While the new Arbitrum products are wholly speculative as of Monday, their use case might change after $ARB tokens are officially issued to network participants. By shauryamalwa

Derivative markets for the upcoming Arbitrum tokens are already open to traders ahead of this week’s claim event.that ARB will be airdropped to community members on Thursday, March 23, based on their prior network activity, marking Arbitrum’s official transition into a decentralized autonomous organization .

This means ARB holders will be able to vote on key decisions governing Arbitrum One and Arbitrum Nova – networks that allow users to transact on the Ethereum blockchain with greater speeds and lower fees.An I Owe You token on the crypto exchange Hotbit trades at $9.74 in Asian afternoon hours on Monday. These tokens represent debt between two parties and settle instantly as trades are made.

If that wasn’t enough, futures powerhouse BitMEX introduced its own ARB token futures product on Monday – offering leverage of up to 20x to give traders a chance to make even more money.listing announcementARB futures prices on BitMEX are considerably lower than Hotbit’s, trading at just over $1 at writing time on Monday.

However, while these products are wholly speculative as of Monday, their use case might change after ARB tokens are officially issued to network participants. Traders and holders of spot ARB may then use futures products to hedge their spot holdings or gain exposure to ARB prices using a smaller amount of initial capital via leverage.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Beware of fake Arbitrum Airdrops, community warnsScammers are going all out to take advantage of the upcoming Arbitrum Airdrop, setting up hundreds of fake accounts and phishing sites to potentially scam users.

Beware of fake Arbitrum Airdrops, community warnsScammers are going all out to take advantage of the upcoming Arbitrum Airdrop, setting up hundreds of fake accounts and phishing sites to potentially scam users.

Read more »

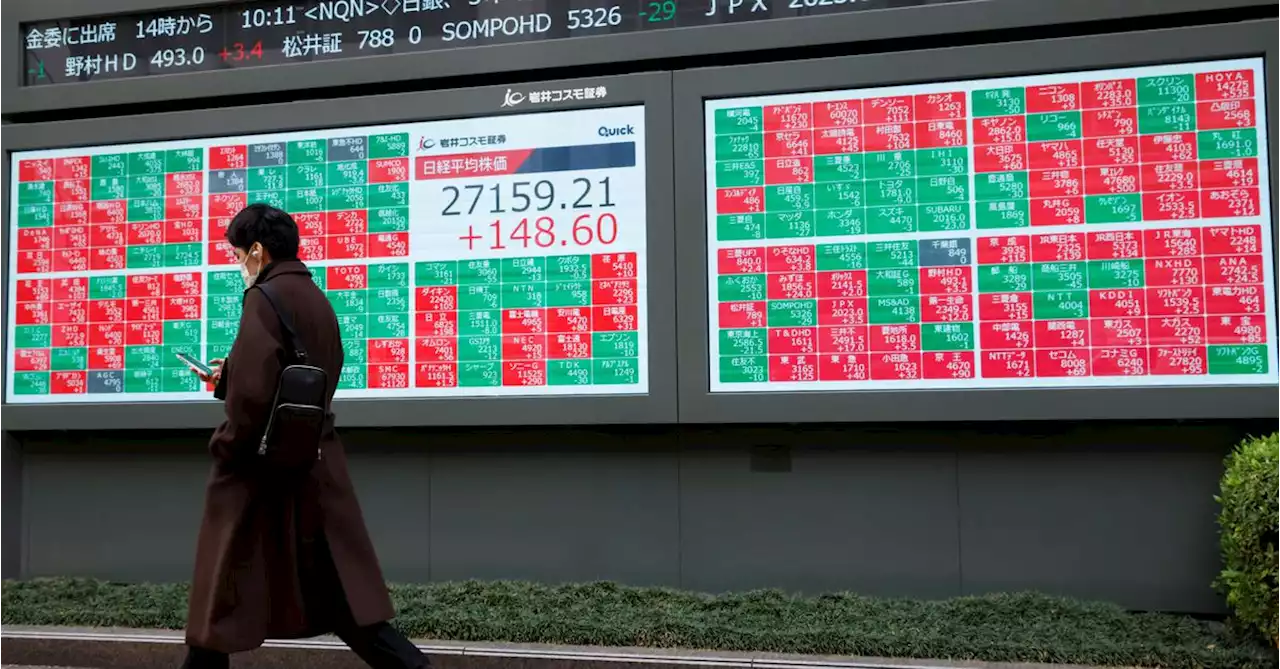

Dow futures rise after UBS buys Credit Suisse to stem bank crisis: Live updatesInvestors remained on edge as the week's trading began with regional banks still under pressure to shore up their deposit bases.

Dow futures rise after UBS buys Credit Suisse to stem bank crisis: Live updatesInvestors remained on edge as the week's trading began with regional banks still under pressure to shore up their deposit bases.

Read more »

U.S. stock-market futures edge higher after historic deal to rescue Credit SuisseU.S. stock-index futures opened with modest gains Sunday evening as investors assessed a historic deal to rescue troubled Swiss lender Credit Suisse as...

U.S. stock-market futures edge higher after historic deal to rescue Credit SuisseU.S. stock-index futures opened with modest gains Sunday evening as investors assessed a historic deal to rescue troubled Swiss lender Credit Suisse as...

Read more »

Stock futures nudge higher on Credit Suisse buyoutU.S. stock futures rose in Asian trade on Monday in relief at a weekend rescue deal for Credit Suisse, though the mood was nervous and financial shares remained under pressure from contagion fears, even with support from global central banks.

Stock futures nudge higher on Credit Suisse buyoutU.S. stock futures rose in Asian trade on Monday in relief at a weekend rescue deal for Credit Suisse, though the mood was nervous and financial shares remained under pressure from contagion fears, even with support from global central banks.

Read more »

S&P 500 Futures, Treasury bond yields rebound on central bank support, UBS-Credit Suisse dealS&P 500 Futures, Treasury bond yields rebound on central bank support, UBS-Credit Suisse deal – by anilpanchal7 SP500 Futures YieldCurve RiskAversion CentralBanks

S&P 500 Futures, Treasury bond yields rebound on central bank support, UBS-Credit Suisse dealS&P 500 Futures, Treasury bond yields rebound on central bank support, UBS-Credit Suisse deal – by anilpanchal7 SP500 Futures YieldCurve RiskAversion CentralBanks

Read more »