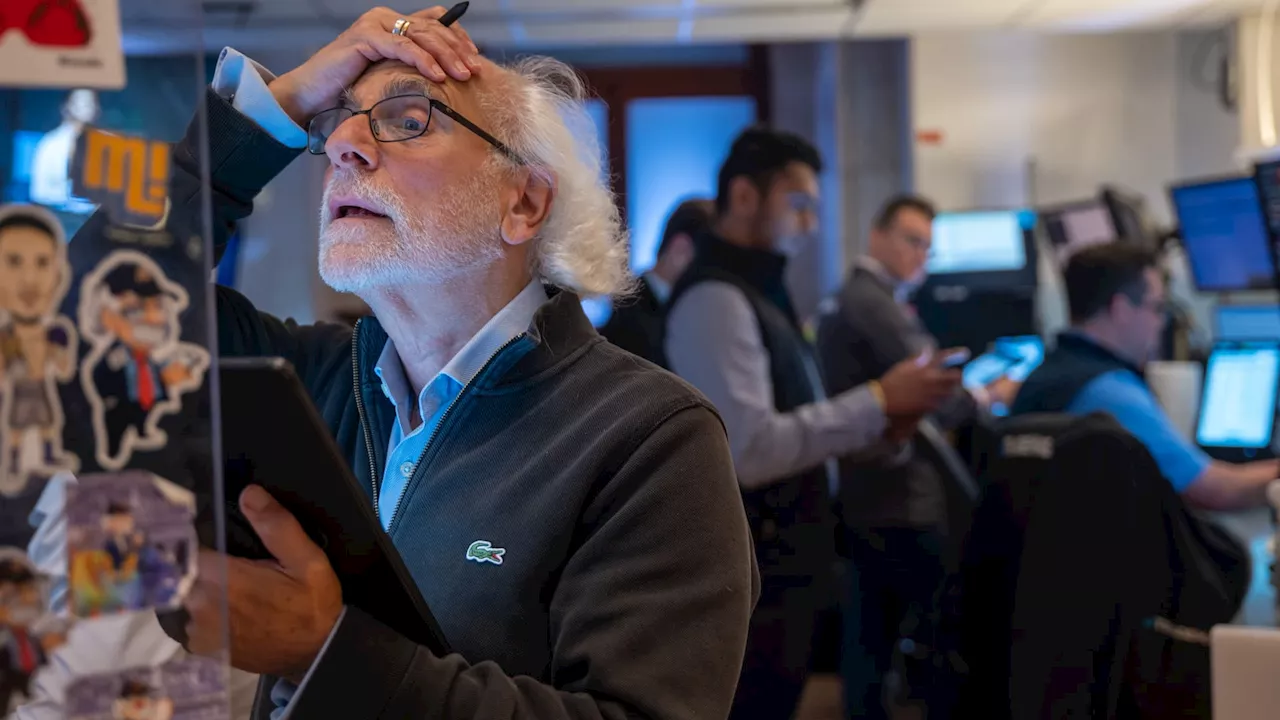

Analysts anticipate a strong earnings report from Apple, but investor attention will be closely focused on iPhone sales and the company's performance in China. Apple's stock has rebounded after a recent correction, but the next earnings release could determine if this upward momentum continues. Investors will be looking for clues on the growth of Apple's services business, gross margins, and the company's outlook for the future. The impact of China's competition and potential tariffs will also be closely watched.

Analysts expect a beat, but iPhone sales and China competition will be key.) will release its earnings after the market closes today, adding to a wave of high-profile reports from the Magnificent 7, including

What stands out is that Apple has been one of the few major tech stocks unaffected by the recent panic sparked by China’s DeepSeek AI. As investors look ahead to tonight’s earnings report, all eyes are on whether Apple can continue this upward momentum and deliver a positive surprise that will drive the stock even higherIn terms of consensus forecasts, EPS is expected to be $2.35, up 7.8% year-on-year, on sales of $124 billion, up 3.7% year-on-year.

Activity in China, especially iPhone sales, will be another focal point in tonight's earnings release. Apple lost its position as the country's largest smartphone manufacturer last year and now faces heightened competition from local brands. Any commentary on this will be closely scrutinized, as it could offer insights into how Apple plans to navigate this increasingly competitive landscape.

These insights can provide a clearer picture of expectations and help investors position themselves effectively as they anticipate how the results might influence Apple’s share price.

Business APPLE EARNINGS IPHONE CHINA COMPETITION

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Earnings playbook: Stocks set to make the biggest moves this week on earningsThese stocks could see sharp moves on the back of their latest earnings results, including a large group of banks.

Read more »

US Stocks Retreat After Jobs Report; Focus Shifts to Bank Earnings and Inflation DataUS stocks experienced a decline on Monday, extending the previous week's sell-off triggered by a strong jobs report. Investor attention is now focused on upcoming earnings releases from major banks and key inflation data.

US Stocks Retreat After Jobs Report; Focus Shifts to Bank Earnings and Inflation DataUS stocks experienced a decline on Monday, extending the previous week's sell-off triggered by a strong jobs report. Investor attention is now focused on upcoming earnings releases from major banks and key inflation data.

Read more »

Wall Street Earnings Kick Off: Wells Fargo, Goldman Sachs, and BlackRock in FocusWall Street's largest financial institutions begin reporting fourth-quarter earnings, with Wells Fargo, Goldman Sachs, and BlackRock leading the way. The market anticipates insights into interest income guidance, regulatory progress, expense management, and dealmaking activity.

Wall Street Earnings Kick Off: Wells Fargo, Goldman Sachs, and BlackRock in FocusWall Street's largest financial institutions begin reporting fourth-quarter earnings, with Wells Fargo, Goldman Sachs, and BlackRock leading the way. The market anticipates insights into interest income guidance, regulatory progress, expense management, and dealmaking activity.

Read more »

GM's 2025 Earnings Outlook in Focus as Q1 Results Top ExpectationsGeneral Motors (GM) is expected to report strong first-quarter 2025 earnings, with analysts predicting a significant jump in adjusted earnings per share and revenue growth. Investors will closely watch GM's guidance for 2025, particularly its updated expectations for adjusted earnings, which have been revised upwards recently. The company's performance in 2024, with soaring share prices, has made it a favorite among Wall Street analysts.

GM's 2025 Earnings Outlook in Focus as Q1 Results Top ExpectationsGeneral Motors (GM) is expected to report strong first-quarter 2025 earnings, with analysts predicting a significant jump in adjusted earnings per share and revenue growth. Investors will closely watch GM's guidance for 2025, particularly its updated expectations for adjusted earnings, which have been revised upwards recently. The company's performance in 2024, with soaring share prices, has made it a favorite among Wall Street analysts.

Read more »

Tesla Earnings Call to Focus on Musk's Political Activities and Impact on BrandTesla's upcoming fourth-quarter earnings report coincides with increased scrutiny regarding CEO Elon Musk's political involvement and its potential influence on the company's brand and performance. Shareholders have submitted numerous questions regarding Musk's time commitment to Tesla, his role in President Trump's administration, and the impact of his controversial political actions on investor confidence and consumer perception.

Tesla Earnings Call to Focus on Musk's Political Activities and Impact on BrandTesla's upcoming fourth-quarter earnings report coincides with increased scrutiny regarding CEO Elon Musk's political involvement and its potential influence on the company's brand and performance. Shareholders have submitted numerous questions regarding Musk's time commitment to Tesla, his role in President Trump's administration, and the impact of his controversial political actions on investor confidence and consumer perception.

Read more »

Tech Earnings in Focus as DeepSeek Sell-Off Heightens ScrutinyAll eyes are on earnings from major tech companies like Meta, Tesla, and Microsoft this week, especially after a recent tech sell-off fueled by DeepSeek concerns. Analysts are closely watching key figures like Meta's AI capital expenditures, Tesla's delivery growth target, and Microsoft's Azure revenue.

Tech Earnings in Focus as DeepSeek Sell-Off Heightens ScrutinyAll eyes are on earnings from major tech companies like Meta, Tesla, and Microsoft this week, especially after a recent tech sell-off fueled by DeepSeek concerns. Analysts are closely watching key figures like Meta's AI capital expenditures, Tesla's delivery growth target, and Microsoft's Azure revenue.

Read more »