Investors are increasing their exposure to U.S. corporate bonds as they take advantage of a surge in supply, but some say conflicting opinions about the economy are creating both long and short trading opportunities.

The belief that the Federal Reserve may be nearing the end of its aggressive interest rate hikes has injected new life into corporate bonds, with credit spreads on both the investment-grade and junk-rated asset class tightening after widening sharply last year. Spreads indicate the premium investors demand to hold corporate bonds rather than safer government debt.

That has encouraged a rush of bond issuance, for now mostly in the investment-grade primary market, and investor appetite for those new issues. However, some investors expect credit spreads may widen again to reflect a recession. And that is also providing an opportunity for those looking to build short positions as companies' ability to pay their debts may deteriorate.

"For a long period, shorting credit was not an interesting trade," said Paul Goldschmid, co-portfolio manager at credit hedge fund King Street, which manages $22 billion. Goldschmid cited low levels of credit downgrades, liquidity issues and bankruptcies for the lack of interesting opportunities.

King Street grew its cash levels last year, but now it's putting cash to work by going short and long on credit, Goldschmid said. As companies' fundamentals deteriorate in the coming months, he expects to reduce shorts that were profitable and get longer.. In the first week of 2023, total U.S.

Six new junk bonds have been sold for $4.725 billion so far this month, compared to just three for $2.12 billion in the whole of December, according to Informa data, reflecting the reopening of a junk bond primary market that saw declining new issue volumes towards the end of 2022.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Investors could find better stock market returns outside the U.S. in 2023With the dollar weakening, it's time for U.S. investors to get more serious about going abroad.

Investors could find better stock market returns outside the U.S. in 2023With the dollar weakening, it's time for U.S. investors to get more serious about going abroad.

Read more »

Analysis | Top conflict hot spots and crises in the world to worry about in 2023A newly released survey shows a rundown of the conflict hot spots most vexing U.S. policymakers. And even that list misses a whole other world of crisis.

Analysis | Top conflict hot spots and crises in the world to worry about in 2023A newly released survey shows a rundown of the conflict hot spots most vexing U.S. policymakers. And even that list misses a whole other world of crisis.

Read more »

Study claims wealthy blue state is America's most affordable, beating states thousands are moving toWalletHub released their 2023 analysis: '2023's Best & Worst States to Raise a Family' and determined that affluent blue states were the most affordable for families

Study claims wealthy blue state is America's most affordable, beating states thousands are moving toWalletHub released their 2023 analysis: '2023's Best & Worst States to Raise a Family' and determined that affluent blue states were the most affordable for families

Read more »

Analysis: Vanguard's climate group exit shows retail investors trail on ESGVanguard Group's decision last month to quit a key climate change coalition underscores how the retail investors who dominate its client base focus less on environmental, social and corporate governance (ESG) priorities than institutional investors.

Analysis: Vanguard's climate group exit shows retail investors trail on ESGVanguard Group's decision last month to quit a key climate change coalition underscores how the retail investors who dominate its client base focus less on environmental, social and corporate governance (ESG) priorities than institutional investors.

Read more »

The 10 best romantic getaways for couples to enjoy this Valentine’s Day 2023The 10 best romantic getaways for couples to enjoy this Valentine's Day 2023

The 10 best romantic getaways for couples to enjoy this Valentine’s Day 2023The 10 best romantic getaways for couples to enjoy this Valentine's Day 2023

Read more »

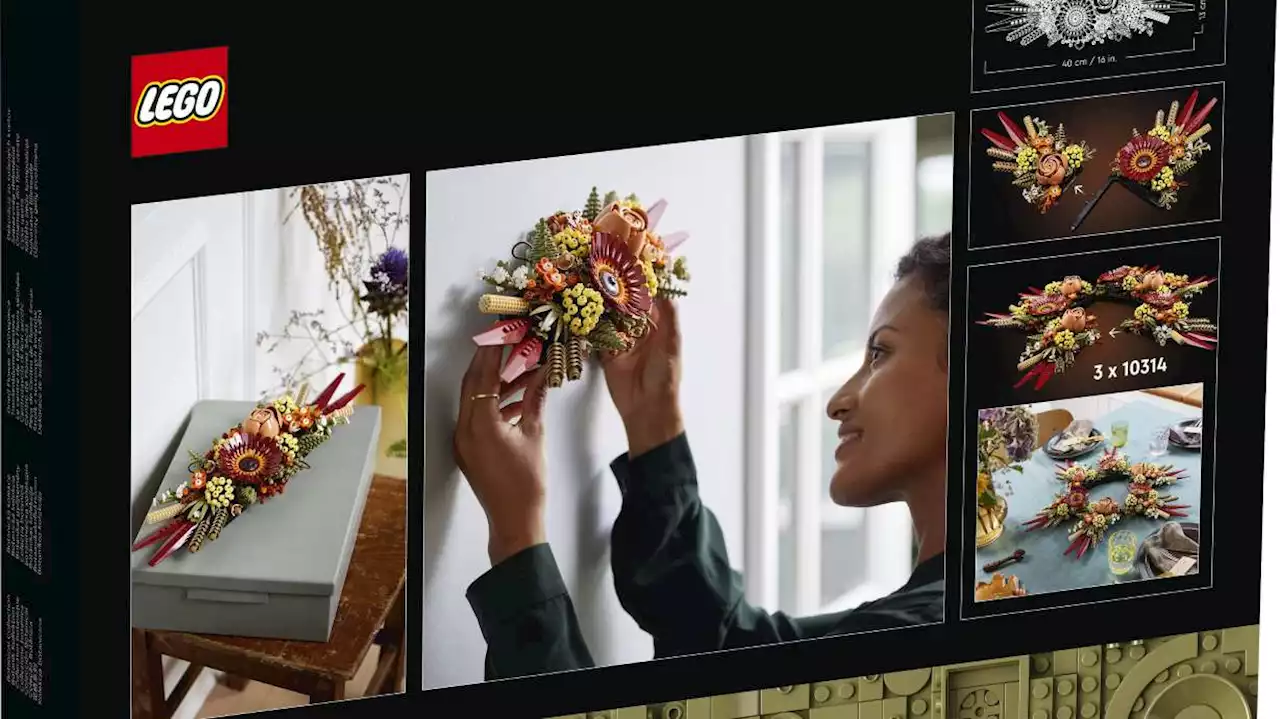

New Lego kits for 2023 include fine art, new botanicals, celebration of Disney's 100th anniversaryInterest in the classic building blocks of Lego shot up during the pandemic but, unlike many companies that saw only a temporary bump amid widespread home isolations, the Danish toymaker continues to see booming sales of its brick-by-brick building kits.

New Lego kits for 2023 include fine art, new botanicals, celebration of Disney's 100th anniversaryInterest in the classic building blocks of Lego shot up during the pandemic but, unlike many companies that saw only a temporary bump amid widespread home isolations, the Danish toymaker continues to see booming sales of its brick-by-brick building kits.

Read more »