The Bank of England has kickstarted a necessary series of British economic U-turns, writes Unmack1

Bank of England Governor Andrew Bailey speaks during the BoE’s financial stability report news conference, at the Bank of England, London, August 4, 2022. Yui Mok/Pool via REUTERS

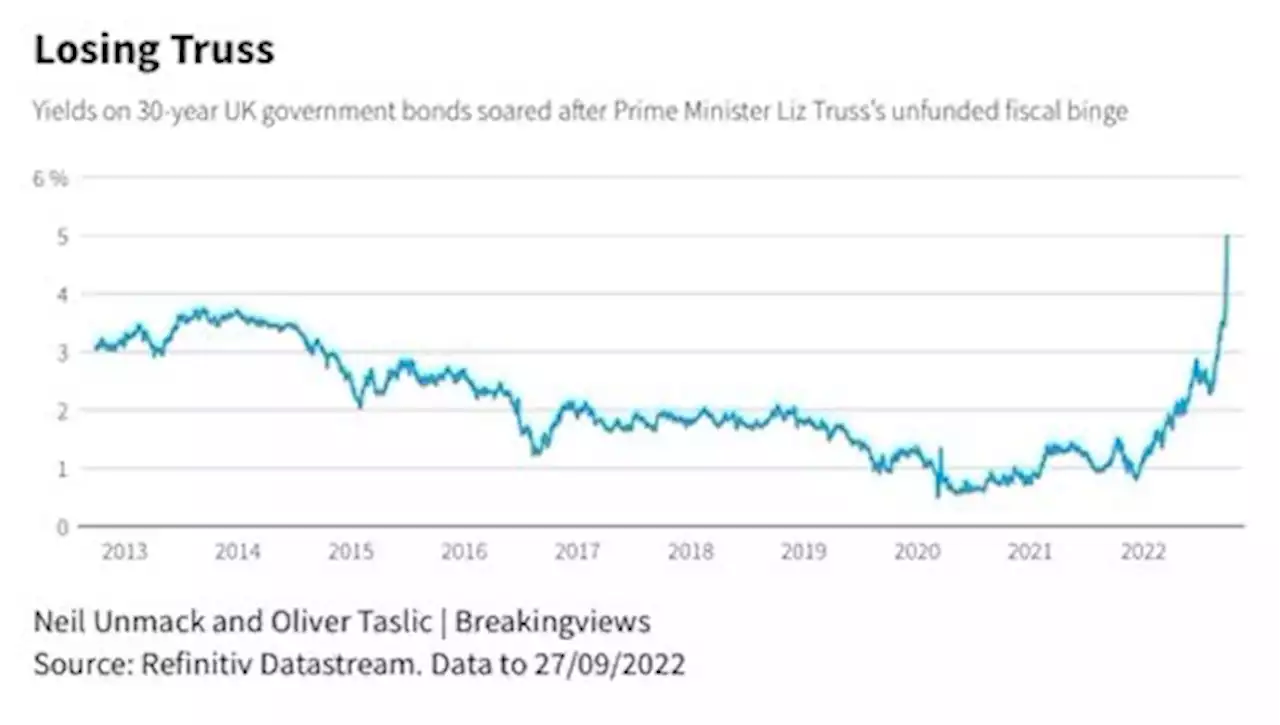

LONDON, Sept 28 - The Bank of England has kickstarted a necessary series of British economic U-turns. UK Prime Minister Liz Truss’s plan to slash taxes has sent the pound and bond prices into a tailspin. The fallout makes it even harder for Governor Andrew Bailey to convince markets he can tighten monetary policy. Hison Wednesday to buy UK government debt and delay plans to sell down its 857 billion pound bond portfolio carries big risks. But it may make the necessary interest rate hikes easier.

Truss’s unfunded tax cuts, unveiled last Friday, started a riot in the debt market. The yield on 10-year UK government bonds had shot up by over a percentage point since last Friday as investors dumped UK assets amid fears of runaway spending and inflation. Bailey needs to persuade investors he will belatedly act to stem price rises. That means being willing to jack up interest rates, even at the expense of stalling economic growth and lifting borrowing costs for homeowners and companies.

The turmoil comes at a particularly bad time because, like the Federal Reserve, the BoE has been preparing to reverse its policy of quantitative easing. That involves shrinking the portfolio of bonds the central bank acquired during recent financial and economic crises. Bailey’s goal is to cut holdings by 80 billion pounds over the next year. This so-called quantitative tightening would require asset managers and investors to buy more bonds even as the government cranks up borrowing.

The BoE’s response to what it called “dysfunction” in the markets is therefore logical, and effective: bond yields dropped sharply after the announcement. But it comes at a cost. There’s a clear danger that the central bank appears to be subsidising the government whose wayward policies created the turmoil. Yet a more orderly bond market will also make it easier for the bank to wield its chief policy weapon of higher interest rates.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England Inflation Fight and Truss Tax Cuts Are at Odds, Worrying InvestorsThe British pound has tumbled as the central bank tries to tame prices at the same time the new prime minister’s policies could stimulate demand.

Bank of England Inflation Fight and Truss Tax Cuts Are at Odds, Worrying InvestorsThe British pound has tumbled as the central bank tries to tame prices at the same time the new prime minister’s policies could stimulate demand.

Read more »

Bank of England Intervenes in Bond Market After Massive Sell-OffThe Bank of England will suspend the planned start of its gilt selling next week and begin temporarily buying long-dated bonds in order to calm the market chaos unleashed by the new government’s so-called “mini-budget.”

Bank of England Intervenes in Bond Market After Massive Sell-OffThe Bank of England will suspend the planned start of its gilt selling next week and begin temporarily buying long-dated bonds in order to calm the market chaos unleashed by the new government’s so-called “mini-budget.”

Read more »

Treasury yields reach 4%, then retreat, after Bank of England buys giltsBenchmark yields hit highest since 2008, but fall back after intervention by the Bank of England to support gilts sparked a rally across the bond markets

Treasury yields reach 4%, then retreat, after Bank of England buys giltsBenchmark yields hit highest since 2008, but fall back after intervention by the Bank of England to support gilts sparked a rally across the bond markets

Read more »

Gilt yields plunge after Bank of England steps in to buy at 'whatever scale is necessary'U.K. gilt yields fell from their highest in 14 years after the Bank of England said it would buy bonds at 'whatever scale is necessary' to restore orderly...

Gilt yields plunge after Bank of England steps in to buy at 'whatever scale is necessary'U.K. gilt yields fell from their highest in 14 years after the Bank of England said it would buy bonds at 'whatever scale is necessary' to restore orderly...

Read more »

Bank of England to Buy Bonds in Bid to Stop Spread of CrisisThe Bank of England said it would buy U.K. government bonds with long maturities “on whatever scale is necessary” in an effort to restore order to the market.

Bank of England to Buy Bonds in Bid to Stop Spread of CrisisThe Bank of England said it would buy U.K. government bonds with long maturities “on whatever scale is necessary” in an effort to restore order to the market.

Read more »

Bank of England seeks to stem bond market turmoilThe Bank of England sought to quell a fire-storm in the British bond market, saying on Wednesday it would buy as much government debt as needed to restore financial stability after chaos triggered by the new government's fiscal policy.

Bank of England seeks to stem bond market turmoilThe Bank of England sought to quell a fire-storm in the British bond market, saying on Wednesday it would buy as much government debt as needed to restore financial stability after chaos triggered by the new government's fiscal policy.

Read more »