This week's crypto market saw dramatic price swings, with Bitcoin experiencing both significant highs and lows. The market was heavily influenced by geopolitical events, speculation about a US sovereign wealth fund, and the ongoing developments in the Bitcoin industry.

The crypto markets experienced a rollercoaster week, marked by sharp price swings and volatility. The drama began unexpectedly during a typically calmer weekend for financial markets, except for the always-active crypto sphere. On Saturday evening and Sunday, Bitcoin (BTC) tumbled from $102,000 to under $100,000 and even dipped below $97,000. While it briefly recovered on Sunday afternoon, bears regained control on Monday morning, sending BTC plummeting below $92,000, a two-week low.

This marked a significant loss of approximately $10,000 within 24 hours and roughly $15,000 since last Friday when it traded above $106,000. However, the cryptocurrency staged a quick rebound, surging back above $100,000 and reaching $102,000 within hours. Despite this brief surge, BTC couldn't sustain its position within the six-digit territory and began to decline in the following days. It flirted with the $96,000 support level several times but managed to hold above it.Recently, BTC experienced a brief surge, reaching $100,000 for the first time since Monday, following the release of US jobs data. However, this rally was short-lived, and BTC quickly retreated below the $100,000 mark. This volatility extends to the broader cryptocurrency market, with most altcoins suffering significant weekly losses. Ethereum (ETH) plunged by 17% to trade below $2,800, while XRP, DOGE, ADA, LINK, AVAX, and SUI all experienced drops of over 20%. OM stands out as the only major-cap altcoin in the green, with an 18% surge since last Friday pushing its price above $6. Several events contributed to this week's market turmoil, including the imposition of tariffs by former US President Donald Trump on several countries, leading to a sharp market crash. The subsequent suspension of these tariffs between the US and Mexico provided some relief. Additionally, news about a potential US sovereign wealth fund investing in Bitcoin fueled speculation and price fluctuations. However, it appears that Bitcoin is not yet included in the fund's portfolio. Meanwhile, MicroStrategy, the largest corporate holder of Bitcoin, dropped 'Micro' from its name, now operating simply as 'Strategy,' and further solidified its position in the Bitcoin space. The company also reported its best quarter for Bitcoin accumulation, indicating continued bullish sentiment. Despite the market uncertainty, some experts remain optimistic about Bitcoin's long-term prospects

Bitcoin Cryptocurrency Altcoins Market Volatility US Tariffs Sovereign Wealth Fund Microstrategy

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bitcoin's Wild Week: Rollercoaster Ride to $96,000 and BackBitcoin experienced a turbulent week, soaring past $100,000 before plummeting to $91,000. It eventually stabilized around $94,000 after a series of dramatic swings.

Bitcoin's Wild Week: Rollercoaster Ride to $96,000 and BackBitcoin experienced a turbulent week, soaring past $100,000 before plummeting to $91,000. It eventually stabilized around $94,000 after a series of dramatic swings.

Read more »

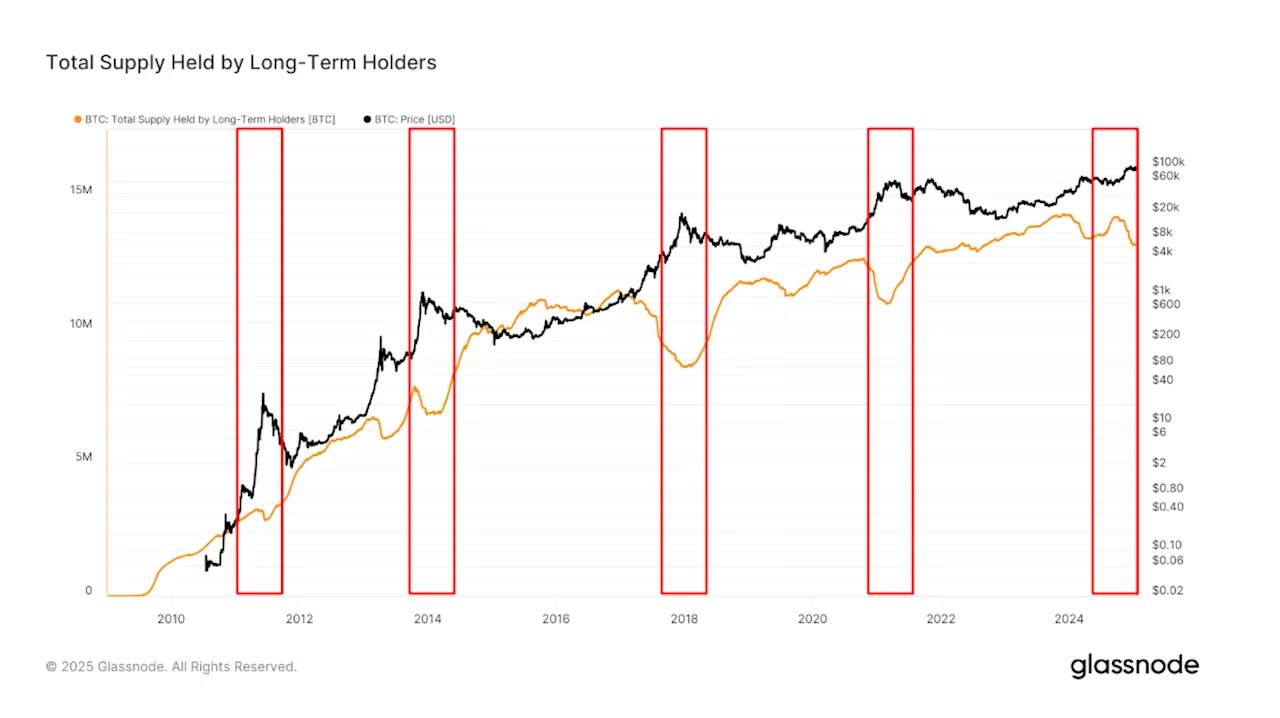

Long-Term Bitcoin Holders Sell Millions Amidst Price VolatilityThe recent surge in selling pressure from long-term bitcoin holders, often dubbed 'smart money,' raises concerns about a potential market top. While bitcoin has remained above $100,000 for most of the year, recent volatility sparked by President Trump's inauguration has contributed to this trend. As these seasoned investors continue to offload their holdings, the market awaits a crucial turning point – the cessation of these sales, which historically has signaled the peak of bitcoin's price cycles.

Long-Term Bitcoin Holders Sell Millions Amidst Price VolatilityThe recent surge in selling pressure from long-term bitcoin holders, often dubbed 'smart money,' raises concerns about a potential market top. While bitcoin has remained above $100,000 for most of the year, recent volatility sparked by President Trump's inauguration has contributed to this trend. As these seasoned investors continue to offload their holdings, the market awaits a crucial turning point – the cessation of these sales, which historically has signaled the peak of bitcoin's price cycles.

Read more »

Bitcoin (BTC) Above $100K is Like Coiled Spring Nearing Burst of Price Volatility, Key Indicator SuggestsVolatility bulls might want to pull up the 60-day price range indicator on their screens as its hinting at heightened BTC price turbulence.

Bitcoin (BTC) Above $100K is Like Coiled Spring Nearing Burst of Price Volatility, Key Indicator SuggestsVolatility bulls might want to pull up the 60-day price range indicator on their screens as its hinting at heightened BTC price turbulence.

Read more »

Bitcoin's Price Climbs Towards Record High, But Volatility PersistsBitcoin's price has been on an upward trajectory, reaching a new record high on Monday. However, recent price volatility raises questions about its future direction. Analysts examine on-chain metrics and technical indicators to assess the likelihood of further price gains.

Bitcoin's Price Climbs Towards Record High, But Volatility PersistsBitcoin's price has been on an upward trajectory, reaching a new record high on Monday. However, recent price volatility raises questions about its future direction. Analysts examine on-chain metrics and technical indicators to assess the likelihood of further price gains.

Read more »

Bitcoin Dominance Surges to 60.6% Amid Price VolatilityBitcoin dominance has reached a significant level of 60.6%, indicating a strong preference for Bitcoin over other cryptocurrencies. Despite price fluctuations, this surge suggests a bullish outlook for Bitcoin and potential rebounds for altcoins.

Bitcoin Dominance Surges to 60.6% Amid Price VolatilityBitcoin dominance has reached a significant level of 60.6%, indicating a strong preference for Bitcoin over other cryptocurrencies. Despite price fluctuations, this surge suggests a bullish outlook for Bitcoin and potential rebounds for altcoins.

Read more »

Bitcoin’s $10K Rollercoaster as Altcoins Show Signs of Recovery (Market Watch)Crypto Blog

Bitcoin’s $10K Rollercoaster as Altcoins Show Signs of Recovery (Market Watch)Crypto Blog

Read more »