Bank of America's stock performance lags behind its peers and key benchmarks despite exceeding earnings expectations in the fourth quarter. Analysts speculate that Berkshire Hathaway, the bank's largest investor, is continuing to sell its shares, driving the underperformance. Berkshire's recent selling activity and the potential impact on Bank of America's stock price are closely watched by investors.

Bank of America has experienced underperformance compared to its peers since its impressive fourth-quarter earnings report. This has led to speculation among analysts that Berkshire Hathaway, the bank's largest investor, might be quietly selling off its shares again. While Bank of America's fourth-quarter results surpassed expectations, driven by strong investment banking and interest income, leading to a more than doubling of profits to $6.

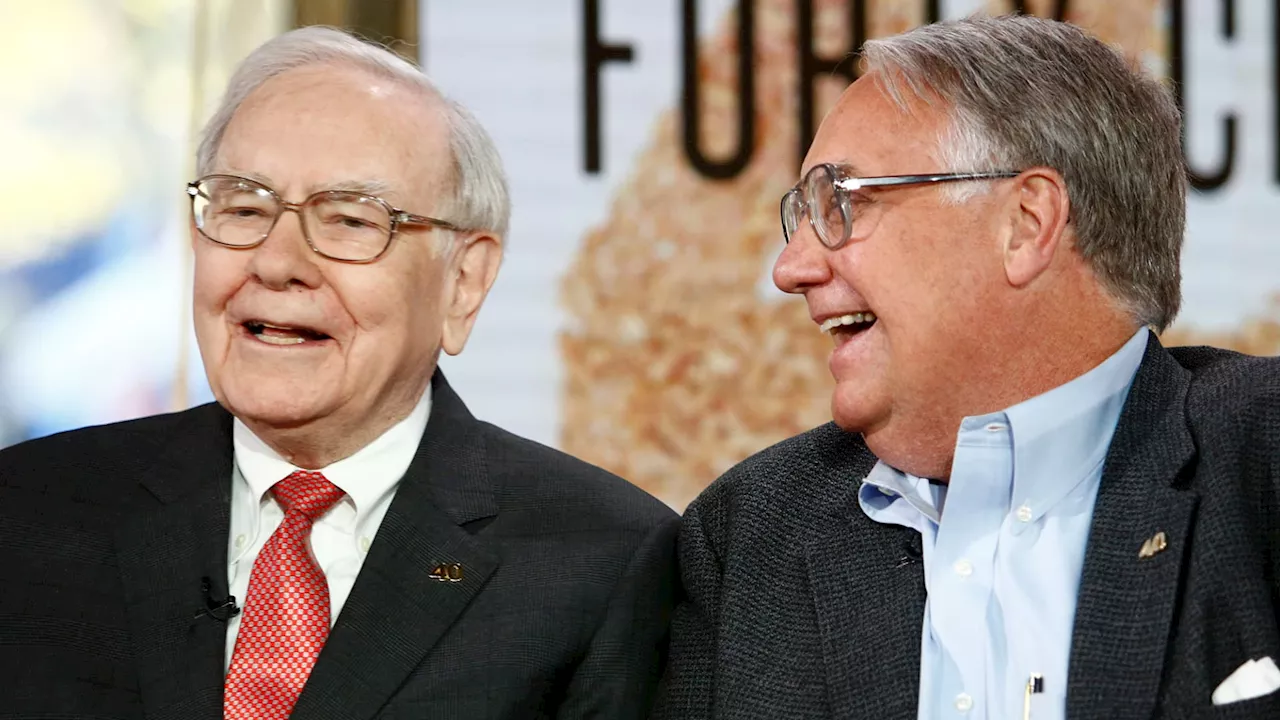

67 billion, or 82 cents per share, its stock price has remained largely stagnant. This contrasts with the S&P 500's 2% gain and the SPDR S&P Bank ETF's (KBE) 4% advance over the same period. Two Wall Street analysts attribute this weakness to continued selling pressure from Warren Buffett's conglomerate. John McDonald of Truist Securities questioned whether the post-earnings underperformance could be attributed to selling pressure from Berkshire Hathaway, particularly following significant sales in the latter half of 2024. Steven Chubak of Wolfe Research echoed this sentiment, stating that recent price movements in Bank of America strongly suggest Berkshire's continued reduction of its position. Berkshire Hathaway initiated a selling spree last year, shedding its once second-largest stock holding behind Apple. The conglomerate eventually reduced its stake below 10%, at which point it was no longer obligated to disclose 'related transactions' promptly. Chubak believes investors are becoming more comfortable navigating the technical overhang associated with Berkshire's selling, and expects the stock to close its valuation gap gradually. However, he remains uncertain about the exact timing. Investors will gain a clearer understanding of Berkshire's current holdings when the company releases its 13F filing with the Securities and Exchange Commission on February 14th. This filing will disclose Berkshire's stock market holdings as of the end of 2024. Additionally, Warren Buffett's annual letter to shareholders, anticipated at the end of this month, might shed light on his overall market outlook and his specific views on Bank of America. Chubak estimates that Berkshire's next 13F filing could reveal a leaner position of around 7% at the end of 2024, with a current holding possibly closer to 5.5% or 6%. Buffett famously invested $5 billion in Bank of America preferred stock and warrants back in 2011 to bolster confidence in the struggling bank following the subprime mortgage crisis. He converted the warrants to common stock in 2017, making Berkshire the bank's largest shareholder. Subsequently, Buffett further increased his investment in 2018 and 2019 by adding another 300 million shares.

BANK OF AMERICA BERKSHIRE HATHAWAY WARREN BUFFETT EARNINGS STOCK PERFORMANCE INVESTOR SPECULATION BANK SECTOR

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Pershing Square's Ackman Aims to Turn Howard Hughes into a Modern-Day Berkshire HathawayBill Ackman's Pershing Square is proposing a deal to acquire a controlling stake in Howard Hughes, aiming to transform it into a conglomerate similar to Warren Buffett's Berkshire Hathaway. The deal would raise Pershing Square's stake to between 61% and 69%. Ackman envisions the new entity investing in operating companies and acquiring assets. If successful, he would become CEO and chairman.

Pershing Square's Ackman Aims to Turn Howard Hughes into a Modern-Day Berkshire HathawayBill Ackman's Pershing Square is proposing a deal to acquire a controlling stake in Howard Hughes, aiming to transform it into a conglomerate similar to Warren Buffett's Berkshire Hathaway. The deal would raise Pershing Square's stake to between 61% and 69%. Ackman envisions the new entity investing in operating companies and acquiring assets. If successful, he would become CEO and chairman.

Read more »

Berkshire Hathaway hasn't paid a dividend in nearly 60 years — Could that ever change?Howard Buffett, Berkshire's future nonexecutive chairman, hesitated when asked about dividends when his father Warren is no long at the helm.

Berkshire Hathaway hasn't paid a dividend in nearly 60 years — Could that ever change?Howard Buffett, Berkshire's future nonexecutive chairman, hesitated when asked about dividends when his father Warren is no long at the helm.

Read more »

Berkshire Hathaway: A Solid Investment in 2025, Regardless of Economic OutlookUBS analysts predict a nearly 17% gain for Berkshire Hathaway shares in 2025, citing the conglomerate's diversified business portfolio and robust financial position.

Berkshire Hathaway: A Solid Investment in 2025, Regardless of Economic OutlookUBS analysts predict a nearly 17% gain for Berkshire Hathaway shares in 2025, citing the conglomerate's diversified business portfolio and robust financial position.

Read more »

Berkshire Hathaway Increases Stake in SiriusXM Amidst Market DownturnBerkshire Hathaway has significantly expanded its holdings in SiriusXM, acquiring millions of shares in recent transactions. This move comes as SiriusXM grapples with declining share prices and subscriber losses. It is unclear if Warren Buffett personally orchestrated this investment.

Berkshire Hathaway Increases Stake in SiriusXM Amidst Market DownturnBerkshire Hathaway has significantly expanded its holdings in SiriusXM, acquiring millions of shares in recent transactions. This move comes as SiriusXM grapples with declining share prices and subscriber losses. It is unclear if Warren Buffett personally orchestrated this investment.

Read more »

Warren Buffett's Berkshire Hathaway scoops up more Sirius XM, boosting stake to 35%The Omaha, Nebraska-based conglomerate purchased roughly 2.3 million shares for about $54 million in separate transactions Thursday through Monday.

Warren Buffett's Berkshire Hathaway scoops up more Sirius XM, boosting stake to 35%The Omaha, Nebraska-based conglomerate purchased roughly 2.3 million shares for about $54 million in separate transactions Thursday through Monday.

Read more »

Warren Buffett's Berkshire Hathaway Increases Stake in SiriusXM Amidst Company's StrugglesBerkshire Hathaway quietly acquired over 2 million shares of SiriusXM, raising eyebrows in the financial world. While Warren Buffett remains silent on the investment, the move signals a potential bet on the struggling satellite radio company.

Warren Buffett's Berkshire Hathaway Increases Stake in SiriusXM Amidst Company's StrugglesBerkshire Hathaway quietly acquired over 2 million shares of SiriusXM, raising eyebrows in the financial world. While Warren Buffett remains silent on the investment, the move signals a potential bet on the struggling satellite radio company.

Read more »