Apple is late to the buy-now-pay-later party. When boss Tim Cook unveiled plans last June to offer American shoppers a version of the popular four-payment system for buying merchandise, the market was in a somewhat healthier state. If anyone can help validate the product, it’s Apple, but times are considerably tougher.

, which bought industry pioneer AfterPay for $29 billion in February 2022, have slumped, too. Customers flocked to the small and short-term loans through the pandemic, attracted by interest-free debt and promises that their borrowing wouldn’t be reported to credit agencies unless they miss payments or fail to pay the money back.reported findings

earlier this month that pay-later consumers, on average, are more likely to be highly indebted and default than the typical credit card user. Apple will be well-versed in these risks, but a bigger crackdown is probably coming. What’s more, shifting consumer sentiment and a cooling economy could hurt demand and increase the risk of bad loans. The $2.5 trillion iPhone maker wouldn’t be the first corporate titan to answer the siren call of financing.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

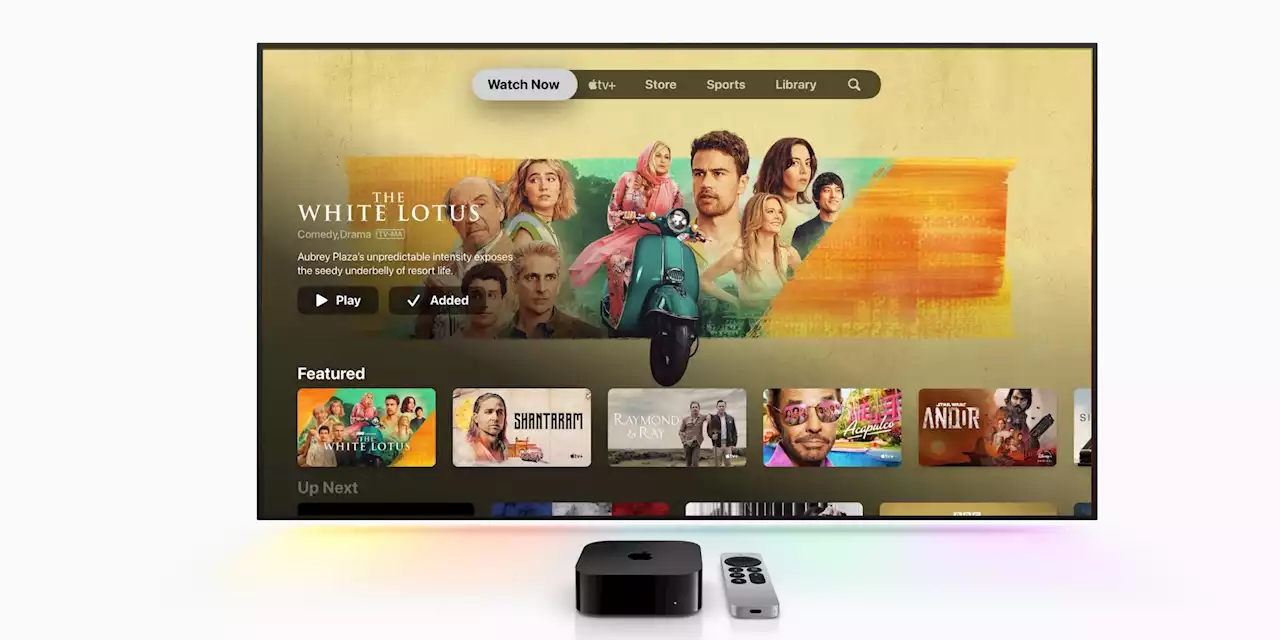

Apple acquires startup that could improve Apple TV+ streamingApple has acquired a Mountain View-based startup called WaveOne, which was developing AI algorithms for compressing video

Apple acquires startup that could improve Apple TV+ streamingApple has acquired a Mountain View-based startup called WaveOne, which was developing AI algorithms for compressing video

Read more »

Apple introduces way to split payments in Apple PayApple will now let consumers use its mobile payment service, Apply Pay, to make purchases immediately and pay for them in installments over time.

Apple introduces way to split payments in Apple PayApple will now let consumers use its mobile payment service, Apply Pay, to make purchases immediately and pay for them in installments over time.

Read more »

Breakingviews - Musk’s Twitter markdown falls short of the markElon Musk is being characteristically optimistic. The billionaire owner of Twitter has offered stock grants to the social media app’s shrunken staff at a valuation of about $20 billion, less than half the price he paid in October. In fact, based on Twitter’s operating performance, the effects of leverage and public market comparisons, the equity is probably worthless.

Breakingviews - Musk’s Twitter markdown falls short of the markElon Musk is being characteristically optimistic. The billionaire owner of Twitter has offered stock grants to the social media app’s shrunken staff at a valuation of about $20 billion, less than half the price he paid in October. In fact, based on Twitter’s operating performance, the effects of leverage and public market comparisons, the equity is probably worthless.

Read more »

Breakingviews - Jack Ma is Beijing’s prodigal entrepreneurIn the biblical parable of the prodigal son, a repentant wastrel returns home to a forgiving and beneficent father. In China, Alibaba founder Jack Ma's homecoming and rehabilitation appears to be part of an official campaign to revive flagging private sector investment. It is unclear who is forgiving who.

Breakingviews - Jack Ma is Beijing’s prodigal entrepreneurIn the biblical parable of the prodigal son, a repentant wastrel returns home to a forgiving and beneficent father. In China, Alibaba founder Jack Ma's homecoming and rehabilitation appears to be part of an official campaign to revive flagging private sector investment. It is unclear who is forgiving who.

Read more »

Breakingviews - Private equity finds silver lining in Asia PacificIt’s hard working in Asia-Pacific private equity these days. The value of deals struck in the region last year almost halved to $198 billion as slower growth, rising inflation and higher interest rates took their toll, research from Bain & Company shows. Yet there are signs of hope.

Breakingviews - Private equity finds silver lining in Asia PacificIt’s hard working in Asia-Pacific private equity these days. The value of deals struck in the region last year almost halved to $198 billion as slower growth, rising inflation and higher interest rates took their toll, research from Bain & Company shows. Yet there are signs of hope.

Read more »

Breakingviews - Easy Diageo succession belies new CEO’s hard jobDiageo’s incoming boss had better be thirsty for a challenge. On Tuesday, the 80 billion pound maker of Guinness and Don Julio tequila announced that Chief Operating Officer Debra Crew would replace CEO Ivan Menezes in July. It’s a textbook succession. Menezes was also COO before he took the top job. The company’s shares barely budged on the news, suggesting investors were well prepared, and that they expect Crew to stick with the current strategy of boosting growth.

Breakingviews - Easy Diageo succession belies new CEO’s hard jobDiageo’s incoming boss had better be thirsty for a challenge. On Tuesday, the 80 billion pound maker of Guinness and Don Julio tequila announced that Chief Operating Officer Debra Crew would replace CEO Ivan Menezes in July. It’s a textbook succession. Menezes was also COO before he took the top job. The company’s shares barely budged on the news, suggesting investors were well prepared, and that they expect Crew to stick with the current strategy of boosting growth.

Read more »