A recent WalletHub survey reveals that a majority of Americans are facing difficulties keeping their savings pace with inflation, despite rising interest rates offered by some banks. The survey highlights consumer frustrations with bank fees and overdraft charges, while also emphasizing a preference for lower fees and higher interest rates when choosing a bank.

Nearly two-thirds of Americans say their savings aren't keeping up with inflation, according to a new WalletHub survey. This sentiment prevails even as some banks offer interest rates above 5%, with many consumers feeling their financial institutions aren't doing enough to help them navigate rising costs. The survey also reveals other frustrations, with 40% of Americans prioritizing low fees when choosing a bank and 75% supporting a $5 cap on overdraft fees.

Meanwhile, concerns about unfamiliarity are holding some back from exploring smaller banks and credit unions that could offer better deals. \With inflation outpacing savings, 65% of Americans say their bank accounts aren't keeping up. Even with interest rates on some savings accounts and CDs exceeding 5%, many feel these gains fall short of offsetting rising costs. High interest rates are also changing how people manage their money, with 64% of respondents saying they're spending less. These shifts highlight the growing struggle to maintain financial stability in today's uncertain economic climate. \When choosing a bank, fees are the biggest factor, cited by 40% of respondents. Interest rates come in second at 30%, while branch locations (15%), customer service (10%), and reviews (5%) round out the list. The survey also found that 65% of Americans say they would switch bank accounts for lower fees, and 53% would switch for higher interest rates. However, familiarity with a bank plays a role—39% of people are hesitant to try smaller banks or credit unions due to a lack of familiarity, despite their potential for better deals. Overdraft fees remain a sore point for many consumers. A strong majority—75% of respondents—support a $5 cap on overdraft fees, which could save account holders money while boosting trust in financial institutions.

INFLATION SAVINGS BANKING FEES INTEREST RATES

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Americans Struggle to Keep Up with Inflation, Seeking Relief in Bank Fees and Interest RatesA recent WalletHub survey reveals that a majority of Americans are struggling to keep their savings ahead of inflation. Despite rising interest rates on some bank accounts, many feel the gains are insufficient to offset the increasing cost of living. The survey also highlights concerns about bank fees, a desire for lower overdraft fees, and a hesitancy to explore alternative financial institutions.

Americans Struggle to Keep Up with Inflation, Seeking Relief in Bank Fees and Interest RatesA recent WalletHub survey reveals that a majority of Americans are struggling to keep their savings ahead of inflation. Despite rising interest rates on some bank accounts, many feel the gains are insufficient to offset the increasing cost of living. The survey also highlights concerns about bank fees, a desire for lower overdraft fees, and a hesitancy to explore alternative financial institutions.

Read more »

Credit Card Debt Soars as More Americans Struggle to PayA new report reveals that nearly half of credit cardholders carry month-to-month debt, with many citing unexpected expenses and rising living costs as contributing factors. The average balance per consumer has reached $6,380, and experts warn that high interest rates can lead to prolonged debt repayment periods.

Credit Card Debt Soars as More Americans Struggle to PayA new report reveals that nearly half of credit cardholders carry month-to-month debt, with many citing unexpected expenses and rising living costs as contributing factors. The average balance per consumer has reached $6,380, and experts warn that high interest rates can lead to prolonged debt repayment periods.

Read more »

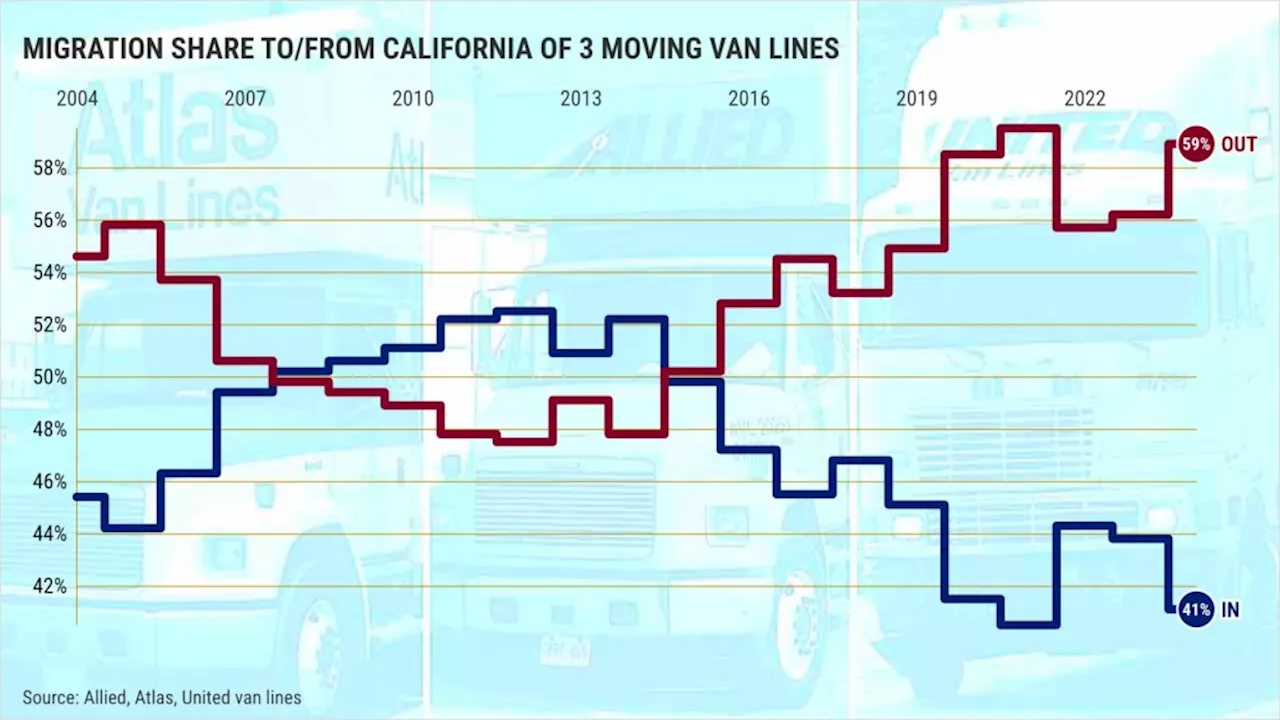

California's Struggle to Attract Americans WorsensNew data reveals that California is facing an ongoing challenge attracting Americans, with 2024 marking the second-worst year for van relocations to the state since 2004. The analysis suggests that the state's high cost of living and other factors may be contributing to the trend.

California's Struggle to Attract Americans WorsensNew data reveals that California is facing an ongoing challenge attracting Americans, with 2024 marking the second-worst year for van relocations to the state since 2004. The analysis suggests that the state's high cost of living and other factors may be contributing to the trend.

Read more »

Credit Card Debt Crisis Looms as Americans Struggle to Pay BillsMillions of Americans are facing a growing crisis of credit card debt, with balances surging to record highs and delinquency rates climbing. Experts warn that the situation will worsen in 2025 as consumers face higher interest rates, sticky inflation, and a potential economic downturn.

Credit Card Debt Crisis Looms as Americans Struggle to Pay BillsMillions of Americans are facing a growing crisis of credit card debt, with balances surging to record highs and delinquency rates climbing. Experts warn that the situation will worsen in 2025 as consumers face higher interest rates, sticky inflation, and a potential economic downturn.

Read more »

Financial Strain Grows as Americans Struggle to Build Emergency SavingsA recent Bankrate survey reveals a concerning decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain faced by many.

Financial Strain Grows as Americans Struggle to Build Emergency SavingsA recent Bankrate survey reveals a concerning decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain faced by many.

Read more »

Financial Insecurity Rises as Americans Struggle to Save for EmergenciesA new Bankrate survey reveals a worrying decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain many face.

Financial Insecurity Rises as Americans Struggle to Save for EmergenciesA new Bankrate survey reveals a worrying decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain many face.

Read more »