When BlackRock filed to create a spot $BTC ETF, market watchers fixated on a mechanism that allows suspicious trades to be flagged to the authorities. What’s more likely to influence the SECGov is an information-sharing deal. IanAllison123 reports.

added. But what’s more likely to influence the U.S. Securities and Exchange Commission ’s decision is an information-sharing deal that flips the position of power in the arrangement and gives regulators the right to demand extra background.

The information in question could be about specific trades or traders, and the agreement also compels a crypto exchange to share data up to and including personally identifiable information , such as the customer’s name and address. Information-sharing agreements do not appear in any of the spot bitcoin ETF filings, but the structure is found in other markets.

Going back to 2017, the SEC has highlighted the need for bitcoin ETF applications to have a surveillance-sharing agreement withbut firms have lacked clarity and an objective standard when it comes to interpreting this. Whenever a broker has a client that sends an order to Nasdaq, for example, and that order is flagged as suspicious by the exchange’s SMARTS surveillance system, then the broker and the exchange are required to file a suspicious activity report .

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bitcoin halving bullish for Saylor’s MicroStrategy: Berenberg CapitalAnalysts from Berenberg Capital Markets say that the upcoming Bitcoin halving could be a major positive for value of shares in saylor’s enterprise analytics firm MicroStrategy.

Bitcoin halving bullish for Saylor’s MicroStrategy: Berenberg CapitalAnalysts from Berenberg Capital Markets say that the upcoming Bitcoin halving could be a major positive for value of shares in saylor’s enterprise analytics firm MicroStrategy.

Read more »

Grayscale's Lawyers Protest SEC's Leveraged Bitcoin ETF ApprovalLawyers for Grayscale have sent a letter to a D.C. court protesting the SECgov's approval of a leveraged bitcoin-based ETF application after the SEC rejected its own spot bitcoin-based ETF application. LizKNapolitano reports

Grayscale's Lawyers Protest SEC's Leveraged Bitcoin ETF ApprovalLawyers for Grayscale have sent a letter to a D.C. court protesting the SECgov's approval of a leveraged bitcoin-based ETF application after the SEC rejected its own spot bitcoin-based ETF application. LizKNapolitano reports

Read more »

Former SEC Chair Says It Would Be Hard to Resist Approving Bitcoin ETFIn recent interview with CNBC, former SEC Chairman Jay Clayton expressed that it would be 'hard to resist' approving Bitcoin ETF as long as regulatory safeguards, similar to those in futures market, are in place

Former SEC Chair Says It Would Be Hard to Resist Approving Bitcoin ETFIn recent interview with CNBC, former SEC Chairman Jay Clayton expressed that it would be 'hard to resist' approving Bitcoin ETF as long as regulatory safeguards, similar to those in futures market, are in place

Read more »

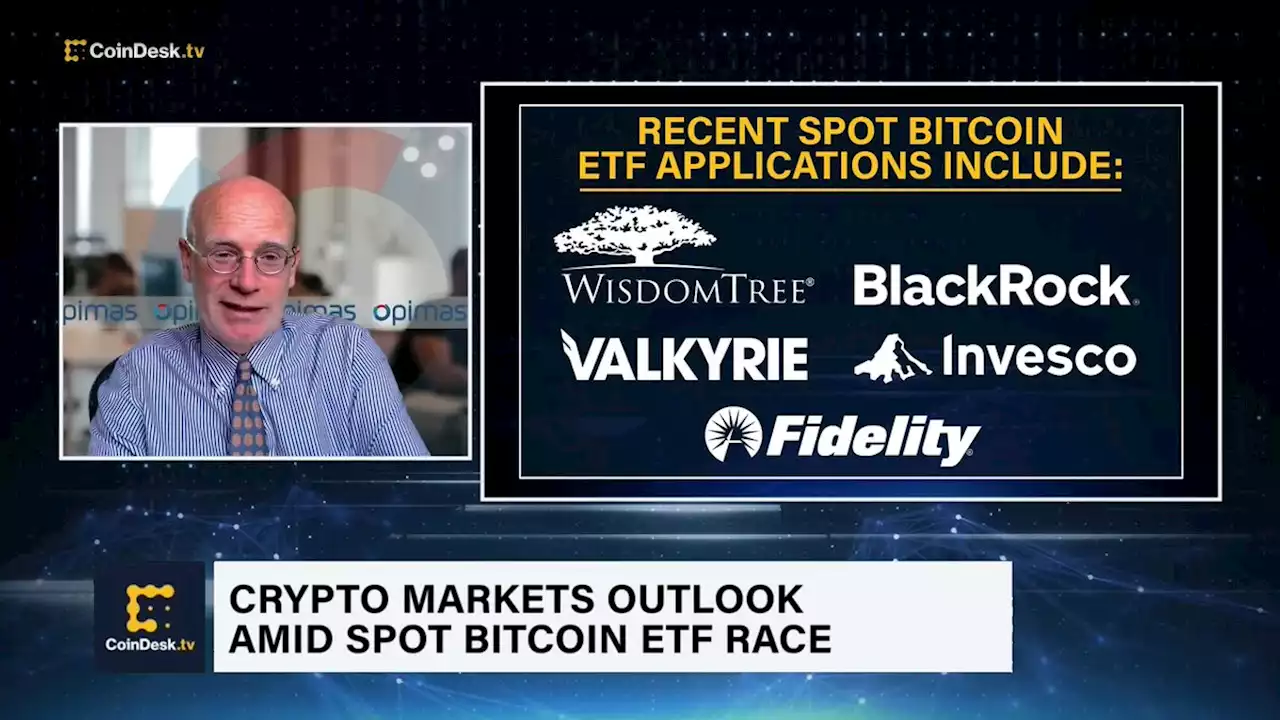

Opimas LLC CEO: BlackRock’s Spot Bitcoin ETF Filing Likely 'Dead on Arrival'Opimas LLC CEO and founder Octavio Marenzi shares his reaction to BlackRock filing for a spot bitcoin exchange-traded fund (ETF) with Coinbase as their partner in the surveillance-sharing agreements. 'They've identified a custodian for the assets that the SEC itself has said is operating illegally...I don't quite see how BlackRock makes this happen,' Marenzi said.

Opimas LLC CEO: BlackRock’s Spot Bitcoin ETF Filing Likely 'Dead on Arrival'Opimas LLC CEO and founder Octavio Marenzi shares his reaction to BlackRock filing for a spot bitcoin exchange-traded fund (ETF) with Coinbase as their partner in the surveillance-sharing agreements. 'They've identified a custodian for the assets that the SEC itself has said is operating illegally...I don't quite see how BlackRock makes this happen,' Marenzi said.

Read more »

Grayscale lawyers criticize SEC over leveraged bitcoin ETFGrayscale lawyer Donald Verrilli argued that the leveraged crypto ETF is “an even riskier investment product.'

Grayscale lawyers criticize SEC over leveraged bitcoin ETFGrayscale lawyer Donald Verrilli argued that the leveraged crypto ETF is “an even riskier investment product.'

Read more »

Former SEC chair says bitcoin ETF approval 'hard to resist' if 'efficacy' provenFormer SEC Chair Jay Clayton said that applicants for a spot bitcoin ETF have a strong chance at approval if they can prove that it’s a more efficient and effective way for investors to buy into the digital asset.

Former SEC chair says bitcoin ETF approval 'hard to resist' if 'efficacy' provenFormer SEC Chair Jay Clayton said that applicants for a spot bitcoin ETF have a strong chance at approval if they can prove that it’s a more efficient and effective way for investors to buy into the digital asset.

Read more »