Hedge fund manager Bill Ackman's firm, Pershing Square, has purchased a significant stake in Uber, valuing the investment at $2.3 billion. Ackman expressed confidence in Uber's management and its future prospects, arguing that the company is undervalued.

In a recent post on X, hedge fund manager Bill Ackman disclosed that his firm, Pershing Square, initiated a position in Uber shares in early January. As of now, Pershing Square has accumulated 30.3 million Uber shares, valued at approximately $2.3 billion based on the current stock price around $75 per share. Ackman expressed his strong conviction in Uber , stating, 'We believe that Uber is one of the best managed and highest quality businesses in the world.

' He further emphasized the company's exceptional value proposition, noting, 'Remarkably, it can still be purchased at a massive discount to its intrinsic value. This favorable combination of attributes is extremely rare, particularly for a large cap company.'Uber's stock experienced a significant surge of over 8% on Friday following Ackman's announcement. The stock had previously faced a decline of 7.5% on Wednesday after the ride-hailing company revealed a reduction in its financial guidance. Pershing Square maintains a concentrated portfolio with ten stock holdings, including its newly acquired Uber stake. As of the end of September, Google's parent company, Alphabet, was Pershing Square's largest holding. Ackman revealed that he was an early investor in Uber through a small investment in a venture fund. He lauded CEO Dara Khosrowshahi's leadership in driving the company's growth, stating, 'I have been a long-term customer and admirer of Uber beginning when Edward Norton showed me the app in its early days. Since he joined the company in 2017, Dara Khosrowshahi CEO has done a superb job in transforming the company into a highly profitable and cash-generative growth machine.

BILL ACKMAN PERSHING SQUARE UBER INVESTMENT STOCK MARKET

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bill Ackman Moves Pershing Square Out of Delaware, Citing Nevada's Business-Friendly LawsBillionaire CEO Bill Ackman is relocating his management company, Pershing Square Capital Management, from Delaware to Nevada. This move follows a trend of high-profile companies, including Dropbox and Tesla, leaving Delaware due to recent court rulings that empower shareholders to challenge executive decisions.

Bill Ackman Moves Pershing Square Out of Delaware, Citing Nevada's Business-Friendly LawsBillionaire CEO Bill Ackman is relocating his management company, Pershing Square Capital Management, from Delaware to Nevada. This move follows a trend of high-profile companies, including Dropbox and Tesla, leaving Delaware due to recent court rulings that empower shareholders to challenge executive decisions.

Read more »

Bill Ackman reveals he's been building a more than $2 billion stake in UberThe hedge fund manager said his fund began buying Uber shares in early January and has amassed 30.3 million shares, worth $2.3 billion.

Bill Ackman reveals he's been building a more than $2 billion stake in UberThe hedge fund manager said his fund began buying Uber shares in early January and has amassed 30.3 million shares, worth $2.3 billion.

Read more »

Pershing Square's Ackman Aims to Turn Howard Hughes into a Modern-Day Berkshire HathawayBill Ackman's Pershing Square is proposing a deal to acquire a controlling stake in Howard Hughes, aiming to transform it into a conglomerate similar to Warren Buffett's Berkshire Hathaway. The deal would raise Pershing Square's stake to between 61% and 69%. Ackman envisions the new entity investing in operating companies and acquiring assets. If successful, he would become CEO and chairman.

Pershing Square's Ackman Aims to Turn Howard Hughes into a Modern-Day Berkshire HathawayBill Ackman's Pershing Square is proposing a deal to acquire a controlling stake in Howard Hughes, aiming to transform it into a conglomerate similar to Warren Buffett's Berkshire Hathaway. The deal would raise Pershing Square's stake to between 61% and 69%. Ackman envisions the new entity investing in operating companies and acquiring assets. If successful, he would become CEO and chairman.

Read more »

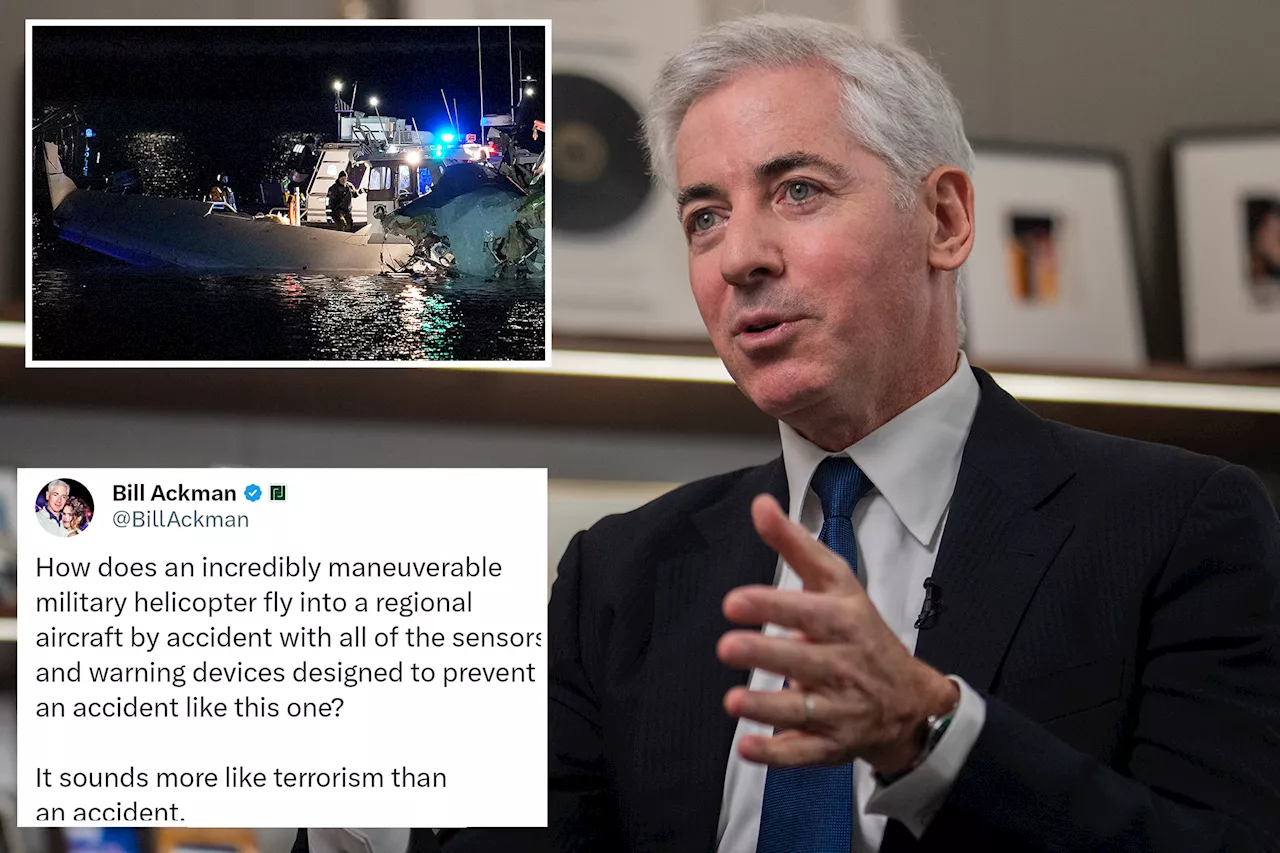

Bill Ackman Deleted X Post Suggesting Mid-Air Collision Could Be TerrorismBillionaire hedge fund manager Bill Ackman deleted a post on X in which he questioned the likelihood of a midair collision between a passenger jet and a military helicopter near Reagan Airport being an accident, suggesting it could have been a terrorist attack. He later deleted the post, expressing sympathy for the victims and their families.

Bill Ackman Deleted X Post Suggesting Mid-Air Collision Could Be TerrorismBillionaire hedge fund manager Bill Ackman deleted a post on X in which he questioned the likelihood of a midair collision between a passenger jet and a military helicopter near Reagan Airport being an accident, suggesting it could have been a terrorist attack. He later deleted the post, expressing sympathy for the victims and their families.

Read more »

Pershing Square Secures U.S. Listing for Universal Music Group in 2025William Ackman's Pershing Square will see its stake in Universal Music Group (UMG) listed on a U.S. stock exchange by September 2025, despite the hedge fund's earlier push for a delisting from the Euronext Amsterdam exchange. The move follows violent attacks against Israeli soccer fans in Amsterdam, prompting Ackman to call for a relocation of UMG's headquarters and a U.S. listing. While UMG will comply with Pershing Square's contractual right to request a U.S. listing, the company maintains its independence in making other decisions regarding its domicile and stock exchange listings.

Pershing Square Secures U.S. Listing for Universal Music Group in 2025William Ackman's Pershing Square will see its stake in Universal Music Group (UMG) listed on a U.S. stock exchange by September 2025, despite the hedge fund's earlier push for a delisting from the Euronext Amsterdam exchange. The move follows violent attacks against Israeli soccer fans in Amsterdam, prompting Ackman to call for a relocation of UMG's headquarters and a U.S. listing. While UMG will comply with Pershing Square's contractual right to request a U.S. listing, the company maintains its independence in making other decisions regarding its domicile and stock exchange listings.

Read more »

Bill Ackman's Pershing Square offers to take over real estate developer Howard Hughes for $85 a shareAckman proposed forming a new subsidiary of Pershing, which currently owns about 38% of Howard Hughes, that would merge with the company.

Bill Ackman's Pershing Square offers to take over real estate developer Howard Hughes for $85 a shareAckman proposed forming a new subsidiary of Pershing, which currently owns about 38% of Howard Hughes, that would merge with the company.

Read more »