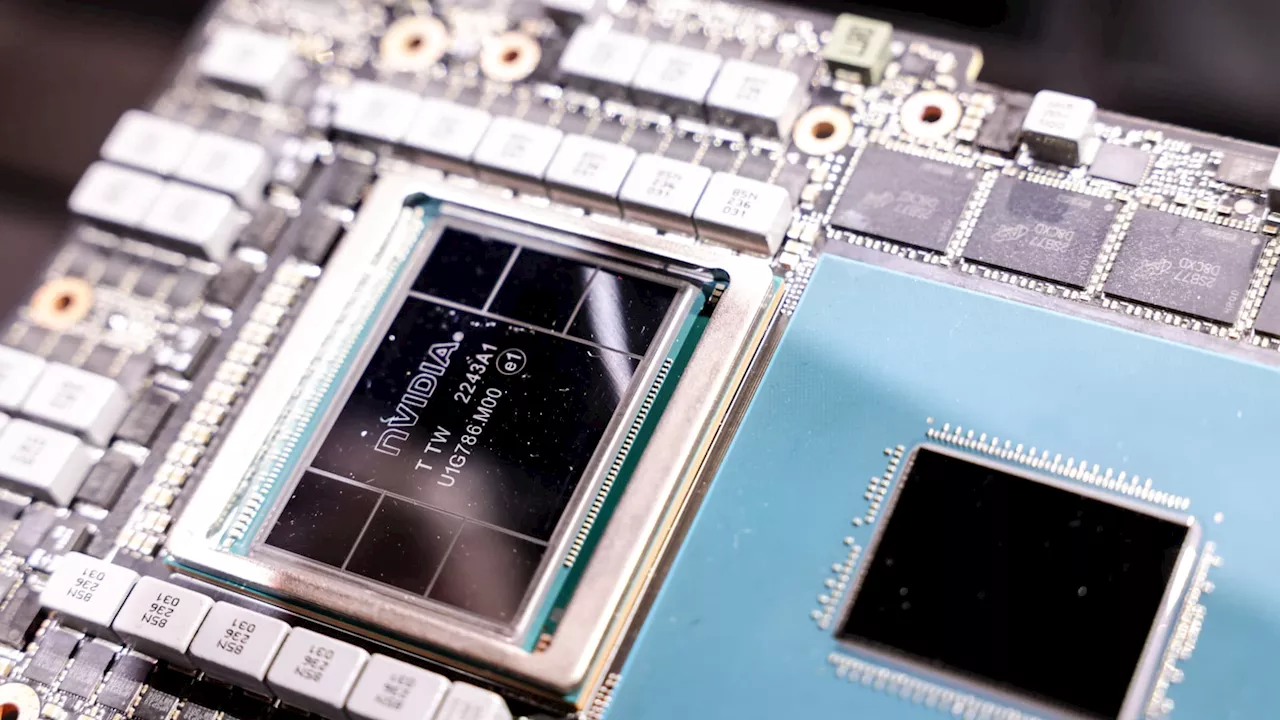

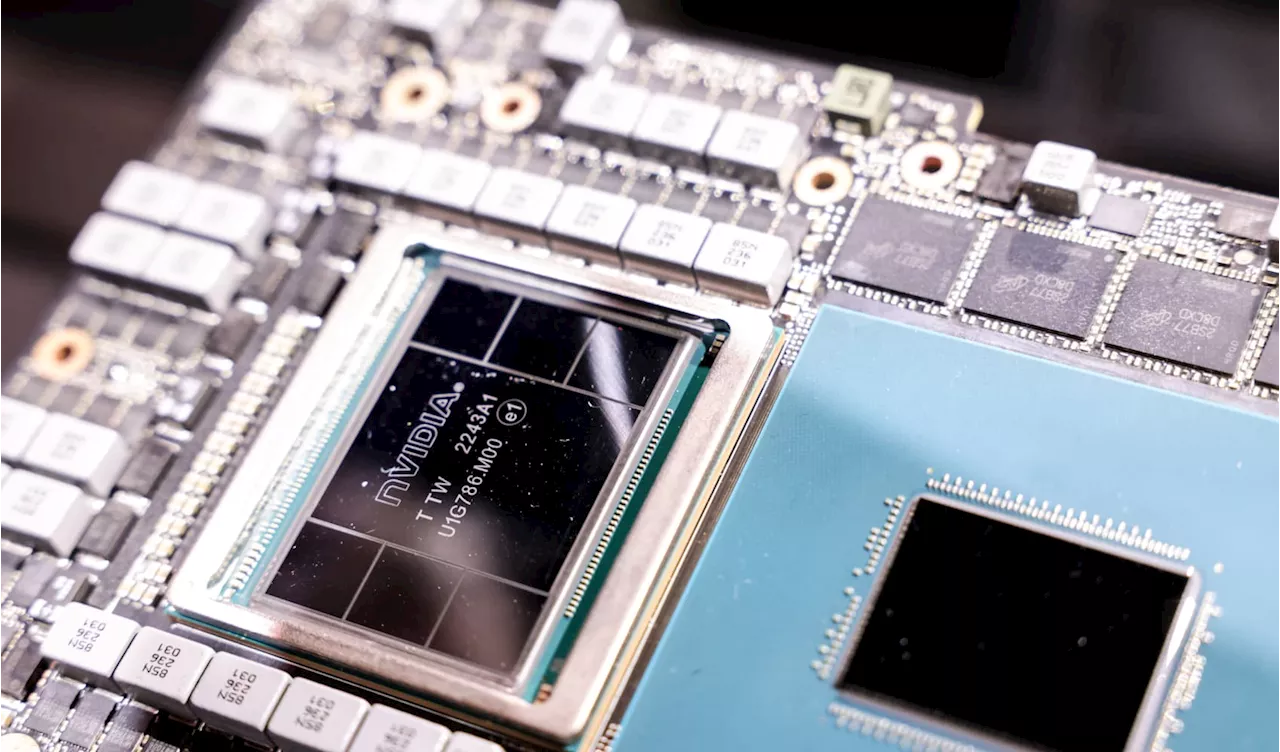

Most Asia-Pacific markets closed 2024 with gains, driven by easing monetary policy and the AI boom. However, analysts predict a more uncertain 2025, with global economic trends and political developments in key markets like South Korea potentially shaping the region's performance.

Analysts say Trump's presidency and China's economy will be key to determining the direction of the Asian markets in 2025.Asia-Pacific stocks had a good run in 2024, with most major markets ending the year in positive territory, as the region's central banks eased monetary policy while an AI boom lifted tech stocks., said Mike Shiao, chief investment officer for Asia ex-Japan at investment management firm Invesco, paving the way for monetary easing.

While tech stocks helped lift Taiwan, they couldn't save South Korea, which was the only major Asian market to end the year in negative territory. The country's "Corporate Value-up program" appears to have failed to boost stocks, with tariff fears andMajor economies, particularly the U.S. and China, will greatly impact South Korea's exports-driven economy, Paul Kim, head of equities at Eastspring Investments, said in the firm's 2025 outlook.

Kim also said that the government will play a key role in the country's markets, highlighting that potential reforms in corporate regulations, fiscal stimulus measures and the possibility of further rate cuts by the Bank of Korea could help the business environment and stimulate domestic demand.

Manufacturing and trade-dependent economies, such as those in Asia, will likely be more negatively impacted, "as tariffs lead to reduced trade flows and put downward pressure on growth," Freida Tay, institutional fixed income portfolio manager at global investment manager MFS Investment Management told CNBC.

On the other hand, countries that have "strong growth, higher inflation and still accommodative monetary conditions" will hike rates, such as Japan and Malaysia.

Nomura analysts expect more stimulus from China to support its economy, while highlighting that Beijing needs to stabilize its embattled property market, fix its fiscal system, beef-up social welfare support, and ease geopolitical tensions in order to "achieve a real, sustainable recovery."

Asia-Pacific Stocks Economy Technology Investment Geopolitics

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Asia-Pacific Stocks Finish 2024 Strong, But 2025 Outlook Remains UncertainDespite a strong performance in 2024, driven by easing monetary policy and the AI boom, the outlook for Asia-Pacific markets in 2025 remains uncertain. While most major markets closed the year in positive territory, South Korea was the only exception, experiencing a significant decline. The direction of the U.S. and China's economies, along with the potential impact of the impeachment of South Korean President Yoon Suk Yeol, are key factors that will shape the region's performance next year.

Asia-Pacific Stocks Finish 2024 Strong, But 2025 Outlook Remains UncertainDespite a strong performance in 2024, driven by easing monetary policy and the AI boom, the outlook for Asia-Pacific markets in 2025 remains uncertain. While most major markets closed the year in positive territory, South Korea was the only exception, experiencing a significant decline. The direction of the U.S. and China's economies, along with the potential impact of the impeachment of South Korean President Yoon Suk Yeol, are key factors that will shape the region's performance next year.

Read more »

Tesla is recalling almost 700,000 vehicles due to a tire pressure monitoring system issueThe recall includes certain 2024 Cybertruck, 2017-2025 Model 3, and 2020-2025 Model Y vehicles.

Tesla is recalling almost 700,000 vehicles due to a tire pressure monitoring system issueThe recall includes certain 2024 Cybertruck, 2017-2025 Model 3, and 2020-2025 Model Y vehicles.

Read more »

Bill Skarsgård's Rotten Tomatoes Cold Streak Is Officially Over Thanks To Acclaimed Upcoming Horror MovieBill Skarsgard in the posters for The Crow (2024), Boy Kills World (2024), and Nosferatu (2024)

Bill Skarsgård's Rotten Tomatoes Cold Streak Is Officially Over Thanks To Acclaimed Upcoming Horror MovieBill Skarsgard in the posters for The Crow (2024), Boy Kills World (2024), and Nosferatu (2024)

Read more »

S&P 500: After a Memorable 2024, Could the Index Keep Rallying Into 2025?Stocks Analysis by Investing.com (Ismael De La Cruz) covering: FTSE 100, S&P 500, CAC 40, Dow Jones Industrial Average. Read Investing.com (Ismael De La Cruz)'s latest article on Investing.com

S&P 500: After a Memorable 2024, Could the Index Keep Rallying Into 2025?Stocks Analysis by Investing.com (Ismael De La Cruz) covering: FTSE 100, S&P 500, CAC 40, Dow Jones Industrial Average. Read Investing.com (Ismael De La Cruz)'s latest article on Investing.com

Read more »

Gold Prices Poised for Growth in 2024 and 2025: UBSGold prices are anticipated to rise next year due to several factors, including continued accumulation by central banks, increasing investor demand for safe-haven assets, and lower interest rates. UBS strategists predict global official sector gold purchases will reach 982 metric tons in 2024, driven by de-dollarization efforts and diversification strategies. Investor demand is expected to rise amid uncertainties surrounding fiscal, trade, and geopolitical developments, leading to increased inflows into gold exchange-traded funds. Additionally, anticipated rate cuts by the Federal Reserve will reduce the opportunity cost of holding gold, a non-interest-bearing asset.

Gold Prices Poised for Growth in 2024 and 2025: UBSGold prices are anticipated to rise next year due to several factors, including continued accumulation by central banks, increasing investor demand for safe-haven assets, and lower interest rates. UBS strategists predict global official sector gold purchases will reach 982 metric tons in 2024, driven by de-dollarization efforts and diversification strategies. Investor demand is expected to rise amid uncertainties surrounding fiscal, trade, and geopolitical developments, leading to increased inflows into gold exchange-traded funds. Additionally, anticipated rate cuts by the Federal Reserve will reduce the opportunity cost of holding gold, a non-interest-bearing asset.

Read more »

Grindrod outlines focus for 2025, reflects on 2024 performanceJSE-listed logistics company Grindrod, in a December 19 pre-closing trading update, said its focus going forward would be to drive growth in bulk handling, container handling, logistics capability and rail and transport, adding that demand for Grindrod's logistics service offering and its long-term business fundamentals remain strong.

Grindrod outlines focus for 2025, reflects on 2024 performanceJSE-listed logistics company Grindrod, in a December 19 pre-closing trading update, said its focus going forward would be to drive growth in bulk handling, container handling, logistics capability and rail and transport, adding that demand for Grindrod's logistics service offering and its long-term business fundamentals remain strong.

Read more »