War, Covid-19 and an aggressive-looking Federal Reserve are conspiring against the Bank of Japan’s ultra-loose monetary stance. The yen has plummeted and the central bank is struggling to keep control of key bond yields. Governor Haruhiko Kuroda must contemplate adjusting policy proactively, or watching market forces do it for him.

The core of Japan’s monetary strategy is a policy called “yield curve control” that caps treasury bond yields, some of them in negative territory. For a while it was effective, but major trading partners are now hiking rates as inflation spreads. In Japan, though, domestic prices are tame and GDP growth is tepid, so it’s senseless to follow suit.

anyway. Traders could just as easily attack that too. Alternatively a standing facility to buy unlimited 10-year bonds might intimidate the market. The most tempting option is to hope the yen finds a floor and bond speculators go away. But it’s dangerous to try to outwait market forces in an environment where so much has changed for good.The Japanese yen has weakened sharply against the dollar- The yield on the benchmark 10-year Japanese government bond hit a six-year high of 0.

- As a result, in an unprecedented intervention, the Bank of Japan offered to purchase an unlimited amount of the notes for four consecutive days after the yield touched 0.245% for the first time since January 2016. - The U.S. central bank may need to raise interest rates more aggressively to tackle high inflation, New York Federal Reserve President John Williams said on March 25. Several U.S. central bank officials, including Fed Chair Jerome Powell, indicated earlier this week a renewed sense of urgency in battling a surge in prices that has pushed inflation to a 40-year high.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

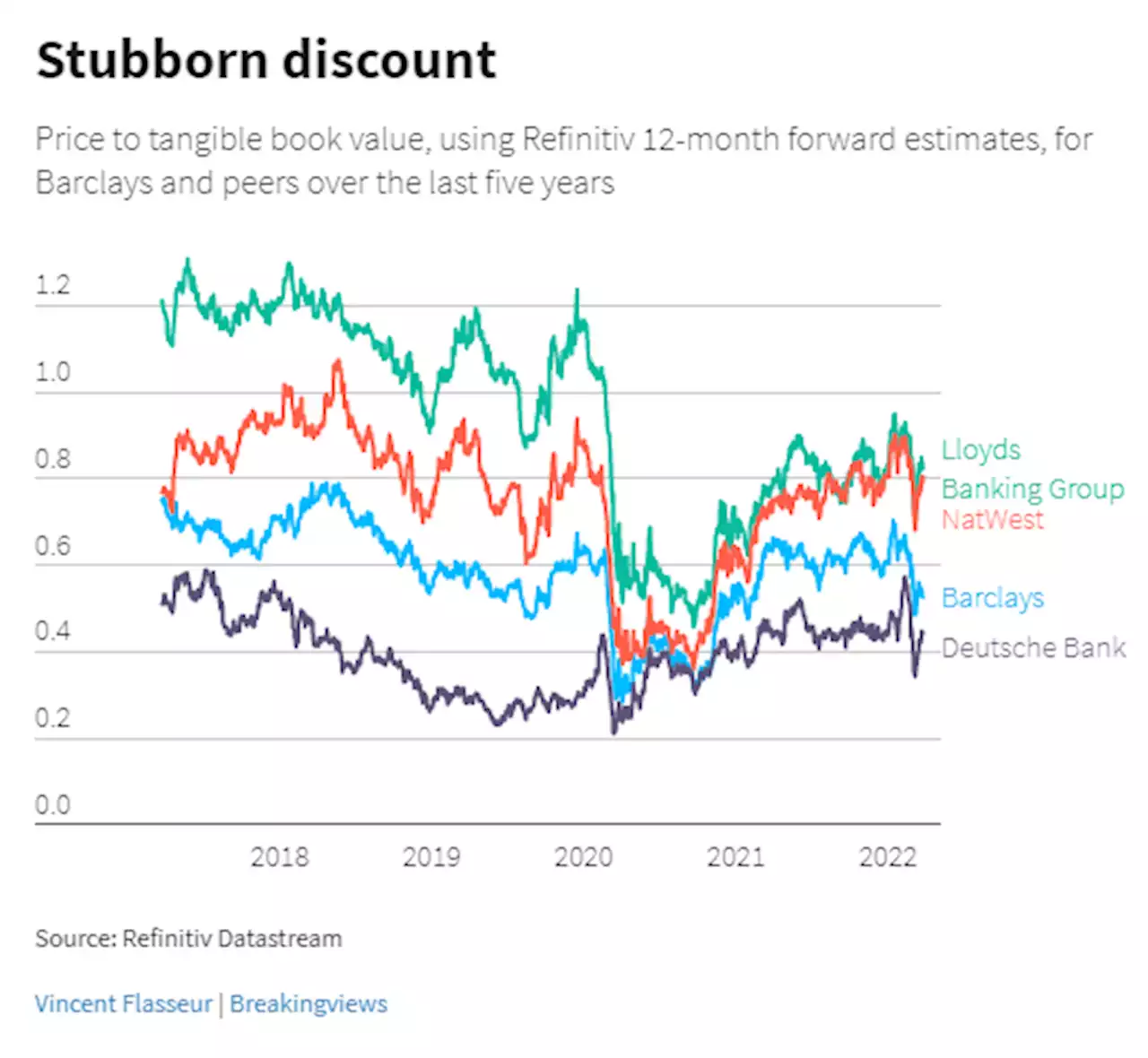

Breakingviews - Barclays’ blunder cements investment bank discountBarclays is reminding investors why it trades at a discount to steadier rivals. The 27 billion pound British bank on Monday alerted shareholders to a 450 million pound ($591 million) loss over mishandled structured-note sales. It seems to be a clerical error. Barclays registered with the U.S. Securities and Exchange Commission about $21 billion of structured products but ended up exceeding that cap by roughly $15 billion. It now has to let investors sell back the excess notes at their issue price, resulting in a loss. The hit to common equity Tier 1 capital should be about 29 basis points – enough to delay the company’s share buyback programme.

Breakingviews - Barclays’ blunder cements investment bank discountBarclays is reminding investors why it trades at a discount to steadier rivals. The 27 billion pound British bank on Monday alerted shareholders to a 450 million pound ($591 million) loss over mishandled structured-note sales. It seems to be a clerical error. Barclays registered with the U.S. Securities and Exchange Commission about $21 billion of structured products but ended up exceeding that cap by roughly $15 billion. It now has to let investors sell back the excess notes at their issue price, resulting in a loss. The hit to common equity Tier 1 capital should be about 29 basis points – enough to delay the company’s share buyback programme.

Read more »

Sudan's Central Bank Warns Against Using Crypto as Economy Suffers: ReportSudan's central bank has warned citizens against using cryptocurrencies over financial and legal risks. By iamsandali

Sudan's Central Bank Warns Against Using Crypto as Economy Suffers: ReportSudan's central bank has warned citizens against using cryptocurrencies over financial and legal risks. By iamsandali

Read more »

Anonymous Claims It Has Released 28GB of Bank of Russia Documents – Bitcoin NewsHacking group Anonymous has reportedly published a large amount of data allegedly belonging to the Bank of Russia.

Anonymous Claims It Has Released 28GB of Bank of Russia Documents – Bitcoin NewsHacking group Anonymous has reportedly published a large amount of data allegedly belonging to the Bank of Russia.

Read more »

NFTs Could Go Mainstream With Instagram’s Planned Support, Deutsche Bank Says.instagram could simplify the process of buying and selling NFTs with its planned support, DeutscheBank said in a report. By willcanny99

NFTs Could Go Mainstream With Instagram’s Planned Support, Deutsche Bank Says.instagram could simplify the process of buying and selling NFTs with its planned support, DeutscheBank said in a report. By willcanny99

Read more »

The Bank of Canada will almost certainly take the steeper path to higher rates next monthThe Bank of Canada will almost certainly take the steeper path to higher rates next month — via financialpost Canada interestrates

The Bank of Canada will almost certainly take the steeper path to higher rates next monthThe Bank of Canada will almost certainly take the steeper path to higher rates next month — via financialpost Canada interestrates

Read more »