BlackRock CEO's latest letter departs from those of the past several years — giving less emphasis to climate risk and ESG investments.

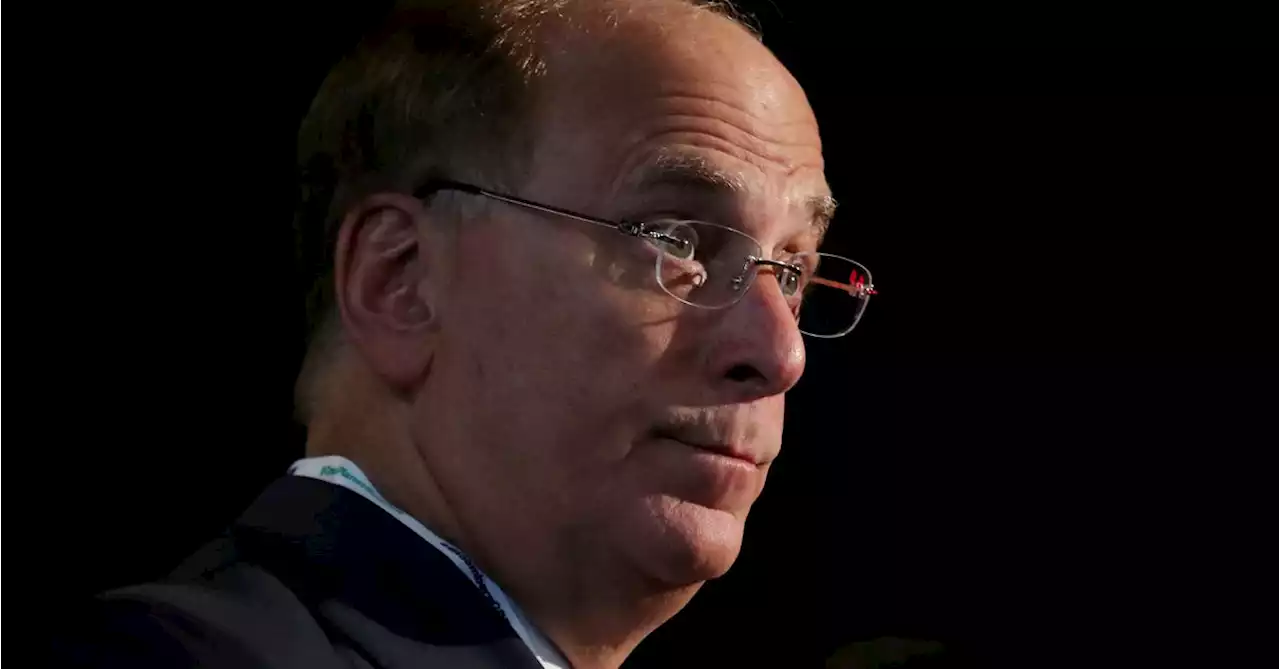

This year’s chairman’s letter from BlackRock CEO Larry Fink, published Wednesday, gives less emphasis to climate risk and environmental, social and governance investments than past letters — but doesn't play down the substance.As the head of the world's largest asset manager, Fink’s letters are widely taken as a signal for how the financial community is thinking about certain topics, and how policy makers may need to respond.

Fink discusses the investment opportunities associated with the energy transition, potential financial repercussions from climate change-related extreme weather events and the need for companies BlackRock invests in to disclose their climate change-related risks.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

BlackRock CEO Larry Fink dials back ESG talk in letter after backlashInsider tells the global tech, finance, markets, media, healthcare, and strategy stories you want to know.

Read more »

Larry Fink: BlackRock is not the 'environmental police'In his annual letter, CEO Larry Fink said BlackRock's recognition of the import of climate risk on finance does not make the company a political chess piece.

Larry Fink: BlackRock is not the 'environmental police'In his annual letter, CEO Larry Fink said BlackRock's recognition of the import of climate risk on finance does not make the company a political chess piece.

Read more »

BlackRock Chief Larry Fink's Latest Letter Shies Away from ESGAs the political backlash increased with the anti-ESG movement, BlackRock CEO Larry Fink appeared to have taken a different approach in his annual letter to investors regarding environmental, social, and governance investing.

BlackRock Chief Larry Fink's Latest Letter Shies Away from ESGAs the political backlash increased with the anti-ESG movement, BlackRock CEO Larry Fink appeared to have taken a different approach in his annual letter to investors regarding environmental, social, and governance investing.

Read more »

BlackRock CEO Fink warns of financial risks, persistent inflationBlackRock Inc Chief Executive Laurence Fink warned on Wednesday the U.S. regional banking sector remains at risk after the collapse of Silicon Valley Bank and that inflation will persist and rates would continue to rise.

BlackRock CEO Fink warns of financial risks, persistent inflationBlackRock Inc Chief Executive Laurence Fink warned on Wednesday the U.S. regional banking sector remains at risk after the collapse of Silicon Valley Bank and that inflation will persist and rates would continue to rise.

Read more »

BlackRock CEO Fink says more bank seizures could follow SVB shutdownBlackRock's Larry Fink says the US banking system may face 'more seizures and shutdowns' after Silicon Valley Bank's collapse

Read more »

BlackRock's Fink says tokenization of asset classes could drive efficiencies in capital marketsLarry Fink's annual letter to shareholders has included his thoughts on digital assets in recent years, and despite recent turmoil in the space, he remains optimistic about the technology.

BlackRock's Fink says tokenization of asset classes could drive efficiencies in capital marketsLarry Fink's annual letter to shareholders has included his thoughts on digital assets in recent years, and despite recent turmoil in the space, he remains optimistic about the technology.

Read more »