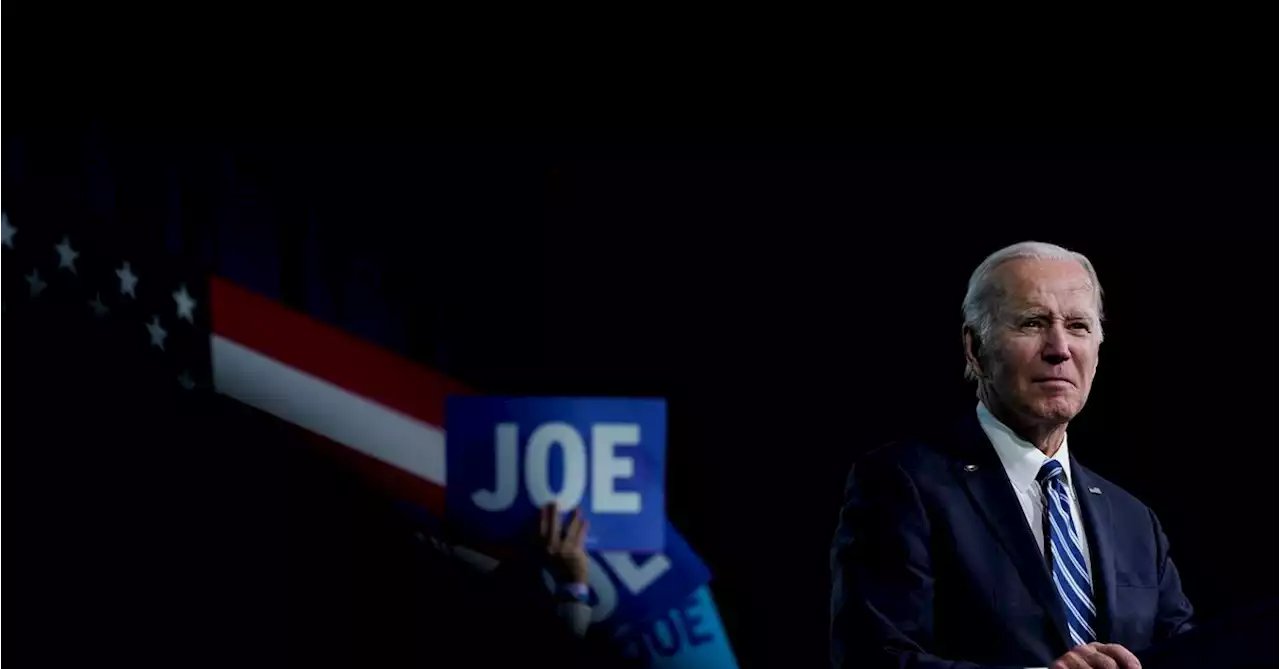

Most Americans split a 2.9% Medicare tax with their employer. Under President Biden's plan, some Americans could pay up to 5%.

President Joe Biden announced potential changes to Medicare on Tuesday as he prepares to present the fiscal year 2024 budget.

Citing a Medicare Trustees Report, President Biden said the changes would extend the solvency of Medicare from 2028 through the 2050s.“Only in Washington can people claim that they are saving something by destroying it,” President Biden said. “The budget I am releasing this week will make the Medicare trust fund solvent beyond 2050 without cutting a penny in benefits. In fact, we can get better value, making sure Americans receive better care for the money they pay into Medicare.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Biden will seek Medicare changes, up tax rate in new budgetPresident Joe Biden has started to unveil parts of his budget proposal being released later this week

Biden will seek Medicare changes, up tax rate in new budgetPresident Joe Biden has started to unveil parts of his budget proposal being released later this week

Read more »

Biden to unveil plan averting Medicare funding crisis, challenging GOPThe White House would raise taxes on high earners and reduce government payments for some prescription drugs in a bid to keep the program stable.

Biden to unveil plan averting Medicare funding crisis, challenging GOPThe White House would raise taxes on high earners and reduce government payments for some prescription drugs in a bid to keep the program stable.

Read more »

Biden to tax high-earners to save MedicareU.S. President Joe Biden will propose raising the Medicare tax on high earners to help keep the federal insurance program solvent as part of his budget to be released on Thursday, the White House said.

Biden to tax high-earners to save MedicareU.S. President Joe Biden will propose raising the Medicare tax on high earners to help keep the federal insurance program solvent as part of his budget to be released on Thursday, the White House said.

Read more »

Biden will seek Medicare changes, up tax rate in new budgetPresident Biden wants to increase taxes to boost funding for Medicare and expand the program’s ability to negotiate lower costs for prescription drugs, according to advance details of his budget proposal being released later this week.

Biden will seek Medicare changes, up tax rate in new budgetPresident Biden wants to increase taxes to boost funding for Medicare and expand the program’s ability to negotiate lower costs for prescription drugs, according to advance details of his budget proposal being released later this week.

Read more »

Biden’s Budget to Lay Out Plan to Extend Key Medicare Trust Fund by 25 YearsPresident Biden’s coming budget blueprint will propose extending the solvency of a key Medicare trust fund by at least 25 years, in part by increasing tax rates on higher earners

Biden’s Budget to Lay Out Plan to Extend Key Medicare Trust Fund by 25 YearsPresident Biden’s coming budget blueprint will propose extending the solvency of a key Medicare trust fund by at least 25 years, in part by increasing tax rates on higher earners

Read more »