Trading volumes in bitcoin options offered by DeribitExchange surge as the cryptocurrency rallies sharply amid U.S. bank failures. Reports godbole17.

Trading in bitcoin options listed on cryptocurrency exchange Deribit has soared in the wake of U.S. bank failures and resulting market volatility.

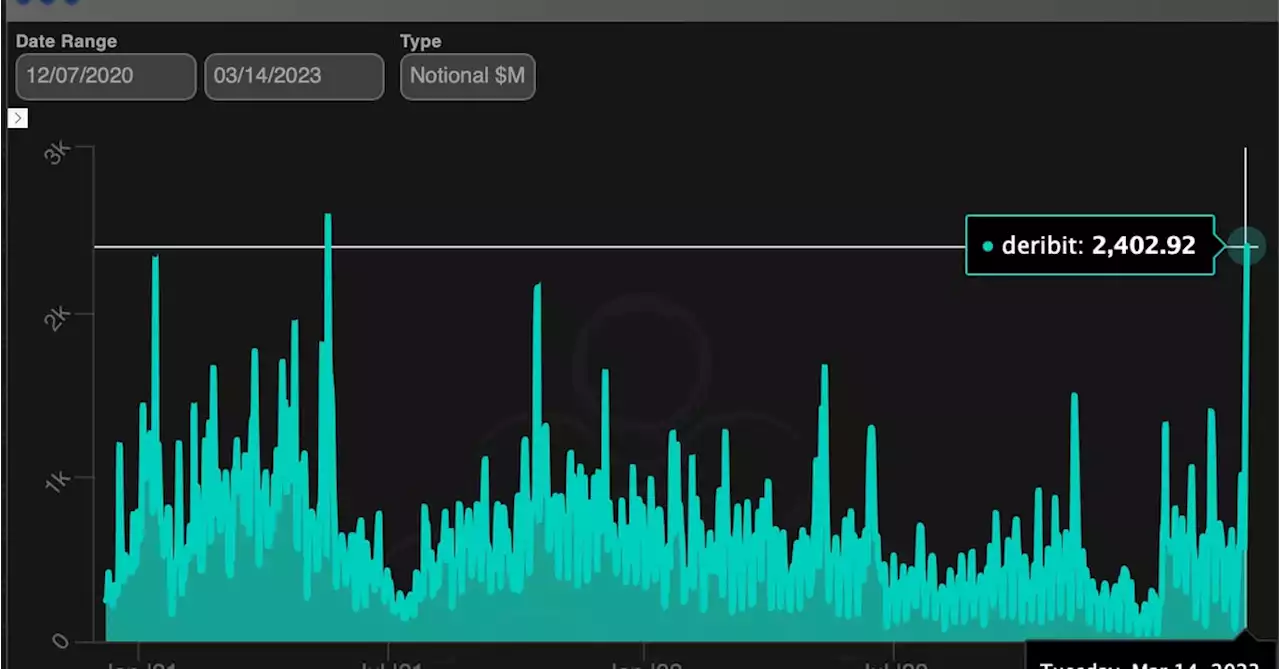

Bitcoin options worth $2.4 billion have changed hands on Deribit in the past 24 hours, the highest single-day tally since May 17, 2021, according to data tracked by Amberdata. The number of contracts traded in the past 24 hours stood at a record high of 99,195 BTC at press time. The 24-hour notional volume in ether options totaled $948 million as of writing, the highest since November.

On Deribit, one options contract represents 1 BTC and 1 ETH. The exchange controls more than 80% of the global crypto options market. Options give traders the right to buy or sell the underlying asset, in this case, bitcoin, at a specific price, known as a strike, by a stated date. Call options give the right to buy, while put options give the right to sell.

Bitcoin initially came under pressure after Silicon Valley Bank shut down on Friday but picked up a bid over the weekend. Prices have risen nearly 25% since late Friday, with prices gaining 9% in the past 24 hours, as the banking crisis has weakened the case for continued monetary tightening by the Federal Reserve.

Bitcoin's seven-day annualized implied volatility , the market's expectation of price turbulence in the short term, rose to a four-month high of 90% early today. The 30-, 60-, 91- and 180-day gauges have also ticked higher, indicating increased demand for options. A similar pattern is observed in the ether options market, where the seven-day implied volatility rose to a two-month high of 77% early today.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

USDC Dominated Trading Volume on Decentralized Exchanges Amidst Depegging Incident – Market Updates Bitcoin NewsStatistics recorded on Saturday show that more than 55% of Uniswap’s trades involved $USDC against wrapped ether, and the stablecoin tether.

USDC Dominated Trading Volume on Decentralized Exchanges Amidst Depegging Incident – Market Updates Bitcoin NewsStatistics recorded on Saturday show that more than 55% of Uniswap’s trades involved $USDC against wrapped ether, and the stablecoin tether.

Read more »

Binance Converts $1 Billion BUSD Into Bitcoin, BNB, and Ethereum – Bitcoin NewsBinance boss CZ announced on Monday that the company had converted $1 billion $BUSD into bitcoin (BTC), BNB, and ethereum (ETH).

Binance Converts $1 Billion BUSD Into Bitcoin, BNB, and Ethereum – Bitcoin NewsBinance boss CZ announced on Monday that the company had converted $1 billion $BUSD into bitcoin (BTC), BNB, and ethereum (ETH).

Read more »

Robert Kiyosaki Warns of 'Crash Landing Ahead' as Bailouts Begin — Advises Buying More Bitcoin – Bitcoin NewsRich Dad Poor Dad author Robert Kiyosaki has warned of a 'crash landing ahead,' advising investors to buy more bitcoin. $BTC cryptocurrency

Robert Kiyosaki Warns of 'Crash Landing Ahead' as Bailouts Begin — Advises Buying More Bitcoin – Bitcoin NewsRich Dad Poor Dad author Robert Kiyosaki has warned of a 'crash landing ahead,' advising investors to buy more bitcoin. $BTC cryptocurrency

Read more »

XRP Sees 112% Increase in Trading Volume as Token Stays Underbought per This MetricXRP stays underbought but sees 112% surge in trading volume $XRP XRPArmy XRPCommunity XRPHolders

XRP Sees 112% Increase in Trading Volume as Token Stays Underbought per This MetricXRP stays underbought but sees 112% surge in trading volume $XRP XRPArmy XRPCommunity XRPHolders

Read more »

Prices, Volume Spike on Mix of Regulators' Backstops and Lower Rate ExpectationsCrypto Markets Analysis: Asset prices reversed on Monday from their recent drop as regulators' words and actions appeared to allay fears about the impact of Silicon Valley bank’s collapse on the banking sector and economy. GWilliamsJr_CMT writes

Prices, Volume Spike on Mix of Regulators' Backstops and Lower Rate ExpectationsCrypto Markets Analysis: Asset prices reversed on Monday from their recent drop as regulators' words and actions appeared to allay fears about the impact of Silicon Valley bank’s collapse on the banking sector and economy. GWilliamsJr_CMT writes

Read more »

Uniswap Hits ATH of Almost $12B in Trading Volume Amidst USDC CrisisDEX platforms generated a massive amount of volume from USDC trades.

Uniswap Hits ATH of Almost $12B in Trading Volume Amidst USDC CrisisDEX platforms generated a massive amount of volume from USDC trades.

Read more »