This article explores the significance of Bitcoin's realized price per year as a crucial support level for the cryptocurrency. It examines historical trends, recent market fluctuations, and expert analysis to shed light on the potential implications of bitcoin trading below this support level.

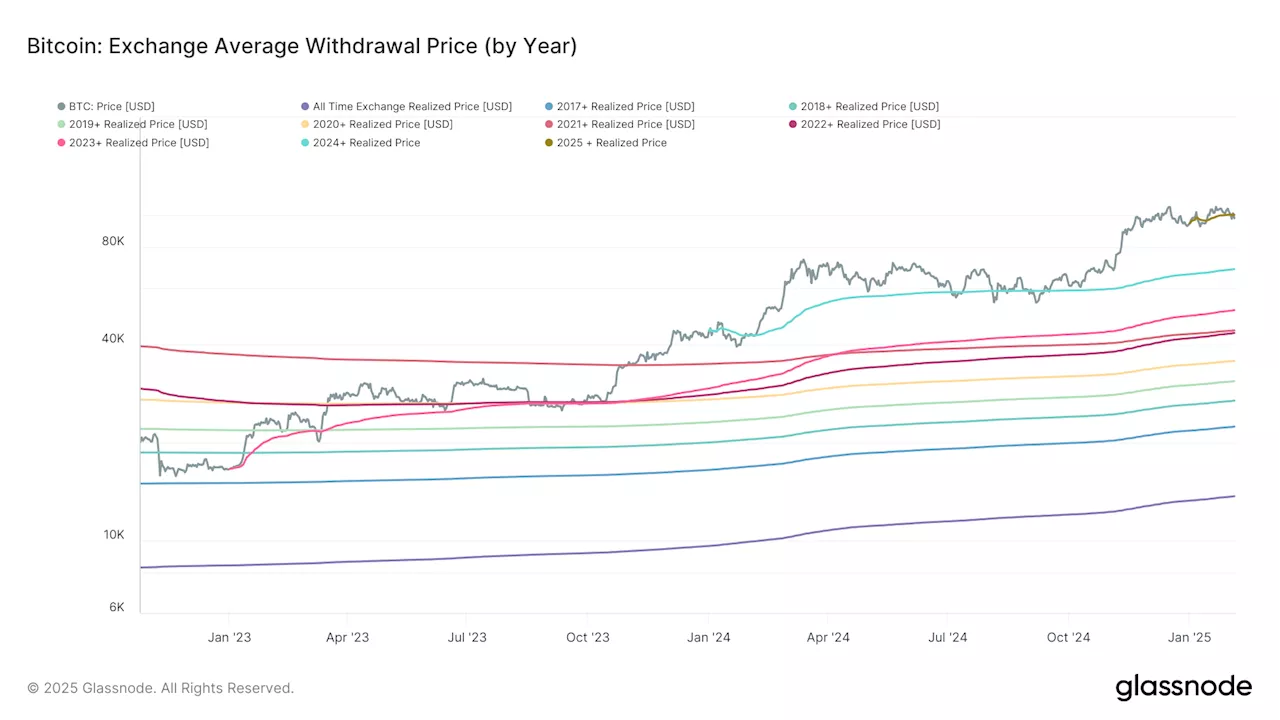

Bitcoin, a leading cryptocurrency, has historically found strong support at its realized price per year. This metric, reflecting the average price at which bitcoins are withdrawn from exchanges, stands at $100,356 for 2025. Currently, bitcoin trades around $98,000, just shy of this support level . Concerns arise when bitcoin dips below this average withdrawal price for an extended period. Such sustained declines can trigger further selling pressure and exacerbate downward price movements.

However, history suggests that bitcoin often rebounds quickly from these dips, reclaiming the support level swiftly. Notably, in 2024, bitcoin repeatedly tested its average withdrawal price near $60,000, briefly falling to $49,000 in August during a yen carry trade unwind. Yet, it managed to regain the support level within a few days. Similarly, in 2023, the realized price acted as a crucial support, holding strong during the Silicon Valley Bank collapse in March (around $20,000) and again in September, preceding bitcoin's Q4 rally.According to Glassnode data, over 2.6 million BTC are currently held at a loss, one of the highest figures this year. The longer bitcoin sustains a price below the 2025 average, the greater the possibility of further declines. James Van Straten, a Senior Analyst at CoinDesk specializing in Bitcoin and its macroeconomic implications, emphasizes the significance of this support level. His expertise encompasses on-chain analytics, gleaned from his previous role as a Research Analyst at Saidler & Co., a Swiss hedge fund. He actively monitors Bitcoin's role within the broader financial system through flow analysis. Beyond his professional engagements, Van Straten serves as an advisor to Coinsilium, a UK publicly traded company, providing guidance on their Bitcoin treasury strategy. He also holds investments in Bitcoin, MicroStrategy (MSTR), and Semler Scientific (SMLR).

BITCOIN REALIZED PRICE SUPPORT LEVEL CRYPTOCURRENCY MARKET ON-CHAIN ANALYTICS

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

'Rich Dad Poor Dad' Author Predicts Bitcoin to Hit $250,000 This Year, Here's TwistProminent Bitcoin supporter Kiyosaki makes stunning Bitcoin price prediction

'Rich Dad Poor Dad' Author Predicts Bitcoin to Hit $250,000 This Year, Here's TwistProminent Bitcoin supporter Kiyosaki makes stunning Bitcoin price prediction

Read more »

Bitcoin Price Analysis: BTC Eyes New All-Time High If Key Support HoldsCrypto Blog

Bitcoin Price Analysis: BTC Eyes New All-Time High If Key Support HoldsCrypto Blog

Read more »

Bitcoin (BTC) Above $100K is Like Coiled Spring Nearing Burst of Price Volatility, Key Indicator SuggestsVolatility bulls might want to pull up the 60-day price range indicator on their screens as its hinting at heightened BTC price turbulence.

Bitcoin (BTC) Above $100K is Like Coiled Spring Nearing Burst of Price Volatility, Key Indicator SuggestsVolatility bulls might want to pull up the 60-day price range indicator on their screens as its hinting at heightened BTC price turbulence.

Read more »

Bitcoin Price at Crucial Point: $97,877 Holds Key to Bull MarketCryptocurrency analyst Ali Martinez warns that Bitcoin's price must hold above $97,877 to sustain the current bull market. If Bitcoin falls below this level, the bull run could be jeopardized. Despite Federal Reserve Chair Jerome Powell's statement on no further interest rate cuts, Bitcoin has surged, adding almost $4,000 to its price in the past 24 hours.

Bitcoin Price at Crucial Point: $97,877 Holds Key to Bull MarketCryptocurrency analyst Ali Martinez warns that Bitcoin's price must hold above $97,877 to sustain the current bull market. If Bitcoin falls below this level, the bull run could be jeopardized. Despite Federal Reserve Chair Jerome Powell's statement on no further interest rate cuts, Bitcoin has surged, adding almost $4,000 to its price in the past 24 hours.

Read more »

Bitcoin Bulls Attempt to Retake Control Near Key Support Ahead of Key NFP ReportMarket Analysis by Investing.com (Günay Caymaz) covering: Bitcoin. Read Investing.com (Günay Caymaz)'s Market Analysis on Investing.com

Bitcoin Bulls Attempt to Retake Control Near Key Support Ahead of Key NFP ReportMarket Analysis by Investing.com (Günay Caymaz) covering: Bitcoin. Read Investing.com (Günay Caymaz)'s Market Analysis on Investing.com

Read more »

Scottie Pippen Predicts Bitcoin Price to Reach $10 Million, Calls Current Price 'Dirt Cheap'Former NBA star Scottie Pippen has shared his bullish stance on Bitcoin, predicting its price to reach $10 million in the future. He believes the current price, even after surpassing $100,000, is incredibly low compared to the overall global asset market. Pippen's prediction comes amidst a surge in Bitcoin's price and the inauguration of a pro-crypto president, Donald Trump.

Scottie Pippen Predicts Bitcoin Price to Reach $10 Million, Calls Current Price 'Dirt Cheap'Former NBA star Scottie Pippen has shared his bullish stance on Bitcoin, predicting its price to reach $10 million in the future. He believes the current price, even after surpassing $100,000, is incredibly low compared to the overall global asset market. Pippen's prediction comes amidst a surge in Bitcoin's price and the inauguration of a pro-crypto president, Donald Trump.

Read more »