The legislation would require the Fed to give crypto banks access to its payment rails. Some say that would be destabilizing.

Even before the latest meltdown, the Federal Reserve had been reluctant to grant master accounts to crypto-focused banks. In Custodia’s case, Federal Reserve Chair Jerome H. Powell has cited his concerns about unleashing a tide of other crypto companies offering banking services while lacking federal insurance backstop.

“If we start granting these, there will be a couple hundred of them soon,” Powell told Lummis when she pressed him on the matter at a January congressional hearing.Under Wyoming law, those banks can put their reserves into more volatile assets than their federally regulated counterparts — such as corporate and municipal debt — which could prompt a run if they suddenly lose value, said Lee Reiners, a former Fed official who now runs Duke University’s Global Financial Markets Center.

Proponents counter that giving more firms access to the central bank’s payments infrastructure will have the opposite effect, shoring up the crypto economy by giving federal overseers a better view of its activity. “Giving more regulated financial institutions access to the payment system reduces risk because it allows more visibility into who owes what,” a Lummis aide said. “And if there’s a systemic crisis, if a bank were to fail, there wouldn’t be as many ripple effects in the economy.

The company, founded by Morgan Stanley veteran Caitlin Long, set up shop in Wyoming in 2020 to take advantage of special rules the state adopted the year before to attract firms looking to mix traditional banking activities with crypto transactions. Shortly after securing its state charter, it applied for a Fed master account.

The Fed is in the midst of developing standards for granting master accounts, a process whose murkiness has drawn criticism from Republicans in Congress.The matter took center stage earlier this year in a partisan fight over the nomination of Sarah Bloom Raskin to serve as the Fed’s top financial regulator. Raskin served on the board of Reserve Trust, a Colorado payments company, when it secured a master account in 2018 after being denied one a year earlier.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

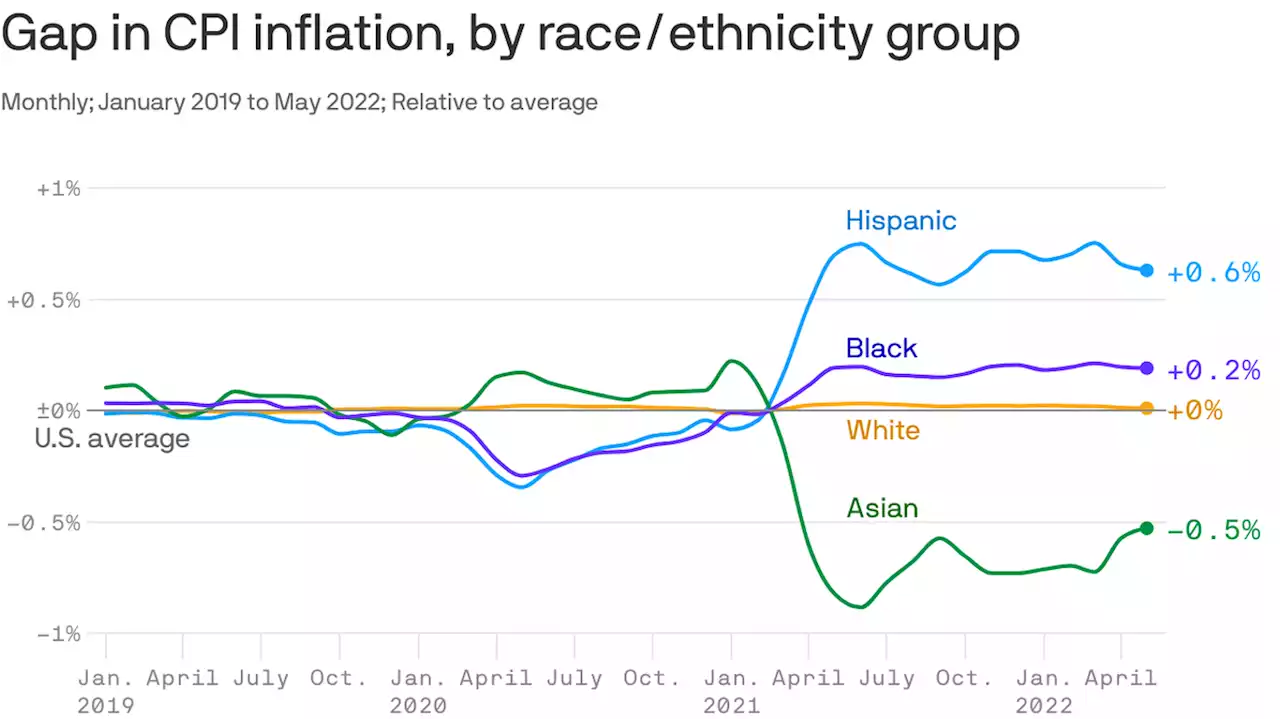

Inflation is higher for Hispanic and Black Americans, NY Fed report saysThe headline inflation number in the Consumer Price Index is an average, and doesn't reveal much about how different households experience rising prices. There are real differences across income groups, or between rural and urban dwellers, for example.

Inflation is higher for Hispanic and Black Americans, NY Fed report saysThe headline inflation number in the Consumer Price Index is an average, and doesn't reveal much about how different households experience rising prices. There are real differences across income groups, or between rural and urban dwellers, for example.

Read more »

High inflation has turned America against Jerome Powell and the FedFed Chair Powell was the economic hero of the pandemic recovery. Now America has turned on him as inflation torches wallets.

Read more »

Recession warning: Economy to shrink for second quarter, Fed bank projectsThe economy will shrink for a second consecutive quarter, a regional Federal Reserve bank projected Thursday in the latest sign of recessionary risks.

Recession warning: Economy to shrink for second quarter, Fed bank projectsThe economy will shrink for a second consecutive quarter, a regional Federal Reserve bank projected Thursday in the latest sign of recessionary risks.

Read more »

![]() Crashing: Atlanta Fed GDP Tracker Plunges to -2.1%Consumer spending, manufacturing, and construction have all rolled over as inflation and interest rates drag down the economy. | Economy

Crashing: Atlanta Fed GDP Tracker Plunges to -2.1%Consumer spending, manufacturing, and construction have all rolled over as inflation and interest rates drag down the economy. | Economy

Read more »

New York lawmakers introduce bill to ban guns from Times Square, mass transitNEW YORK — (NEW YORK) -- New York lawmakers introduced legislation Friday that would ban the concealed carry of guns in a 'sensitive location,' including Times Square and all mass public transportation, according to a draft of the bill.

New York lawmakers introduce bill to ban guns from Times Square, mass transitNEW YORK — (NEW YORK) -- New York lawmakers introduced legislation Friday that would ban the concealed carry of guns in a 'sensitive location,' including Times Square and all mass public transportation, according to a draft of the bill.

Read more »

As California's 4-Day Workweek Bill Stalls, a Look at History of Labor HoursDisputes over working hours have long pitted employees against employers in California history, says Fred Glass, author and instructor in Labor and Community Studies at City College of San Francisco.

As California's 4-Day Workweek Bill Stalls, a Look at History of Labor HoursDisputes over working hours have long pitted employees against employers in California history, says Fred Glass, author and instructor in Labor and Community Studies at City College of San Francisco.

Read more »