Having tested offers briefly above 95.00 in the Asian session, AUD/JPY has turned south, witnessing a steep sell-off in the European session on Monday.

AUD/JPY rebounds after crashing to 15-month lows near 90.00. Risk-aversion remains in full steam, as Iran is likely to attack Israel. The Japanese Yen keeps rallying on safe-haven flows at the expense of the higher-yielding Aussie. Heightening risk-aversion across the financial markets contributed to increased flight to safety in the Japanese Yen while traders cut their exposure in the higher-yielding currency – the Australian Dollar.

Risk sentiment FAQs What do the terms'risk-on' and 'risk-off' mean when referring to sentiment in financial markets? In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets.

Crosses Riskaversion Middleeast

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

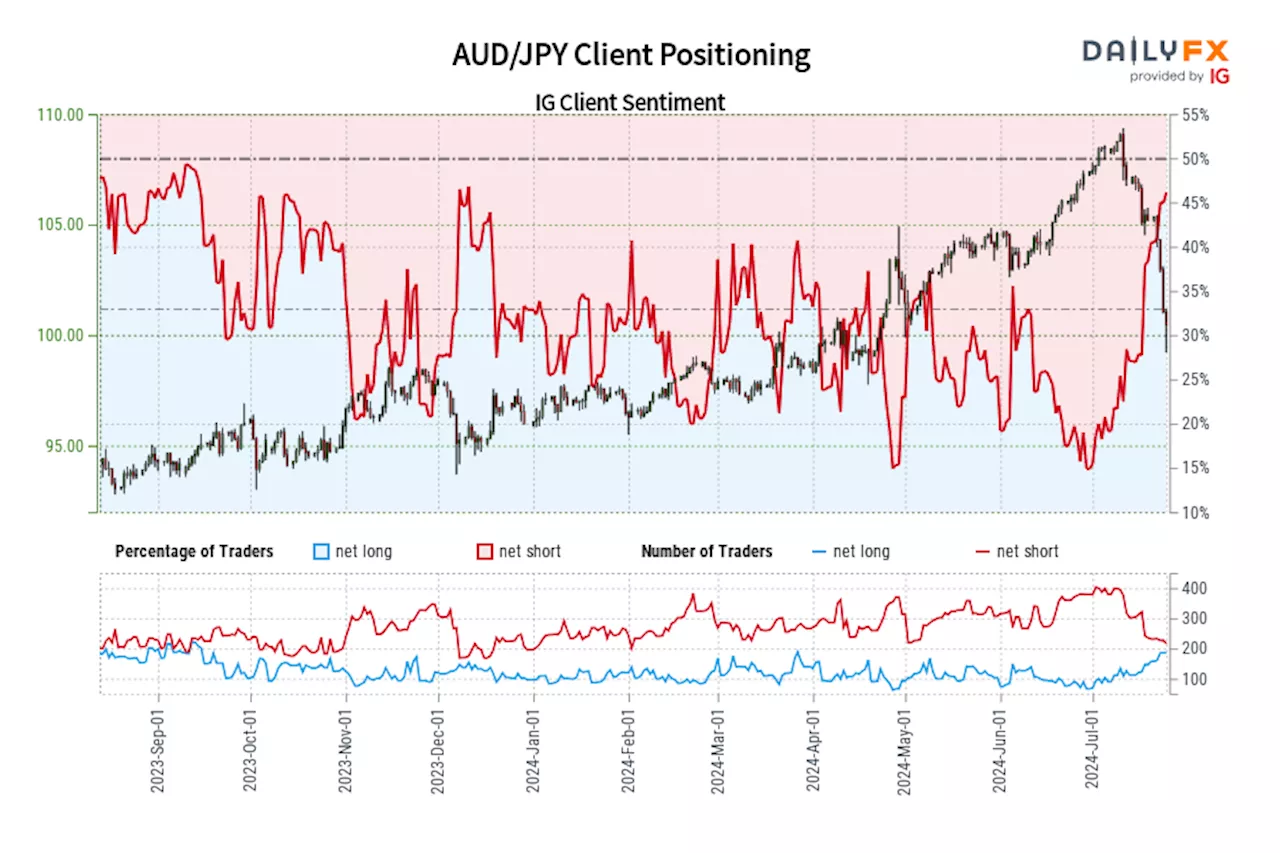

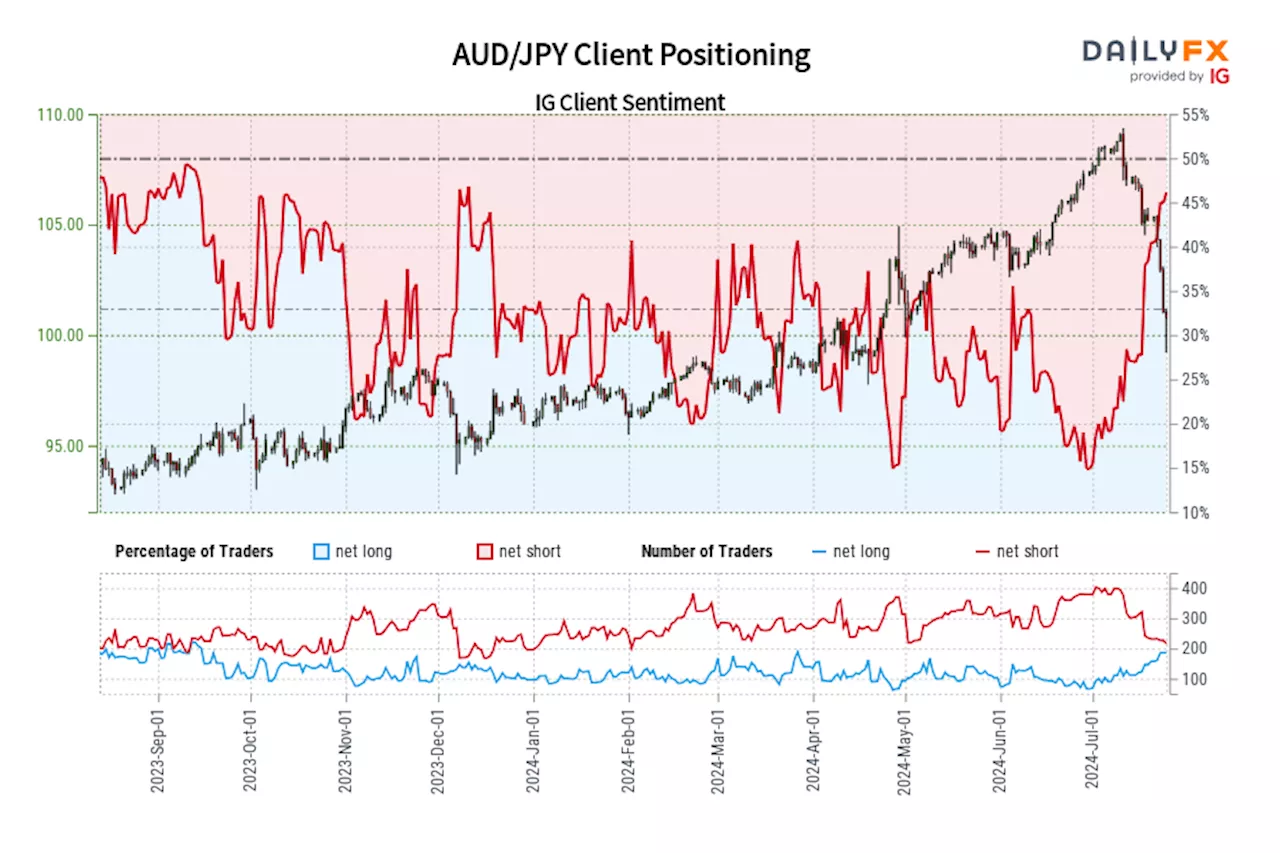

AUD/JPY IG Client Sentiment: Our data shows traders are now at their most net-long AUD/JPY since Sep 13 when AUD/JPY traded near 94.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

AUD/JPY IG Client Sentiment: Our data shows traders are now at their most net-long AUD/JPY since Sep 13 when AUD/JPY traded near 94.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

Read more »

AUD/JPY IG Client Sentiment: Our data shows traders are now net-long AUD/JPY for the first time since Sep 13, 2023 when AUD/JPY traded near 94.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

AUD/JPY IG Client Sentiment: Our data shows traders are now net-long AUD/JPY for the first time since Sep 13, 2023 when AUD/JPY traded near 94.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

Read more »

AUD/JPY IG Client Sentiment: Our data shows traders are now at their most net-long AUD/JPY since Jul 26 when AUD/JPY traded near 100.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

AUD/JPY IG Client Sentiment: Our data shows traders are now at their most net-long AUD/JPY since Jul 26 when AUD/JPY traded near 100.60.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/JPY-bearish contrarian trading bias.

Read more »

AUD/JPY Price Analysis: Downtrend persisting, pair in lows since MarchDespite showing signs of a slight recovery Monday, the AUD/JPY pair substantiates the bearish streak, losing ground dramatically over the week with dwindling trading volume reinforcing this downward sentiment.

AUD/JPY Price Analysis: Downtrend persisting, pair in lows since MarchDespite showing signs of a slight recovery Monday, the AUD/JPY pair substantiates the bearish streak, losing ground dramatically over the week with dwindling trading volume reinforcing this downward sentiment.

Read more »

AUD/JPY flat lines below 101.00 ahead of Australian CPI and BoJ on WednesdayThe AUD/JPY cross struggles to gain any meaningful traction during the Asian session on Tuesday and remains confined in a three-day-old range, well above a three-month low touched last week.

AUD/JPY flat lines below 101.00 ahead of Australian CPI and BoJ on WednesdayThe AUD/JPY cross struggles to gain any meaningful traction during the Asian session on Tuesday and remains confined in a three-day-old range, well above a three-month low touched last week.

Read more »

AUD/JPY rebounds after the post-BoJ slump to the lowest level since April 19The AUD/JPY cross plummets to its lowest level since April 19 after the Bank of Japan (BoJ) announced its policy decision on Wednesday, validating the Asian session breakdown through the 200-day Simple Moving Average (SMA).

AUD/JPY rebounds after the post-BoJ slump to the lowest level since April 19The AUD/JPY cross plummets to its lowest level since April 19 after the Bank of Japan (BoJ) announced its policy decision on Wednesday, validating the Asian session breakdown through the 200-day Simple Moving Average (SMA).

Read more »