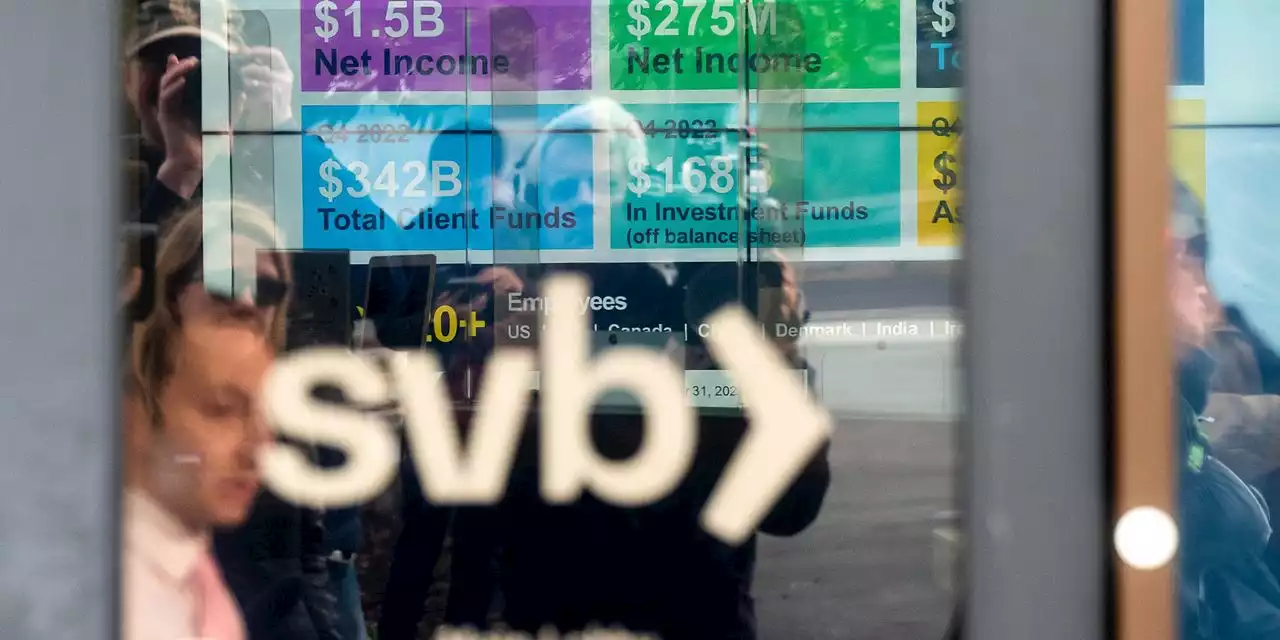

The banking collapse raises concern for risk management, especially accounting for weather extremes, stranded oil assets and more, says RAN's Aditi Sen.

Over the last few weeks the second biggest bank collapse in 16 years rocked the world. Self-inflicted deregulation is to blame, with a far more troubling undercurrent: failure of risk management.

If the foreseeable risks of inflation and interest rates were surprising, many banks have another crisis coming. The juggernaut is climate-change risk in all its forms. The bottom line for action is cash, not empty pledges and false solutions. Where is the financing for the future of energy and a just transition, and thus, our future economy?

The threat of climate instability could not be clearer in the IPCC report. The climate chaos predicted will have a larger impact at lower temperatures than previously thought. Every increment of global warming will make weather extremes more disruptive, causing widespread damages to communities and natural ecosystems, as well as dire impacts to economies, according to the report.

“ Regulators may try to bail them out again when the shockwaves of climate chaos hit the banks because they’re too big to fail, but they’re not too big to fail humanity. ”

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Banks trim borrowing from the Fed againBanks trimmed borrowing from the Federal Reserve for the second week in a row, another sign the U.S. financial system has stabilized.

Banks trim borrowing from the Fed againBanks trimmed borrowing from the Federal Reserve for the second week in a row, another sign the U.S. financial system has stabilized.

Read more »

Banks are in turmoil but a bigger financial crisis may be brewing elsewhere | CNN BusinessThe International Monetary Fund warned this week of 'vulnerabilities' among so-called non-bank financial institutions, saying global financial stability could hinge on their resilience. The Bank of England called attention to the same issue last month.

Banks are in turmoil but a bigger financial crisis may be brewing elsewhere | CNN BusinessThe International Monetary Fund warned this week of 'vulnerabilities' among so-called non-bank financial institutions, saying global financial stability could hinge on their resilience. The Bank of England called attention to the same issue last month.

Read more »

Short sellers made $7B in the most profitable bets against banks since 2008Short sellers just reaped a $7 billion bounty in the most profitable bets against banks since the 2008 financial crisis

Read more »

Declines in Loan Values Are Widespread Among BanksNearly every publicly traded bank in the country is sitting on loans that have declined in value since they were made. The culprit is rising interest rates

Declines in Loan Values Are Widespread Among BanksNearly every publicly traded bank in the country is sitting on loans that have declined in value since they were made. The culprit is rising interest rates

Read more »

Good Friday 2023: Here's what's open and where banks might be closedHere’s everything you need to know about Good Friday.

Good Friday 2023: Here's what's open and where banks might be closedHere’s everything you need to know about Good Friday.

Read more »

House Oversight Committee subpoenas banks for Biden family financial recordsThe House Oversight Committee has issued subpoenas to banks asking for financial records regarding the Biden family, according to sources.

House Oversight Committee subpoenas banks for Biden family financial recordsThe House Oversight Committee has issued subpoenas to banks asking for financial records regarding the Biden family, according to sources.

Read more »