an agreement that would have allowed him to finish up his five-year term. Now, one of Carlyle’s co-founders, Bill Conway, will lead it as they search for a new CEO. That in some regards is a step back. Conway is around 15 years Lee’s senior, and his appointment suggests there weren’t other candidates ready to go.

Transitional setbacks are natural after a company has been run by its founders for decades, and something similar could happen at any of Carlyle’s competitors. Still buyout shops are becoming broader in their scope and less flashy in the assets they manage and the fees that they charge. As the alternative asset management business starts to blend with traditional asset management, it becomes more competitive, and the environment more challenging.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Letter: Shame on Lee and Romney for again voting against the veterans-aiding “Burn Pit Bill”We just learned that the United States Senate passed the PACT Act by an 86-ll roll call vote. Sens. Mike Lee and Mitt Romney were two of the nay votes. This the second time that they voted against what is commonly known as the “Burn Pit Bill.”

Letter: Shame on Lee and Romney for again voting against the veterans-aiding “Burn Pit Bill”We just learned that the United States Senate passed the PACT Act by an 86-ll roll call vote. Sens. Mike Lee and Mitt Romney were two of the nay votes. This the second time that they voted against what is commonly known as the “Burn Pit Bill.”

Read more »

Why now is actually a great time to build a new PC | Digital TrendsCurrent gen CPUs and GPUs have never been cheaper, and passing up this opportunity to wait for the next generation might be a bad idea.

Why now is actually a great time to build a new PC | Digital TrendsCurrent gen CPUs and GPUs have never been cheaper, and passing up this opportunity to wait for the next generation might be a bad idea.

Read more »

Breakingviews - Breakingviews: U.S.-China relationship bleeds by a thousand cutsChinese officials love enumeration: the 'Three Represents' outlines the responsibilities of the Chinese Communist Party; the 'Five Confidences' codify socialism with Chinese characteristics. The latest 'Eight Suspends' may well become shorthand for the final stage of the disintegrating relationship between Washington and the People’s Republic.

Breakingviews - Breakingviews: U.S.-China relationship bleeds by a thousand cutsChinese officials love enumeration: the 'Three Represents' outlines the responsibilities of the Chinese Communist Party; the 'Five Confidences' codify socialism with Chinese characteristics. The latest 'Eight Suspends' may well become shorthand for the final stage of the disintegrating relationship between Washington and the People’s Republic.

Read more »

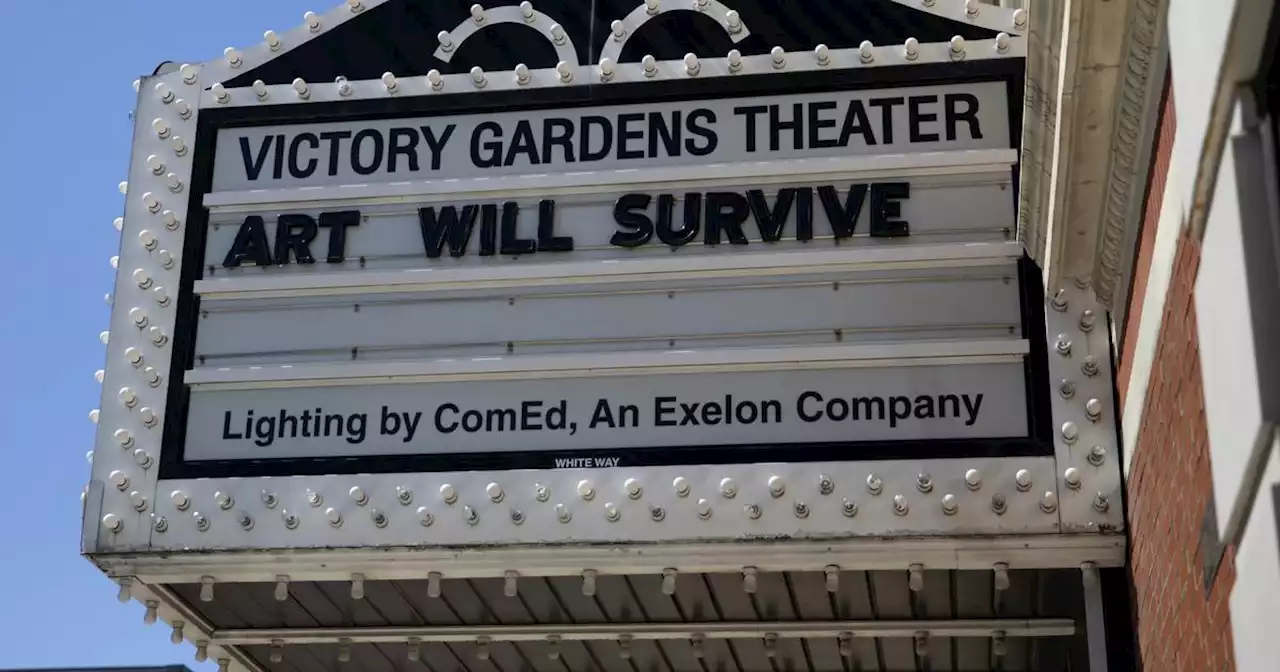

Column: Chicago theater has a crisis of leadership — and it has to stop eating its ownThe names aren’t included here and don’t matter a jot for the point I am making. Chicago theater needs to be a community again.

Column: Chicago theater has a crisis of leadership — and it has to stop eating its ownThe names aren’t included here and don’t matter a jot for the point I am making. Chicago theater needs to be a community again.

Read more »

Musician Cookbooks You Need for Your Next Dinner PartySee our top picks for celebrity cookbooks, from Snoop Dogg’s guide to “munchies” to Paul McCartney’s “meat free” meals.

Musician Cookbooks You Need for Your Next Dinner PartySee our top picks for celebrity cookbooks, from Snoop Dogg’s guide to “munchies” to Paul McCartney’s “meat free” meals.

Read more »

Breakingviews - Transportation M&A nightmare worth the tripWith transportation deals, as in life, it’s not the destination but the journey. Canadian Pacific Railway’s plan to close its $27 billion merger with Kansas City Southern has gotten fresh pushback after more than a year in limbo. And shareholders in JetBlue Airways’ tie-up with Spirit Airlines may be stuck in a similar layover. Painful concessions may be involved. But with deals in quasi-monopolistic industries, the key is seeing deals through.

Breakingviews - Transportation M&A nightmare worth the tripWith transportation deals, as in life, it’s not the destination but the journey. Canadian Pacific Railway’s plan to close its $27 billion merger with Kansas City Southern has gotten fresh pushback after more than a year in limbo. And shareholders in JetBlue Airways’ tie-up with Spirit Airlines may be stuck in a similar layover. Painful concessions may be involved. But with deals in quasi-monopolistic industries, the key is seeing deals through.

Read more »