Banks are leaving women behind — and it's costing them $700 billion a year

There are an estimated 320 million registered micro, small, and medium-sized enterprises, or MSMEs, in the developing world contributing two-thirds of private-sector employment and up to 40% of GDP in their respective countries. While a quarter of these businesses are led by women, many of them struggle to get funding — resulting inin unmet financing needs.

The changes needed to close the gender gap in small businesses' access to capital are too complex and intertwined for any single actor to tackle alone. Governments must shape policies that address the differences in women's access to technology and financial services. For their part, financial-service providers will need to take off the blinders that keep them from seeing women as valued clients.

But what if the problem isn't so much a lack of assets but a legal framework that doesn't allow the assets womenown to be used as collateral? Land and buildings form 73% of the assets used as collateral by developing-country banks. But roughly 40% of countries limit women's property rights in some way. Lawsor require her husband's consent before she can borrow against the property — even if that property was acquired during the marriage or the woman brought it into the marriage.

These discriminatory legal frameworks often reflect restrictive social and cultural norms, and, as a result, much-needed reforms have been slow. Meanwhile, a growing number of countries are moving to allow the use of a business' assets such as equipment or inventory , opening the door to women who don't have access to land or property to secure loans.

When evaluating a loan application, banks also look at a prospective borrower's demonstrated history of repayment — how well have they done repaying other debts like home loans, credit cards, or even utility bills. But in many developing countries, government-sponsored credit bureaus collect limited data, primarily related to large business loans, leaving banks little information to go on when considering new loans for women-led businesses.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

These banks are moving tech and product jobs to Philly, where the talent isWhile the work-from-home movement has emptied some offices in Center City, software engineers and financial-product managers keep arriving. Two of the nation’s largest banks have lately announced they are expanding new-product centers here.

These banks are moving tech and product jobs to Philly, where the talent isWhile the work-from-home movement has emptied some offices in Center City, software engineers and financial-product managers keep arriving. Two of the nation’s largest banks have lately announced they are expanding new-product centers here.

Read more »

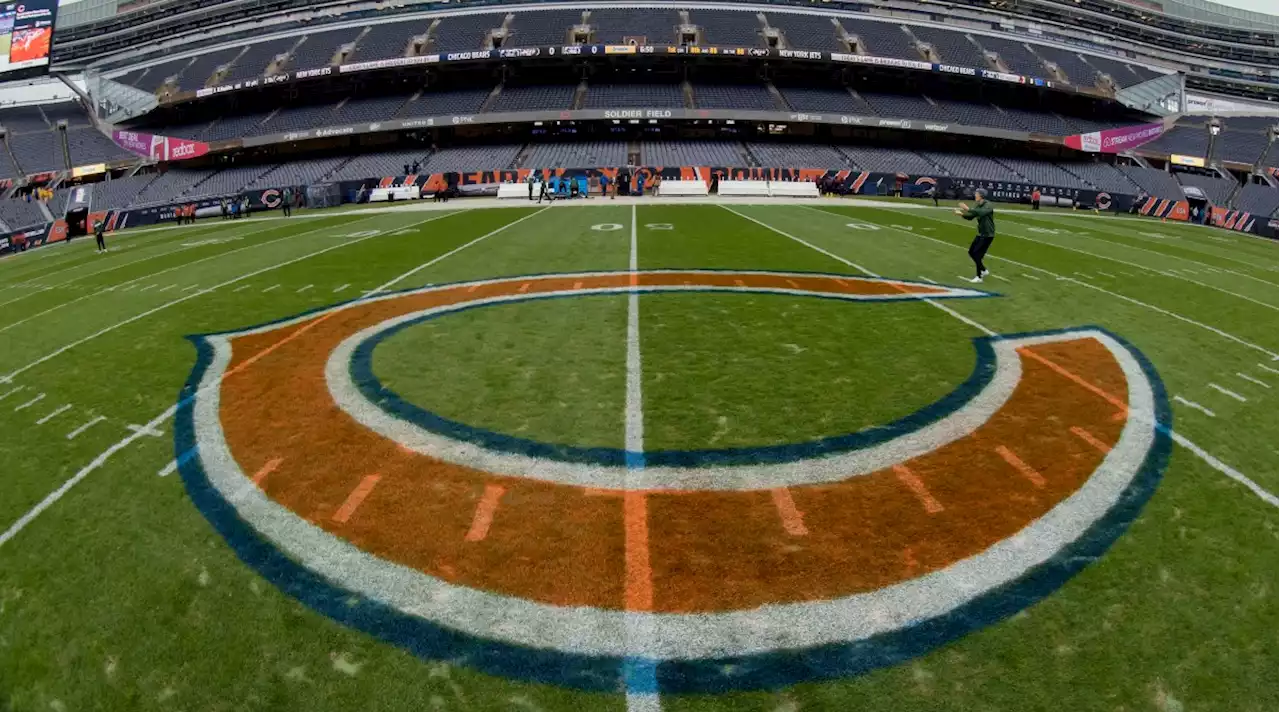

Chicago Mayor Doubles Down on Soldier Field Dome ProposalThe potential upgrade and expansion project at the Bears’ stadium could cost more than $2 billion.

Chicago Mayor Doubles Down on Soldier Field Dome ProposalThe potential upgrade and expansion project at the Bears’ stadium could cost more than $2 billion.

Read more »

Credit Suisse Names Ulrich Körner CEO and Launches Strategic RevampCredit Suisse named Ulrich Körner as its next chief executive and charged him to lead a fresh effort to stabilize the bank after financial losses and scandals

Credit Suisse Names Ulrich Körner CEO and Launches Strategic RevampCredit Suisse named Ulrich Körner as its next chief executive and charged him to lead a fresh effort to stabilize the bank after financial losses and scandals

Read more »

Credit Suisse Names Ulrich Koerner as CEO, Launches Strategic Review as Losses DeepenThe embattled Swiss bank posted a net loss of 1.593 billion Swiss francs ($1.66 billion), far below consensus expectations among analysts for a 398.16 million Swiss franc loss.

Credit Suisse Names Ulrich Koerner as CEO, Launches Strategic Review as Losses DeepenThe embattled Swiss bank posted a net loss of 1.593 billion Swiss francs ($1.66 billion), far below consensus expectations among analysts for a 398.16 million Swiss franc loss.

Read more »

UBS misses expectations; CEO cites one of the 'most challenging' quarters for investors in a decadeUBS posted net profit attributable to shareholders of $2.108 billion, below analyst expectations aggregated by the Swiss bank.

UBS misses expectations; CEO cites one of the 'most challenging' quarters for investors in a decadeUBS posted net profit attributable to shareholders of $2.108 billion, below analyst expectations aggregated by the Swiss bank.

Read more »