BlackRock, a major Wall Street firm, is investing millions of dollars in an estimated 30 Chinese military-linked companies currently sanctioned by the U.S. government, according to a think tank report prepared for Congress.

The New York Stock Exchange is shown on Tuesday, March 19, 2024, in New York. Stocks are opening lower as some of Wall Street’s mania around artificial-intelligence technology cools.

Noting that BlackRock has said it does not do business with firms in China producing nuclear arms, the report concludes: “The reality is that BlackRock holds stock in Chinese companies pursuing an aggressive buildup of nuclear warheads meant to hold United States territory at risk.” BlackRock is regarded as among the most powerful companies and its giant asset fund “gives BlackRock influence over thousands of companies worldwide,” the report said.

While both BlackRock and MSCI say they promote ESG agendas, the companies “willfully undermine congressional intent to protect defenseless Uyghurs by investing in companies involved in the ongoing oppression,” the report said. CGN Power’s parent, China General Nuclear Power Group, is a military-controlled company that was sanctioned by the U.S. government in 2019 for allegedly trying to steal nuclear technology and materials from the United States, the report said. BlackRock funds invested $142 million in CGN Power, according to the report.

The committee report said MSCI, described as the world’s leading index provider, and BlackRock, dubbed the world’s largest asset manager, funneled $3.7 billion and $1.9 billion, respectively, into banned Chinese companies. The report is based on publicly available information that compared BlackRock’s financial holdings in China with sanctions lists published by the Treasury and Commerce Departments, and the congressionally mandated list of Chinese military companies produced by the Pentagon.

“This symbiotic relationship allows Wall Street to pull management fees out of China’s multi-trillion-dollar investment market while Beijing channels billions of dollars to companies that support the PLA,” Mr. Bernier said. The CPA report contended that BlackRock has been able to circumvent U.S. sanctions law by offering investment products through foreign subsidiaries, including Hong Kong-based BlackRock Asset Management North Asia Limited. In mainland China, BlackRock is represented by BlackRock Fund Management Company, a wholly-owned mutual fund company located in Shanghai.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BlackRock updates Bitcoin ETF, adds 5 Wall Street firmsBlackRock updated its Bitcoin ETF prospectus on April 5, adding five big Wall Street firms as new authorized participants.

Read more »

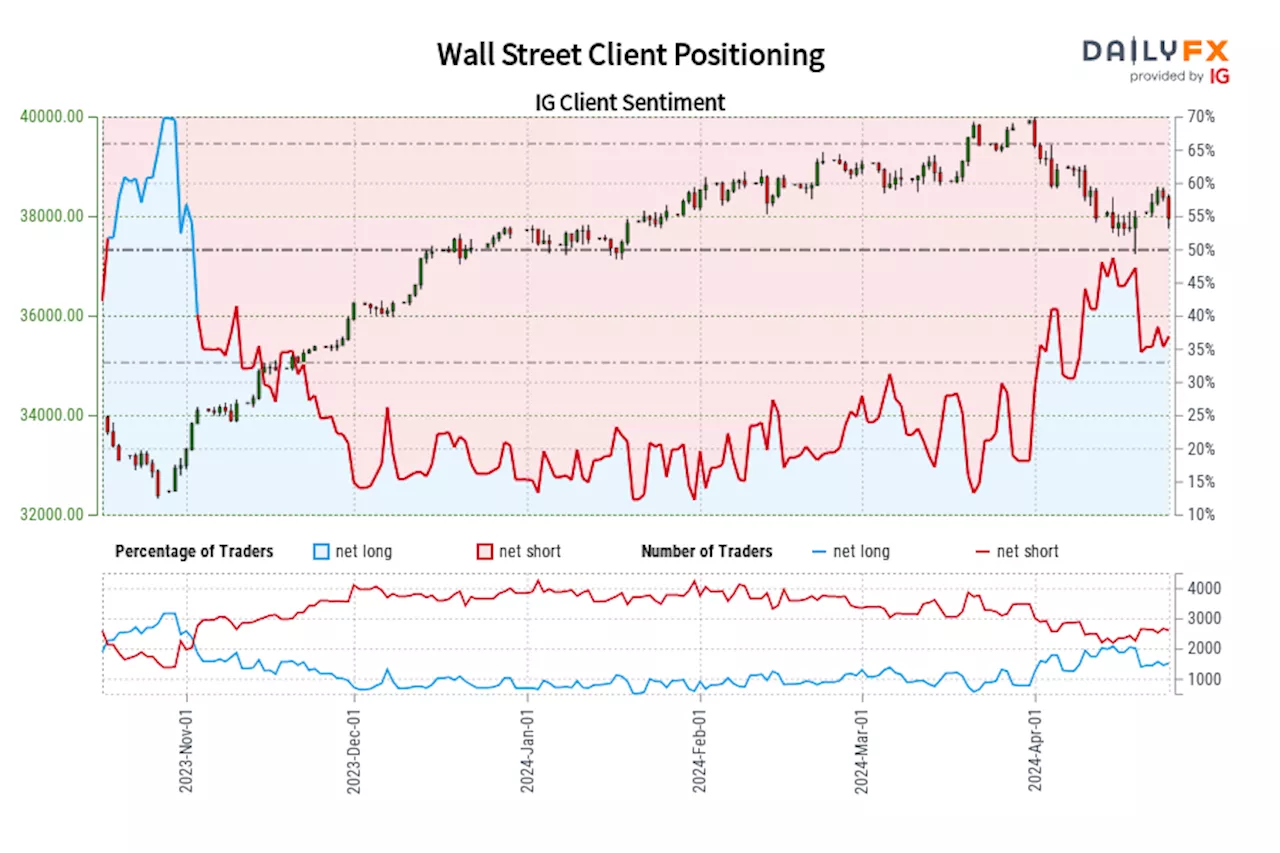

Wall Street IG Client Sentiment: Our data shows traders are now net-long Wall Street for the first time since Nov 02, 2023 when Wall Street traded near 33,825.70.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias.

Wall Street IG Client Sentiment: Our data shows traders are now net-long Wall Street for the first time since Nov 02, 2023 when Wall Street traded near 33,825.70.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias.

Read more »

![]() Asia markets mostly rise, tracking Wall Street gains; China factory activity data on deckJapan’s top currency diplomat Masato Kanda declined to comment on whether the finance ministry had intervened in the yen.

Asia markets mostly rise, tracking Wall Street gains; China factory activity data on deckJapan’s top currency diplomat Masato Kanda declined to comment on whether the finance ministry had intervened in the yen.

Read more »

Asia markets mostly set to track Wall Street gains; China factory activity data on deckInvestors will be looking for any official confirmation or denial that Japan has intervened in the yen, after the currency swung wildly on Monday.

Asia markets mostly set to track Wall Street gains; China factory activity data on deckInvestors will be looking for any official confirmation or denial that Japan has intervened in the yen, after the currency swung wildly on Monday.

Read more »

Asia markets mostly set to track Wall Street gains; China factory activity data on deckInvestors will be looking for any official confirmation or denial that Japan has intervened in the yen, after the currency swung wildly on Monday.

Asia markets mostly set to track Wall Street gains; China factory activity data on deckInvestors will be looking for any official confirmation or denial that Japan has intervened in the yen, after the currency swung wildly on Monday.

Read more »

Vanguard, State Street and BlackRock Key Votes at Disney Shareholder MeetingVanguard, State Street and BlackRock, the largest investors at Disney, are key votes to court as Wednesday's shareholder meeting nears. Other institutional holders also control a significant portion of Disney shares. Smaller shareholders, including Norway's sovereign wealth fund, have confirmed their support for the current management. Trian, the activist investor, has gained support from former Marvel chairman Ike Perlmutter and other institutional investors.

Vanguard, State Street and BlackRock Key Votes at Disney Shareholder MeetingVanguard, State Street and BlackRock, the largest investors at Disney, are key votes to court as Wednesday's shareholder meeting nears. Other institutional holders also control a significant portion of Disney shares. Smaller shareholders, including Norway's sovereign wealth fund, have confirmed their support for the current management. Trian, the activist investor, has gained support from former Marvel chairman Ike Perlmutter and other institutional investors.

Read more »