For Credit Suisse's 50,000 employees, many questions remain.

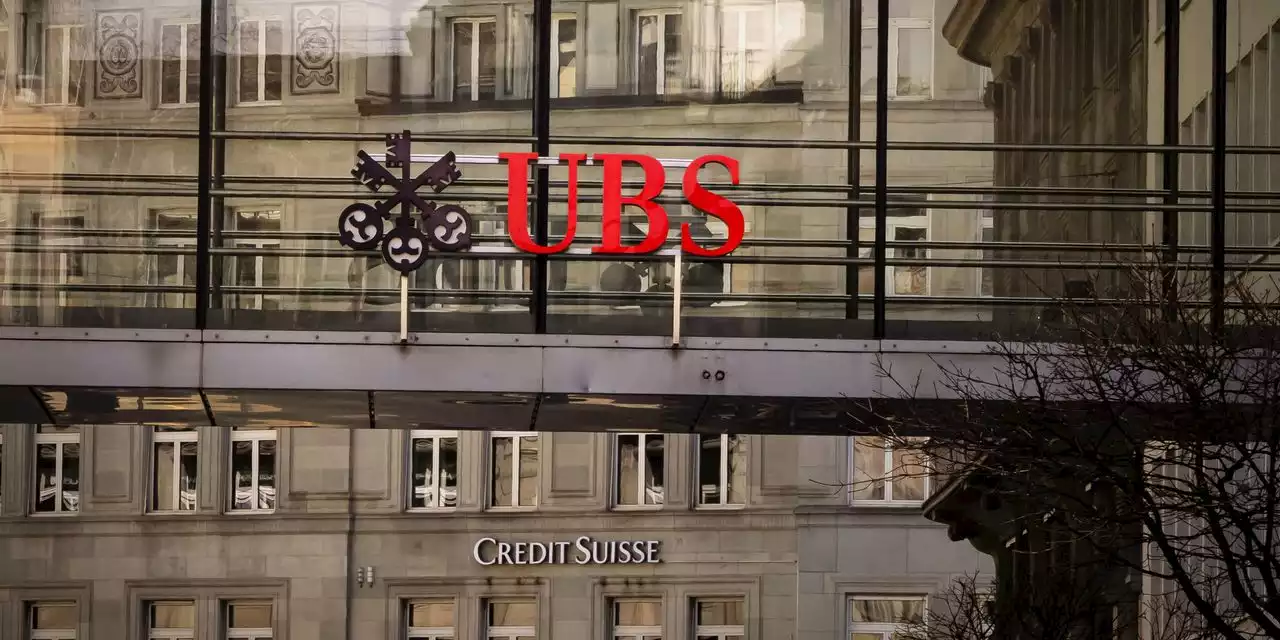

Credit Suisse’s fate is sealed, as Swiss rival UBS acquired the bank for 3 billion francs in a historic deal that has shaken the financial sector. But for its 50,000 employees, many questions remain.

“I’ve cried twice in my career. One during my first week in investment banking when I thought ‘what the hell have I let myself into’, and once today,” said one investment banker contacted by Financial News. The number of potential redundancies from the tie-up has yet to be announced, but it is expected to be significantly higher than the 9,000 cuts planned by Credit Suisse.

Responding to questions, executives reiterated that a strategy laid out in October, which involved refocusing Credit Suisse around wealth management, cutting risk-weighted assets and spinning out the investment bank into a separate unit called CS First Boston, was still the right one and the bank’s demise was caused by liquidity issues, the people said.

At an offsite meeting in New York earlier in March, Klein outlined plans for a Goldman Sachs-style partnership for around 100 of Credit Suisse’s investment bankers, who stood to hold around 20% of the equity in the new venture. As recently as March 14, Körner said that he was “excited” about the CS First Boston spinout, which was aiming to refocus Credit Suisse’s investment bank around so-called capital light activities such as M&A.

“A lot of us could have left a long time ago, but have made a conscious decision to stay,” said one dealmaker. “It was high risk, but we trusted the changes that were being made, avoided the cuts and were looking to future of the franchise. People might say ‘why bother?’ when bonuses are shrinking and the bank is taking so many hits. But the culture here is better than a lot of Wall Street firms and they treat people with respect.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Read more »

Shocked Credit Suisse staff fear uncertain future despite UBS rescue dealCredit Suisse staff arriving to work in Hong Kong and Singapore on Monday morning fretted about retrenchments and retaining business after larger Swiss rival UBS agreed to swallow the 167-year-old bank in a state-backed rescue.

Shocked Credit Suisse staff fear uncertain future despite UBS rescue dealCredit Suisse staff arriving to work in Hong Kong and Singapore on Monday morning fretted about retrenchments and retaining business after larger Swiss rival UBS agreed to swallow the 167-year-old bank in a state-backed rescue.

Read more »

UBS examining takeover of Credit Suisse to stem banking turmoilThe 167-year-old Credit Suisse is the biggest name ensnared in the market turmoil unleashed by the collapse of U.S. lenders Silicon Valley Bank and Signature Bank over the past week, and its slide has fanned fears of broader banking problems.

UBS examining takeover of Credit Suisse to stem banking turmoilThe 167-year-old Credit Suisse is the biggest name ensnared in the market turmoil unleashed by the collapse of U.S. lenders Silicon Valley Bank and Signature Bank over the past week, and its slide has fanned fears of broader banking problems.

Read more »

UBS, regulators race to seal Credit Suisse deal as soon as Saturday - FTThe Swiss National Bank and Swiss regulator FINMA have told their international counterparts they regard a deal with UBS Group as the only way to prevent a collapse in confidence in Credit Suisse Group , the Financial Times reported on Saturday.

UBS, regulators race to seal Credit Suisse deal as soon as Saturday - FTThe Swiss National Bank and Swiss regulator FINMA have told their international counterparts they regard a deal with UBS Group as the only way to prevent a collapse in confidence in Credit Suisse Group , the Financial Times reported on Saturday.

Read more »

UBS in Talks to Take Over Credit SuisseUBS is in talks to take over parts or all of Credit Suisse, part of an urgent effort by Swiss and global authorities to restore trust in the banking system.

UBS in Talks to Take Over Credit SuisseUBS is in talks to take over parts or all of Credit Suisse, part of an urgent effort by Swiss and global authorities to restore trust in the banking system.

Read more »

UBS, regulators race to seal Credit Suisse deal as soon as Saturday, Financial Times reportsThe Swiss National Bank and Swiss regulator FINMA have told their international counterparts they regard a deal with UBS Group as the only way to prevent a collapse in confidence in Credit Suisse Group , the Financial Times reported on Saturday.

UBS, regulators race to seal Credit Suisse deal as soon as Saturday, Financial Times reportsThe Swiss National Bank and Swiss regulator FINMA have told their international counterparts they regard a deal with UBS Group as the only way to prevent a collapse in confidence in Credit Suisse Group , the Financial Times reported on Saturday.

Read more »