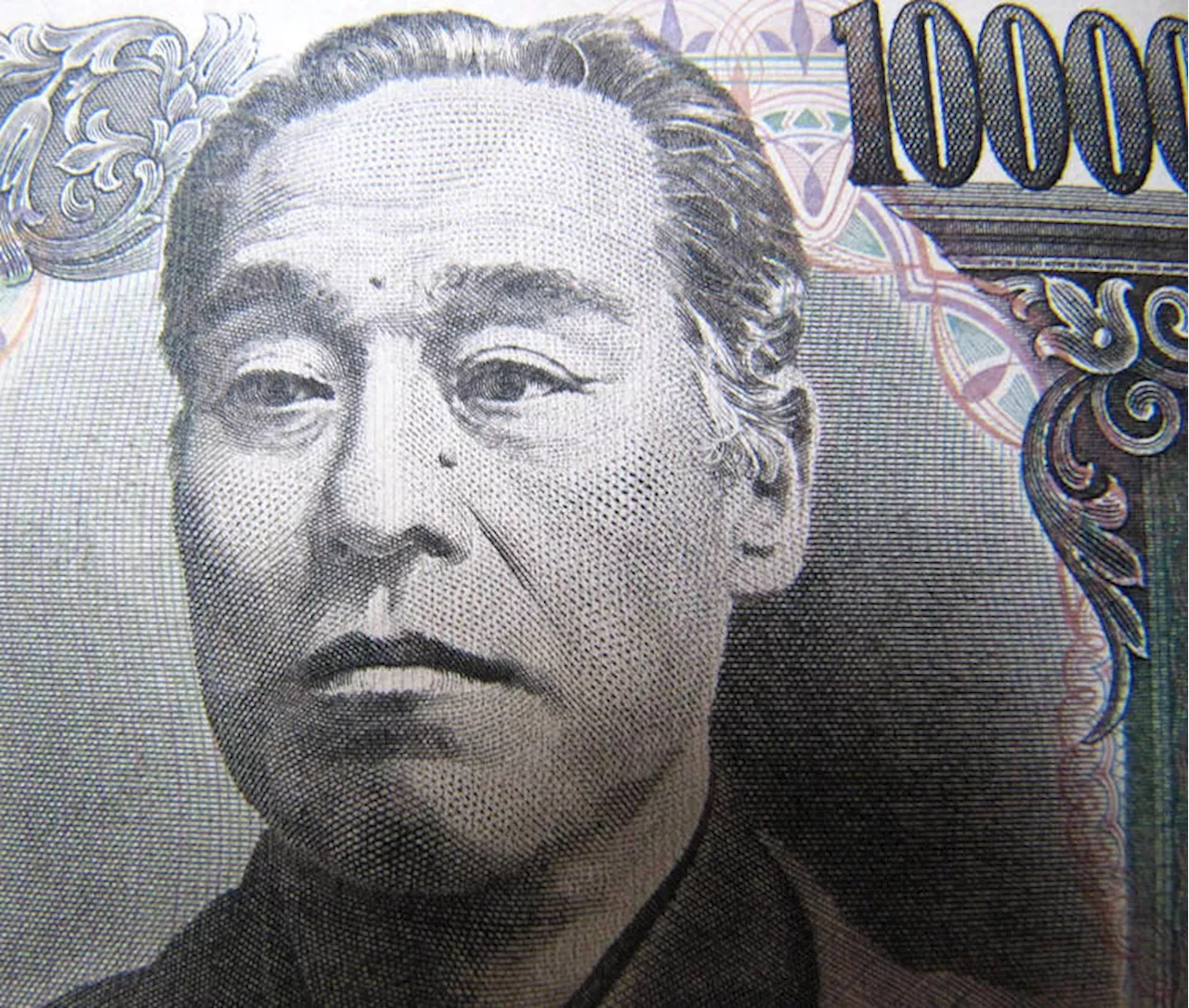

While analysts predict no change at this week's Bank of Japan (BOJ) meeting, opinions are divided on future rate hikes. Some experts anticipate a move in October or December, citing strong inflation and wage data, while others believe the yen's appreciation and potential Fed cuts will deter the BOJ from raising rates again this year.

There is consensus among the 32 analysts polled by CNBC that there would be no change at this week's BOJ meeting, which concludes Friday.Analysts polled by CNBC gave a year-end forecast for the yen of 140.2 against the U.S. dollar.

Gregor Hirt, global chief investment officer for multi asset at Allianz Global Investors, sees a strong chance of one hike this year, most likely in October. On the other hand, Richard Kaye, a portfolio manager for Japan equities at Comgest, told CNBC it is highly unlikely the central bank will raise rates again this year, especially if the Japanese yen continues to appreciate.

The BOJ surprised some market participants in July, when it decided to raise borrowing costs to 0.25% which helped spur aA Reuters poll of economists published last month estimated a 57% chance that the BOJ would raise rates again by year end.CNBC also surveyed 28 analysts about their end of year forecast for the Japanese yen against the dollar. The average projection is 140.2.

BOJ Interest Rate Hike Japanese Yen Economics Monetary Policy

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Fed's dovish shift a mixed blessing for BOJ rate hike planFed's dovish shift a mixed blessing for BOJ rate hike plan

Fed's dovish shift a mixed blessing for BOJ rate hike planFed's dovish shift a mixed blessing for BOJ rate hike plan

Read more »

Japan August inflation seen accelerating, boosting case for BOJ rate hikeJapan August inflation seen accelerating, boosting case for BOJ rate hike - Reuters poll

Japan August inflation seen accelerating, boosting case for BOJ rate hikeJapan August inflation seen accelerating, boosting case for BOJ rate hike - Reuters poll

Read more »

Japanese Yen rises due to increasing odds of a further BoJ rate hikeThe Japanese Yen (JPY) appreciates for the second consecutive day against the US Dollar (USD), driven by hawkish sentiment surrounding the Bank of Japan (BoJ).

Japanese Yen rises due to increasing odds of a further BoJ rate hikeThe Japanese Yen (JPY) appreciates for the second consecutive day against the US Dollar (USD), driven by hawkish sentiment surrounding the Bank of Japan (BoJ).

Read more »

USD/JPY Bears Eye Break Below Key 142 Level With Fed Cut, BoJ Hike in PlayForex Analysis by Investing.com (Damian Nowiszewski) covering: USD/JPY. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

USD/JPY Bears Eye Break Below Key 142 Level With Fed Cut, BoJ Hike in PlayForex Analysis by Investing.com (Damian Nowiszewski) covering: USD/JPY. Read Investing.com (Damian Nowiszewski)'s latest article on Investing.com

Read more »

AUD/JPY remains capped under 98.00, investors await BoJ’s Ueda speechThe AUD/JPY cross trades in negative territory for the third consecutive day around 97.90 during the Asian trading hours on Thursday.

AUD/JPY remains capped under 98.00, investors await BoJ’s Ueda speechThe AUD/JPY cross trades in negative territory for the third consecutive day around 97.90 during the Asian trading hours on Thursday.

Read more »

Japanese Yen remains tepid ahead of BoJ Governor Ueda's speech in parliamentThe Japanese Yen (JPY) edges lower against the US Dollar (USD) on Thursday.

Japanese Yen remains tepid ahead of BoJ Governor Ueda's speech in parliamentThe Japanese Yen (JPY) edges lower against the US Dollar (USD) on Thursday.

Read more »