The AUD/JPY cross gathers strength to around 97.40 during the Asian session on Thursday.

AUD/JPY climbs to near 97.40 in Thursday’s Asian session, adding 0.20% on the day. The Australia n dropped to 3.9% in November from 4.1% in October, stronger than expected. BoJ rate hike uncertainty drags the JPY lower. The Aussie gains traction after the release of the Australia n employment report.

Employment FAQs How do employment levels affect currencies? Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency.

Crosses Macroeconomics CPI Australia

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

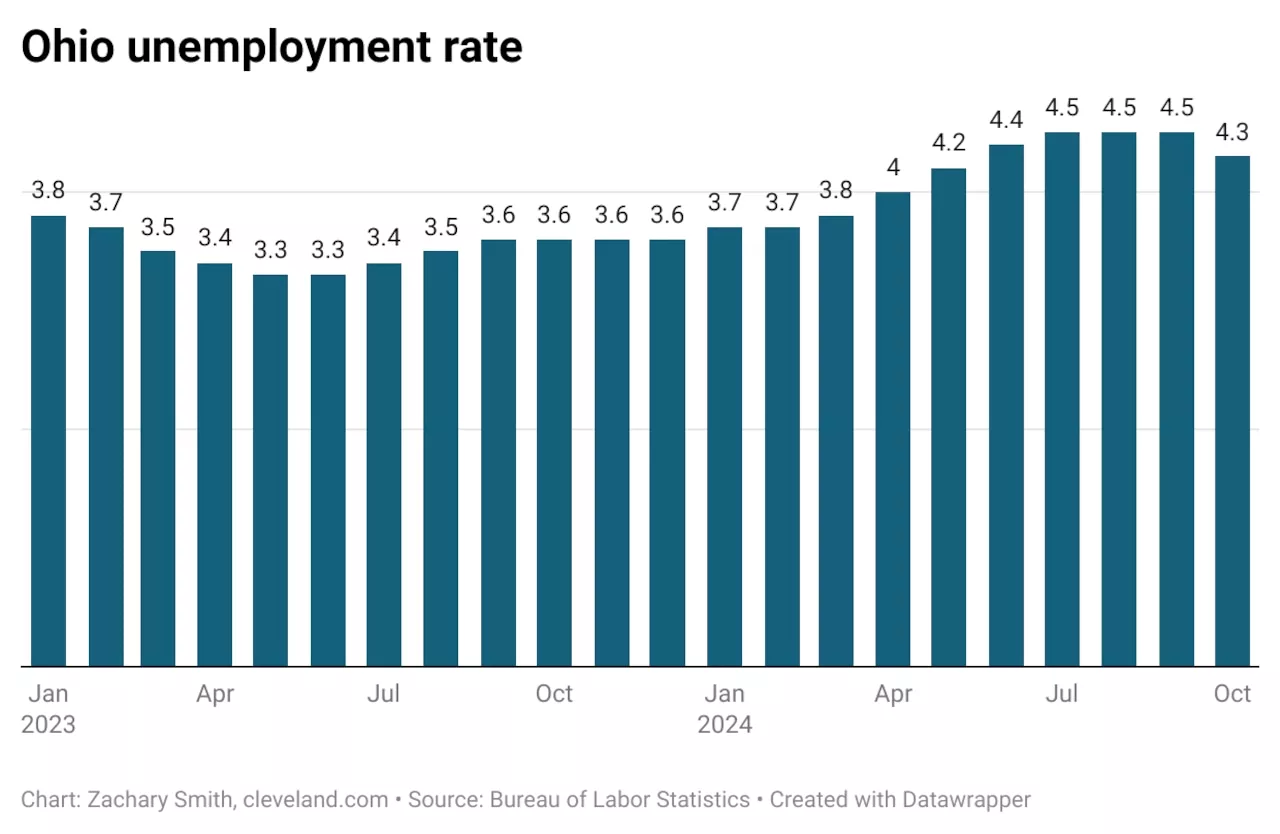

Ohio’s unemployment rate drops for first time in 18 months; remains above national levelOhio’s unemployment rate was 4.3% in October, remaining above the national unemployment rate of 4.1%

Ohio’s unemployment rate drops for first time in 18 months; remains above national levelOhio’s unemployment rate was 4.3% in October, remaining above the national unemployment rate of 4.1%

Read more »

AUD/JPY falls below 100.50 as the likelihood of a BoJ rate hike next month revivesAUD/JPY continues its decline, nearing 100.30 during the Asian trading hours on Friday.

AUD/JPY falls below 100.50 as the likelihood of a BoJ rate hike next month revivesAUD/JPY continues its decline, nearing 100.30 during the Asian trading hours on Friday.

Read more »

AUD/JPY rises above 101.00 due to growing doubts over future BoJ rate hikesAUD/JPY extends its gains for the third successive day, trading around 101.20 during European hours on Wednesday.

AUD/JPY rises above 101.00 due to growing doubts over future BoJ rate hikesAUD/JPY extends its gains for the third successive day, trading around 101.20 during European hours on Wednesday.

Read more »

AUD/JPY tumbles to near 96.50 as RBA leaves interest rate unchanged at 4.35%The AUD/JPY cross weakens to near 96.55 during the Asian trading hours on Tuesday.

AUD/JPY tumbles to near 96.50 as RBA leaves interest rate unchanged at 4.35%The AUD/JPY cross weakens to near 96.55 during the Asian trading hours on Tuesday.

Read more »

AUD/JPY rises above 101.00 due to rising doubts over BoJ rate hikesAUD/JPY extends its winning streak for the third successive session, trading around 101.20 during the Asian hours on Wednesday.

AUD/JPY rises above 101.00 due to rising doubts over BoJ rate hikesAUD/JPY extends its winning streak for the third successive session, trading around 101.20 during the Asian hours on Wednesday.

Read more »

Australia unemployment rate set to stabilize at 4.1% in OctoberThe Australian Bureau of Statistics (ABS) will release the October monthly employment report at 00:30 GMT on Thursday.

Australia unemployment rate set to stabilize at 4.1% in OctoberThe Australian Bureau of Statistics (ABS) will release the October monthly employment report at 00:30 GMT on Thursday.

Read more »