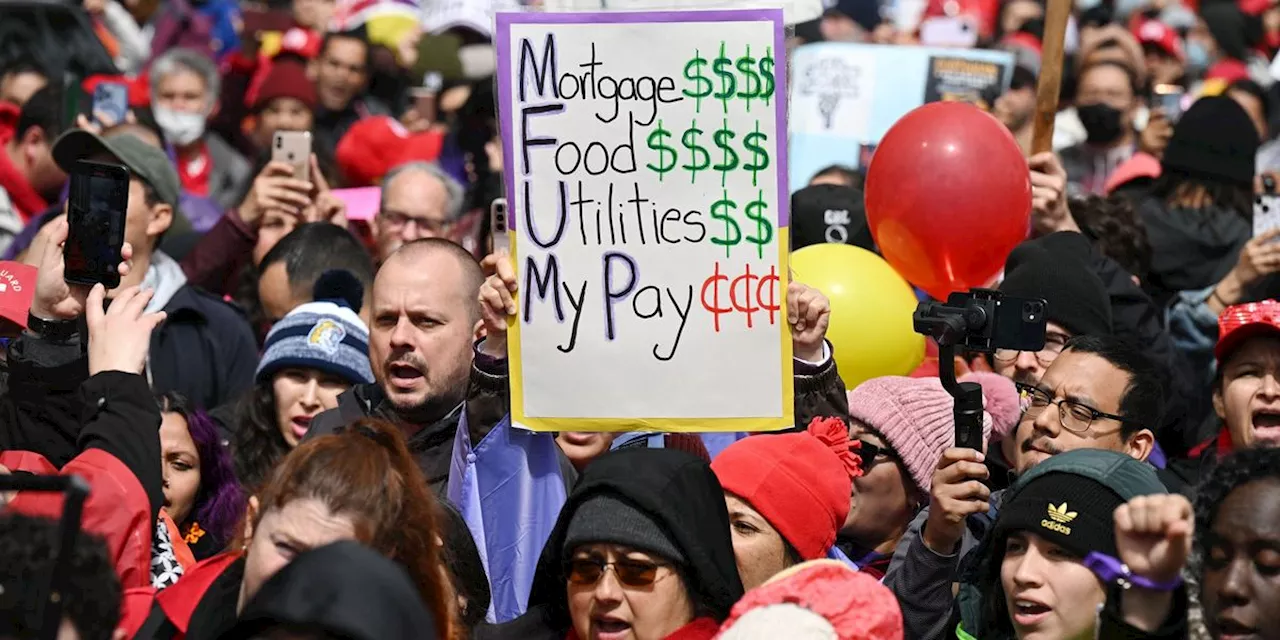

A new Bankrate survey reveals a concerning decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain on many households.

A recent Bankrate survey reveals a troubling trend: only 41% of Americans would use savings to cover a $1,000 emergency, such as an unexpected car repair or medical bill. This percentage represents a decline from 44% in the previous year, indicating a growing financial strain on many Americans. Adding to the concern, 27% of U.S. adults have no emergency savings whatsoever, the highest figure observed since 2020.

Instead of relying on savings, a significant 43% of individuals would turn to credit cards, loans, or borrowing from others to handle such emergencies. Credit card usage as a coping mechanism has even increased to 25%, up from 21% last year.This reliance on credit and borrowing reflects the challenging economic climate. Rising prices and elevated interest rates are significantly squeezing household budgets, forcing 73% of Americans to report saving less due to these pressures. While inflation has moderated since its peak in 2022, it remains stubbornly above the Federal Reserve's target. This persistent economic uncertainty is fueling widespread anxiety about financial stability. Nearly 70% of Americans express worry that they wouldn't be able to cover their living expenses if they lost their primary source of income. With unemployment projections reaching 4.4% by the end of 2025, financial insecurity is becoming a pressing national concern.Perhaps unsurprisingly, younger generations are disproportionately affected by the struggle to build emergency savings. Despite inflation slowing and wages holding steady, many Americans continue to face financial hurdles. Rising costs, high interest rates, and the ever-present threat of job loss leave nearly half the population ill-equipped to handle a $1,000 unexpected expense. Taking proactive steps to establish an emergency fund can empower individuals to navigate these financial challenges with greater resilience. Even small, consistent contributions can create a safety net for the inevitable bumps in the road

Emergency Savings Financial Strain Inflation Interest Rates Job Security

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Financial Strain Grows as Americans Struggle to Build Emergency SavingsA recent Bankrate survey reveals a concerning decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain faced by many.

Financial Strain Grows as Americans Struggle to Build Emergency SavingsA recent Bankrate survey reveals a concerning decline in Americans' ability to cover unexpected expenses, highlighting the growing financial strain faced by many.

Read more »

Financial Insecurity Grips Americans: Emergency Savings PlummetA new Bankrate survey reveals that only 41% of Americans could cover a $1,000 emergency, highlighting the growing financial strain many face. The survey also found that 27% of U.S. adults have no emergency savings at all, and 43% would rely on credit cards or loans to cover an unexpected expense. Rising prices, high interest rates, and job uncertainty are contributing to this trend.

Financial Insecurity Grips Americans: Emergency Savings PlummetA new Bankrate survey reveals that only 41% of Americans could cover a $1,000 emergency, highlighting the growing financial strain many face. The survey also found that 27% of U.S. adults have no emergency savings at all, and 43% would rely on credit cards or loans to cover an unexpected expense. Rising prices, high interest rates, and job uncertainty are contributing to this trend.

Read more »

The Vanishing American Dream: Workers Struggle While Wealth ConcentratesA conversation with an ATT employee highlights the growing disparity between the wealthy and the working class. The author explores the decline of the American Dream, stagnant wages, rising healthcare costs, and the impact of job insecurity.

The Vanishing American Dream: Workers Struggle While Wealth ConcentratesA conversation with an ATT employee highlights the growing disparity between the wealthy and the working class. The author explores the decline of the American Dream, stagnant wages, rising healthcare costs, and the impact of job insecurity.

Read more »

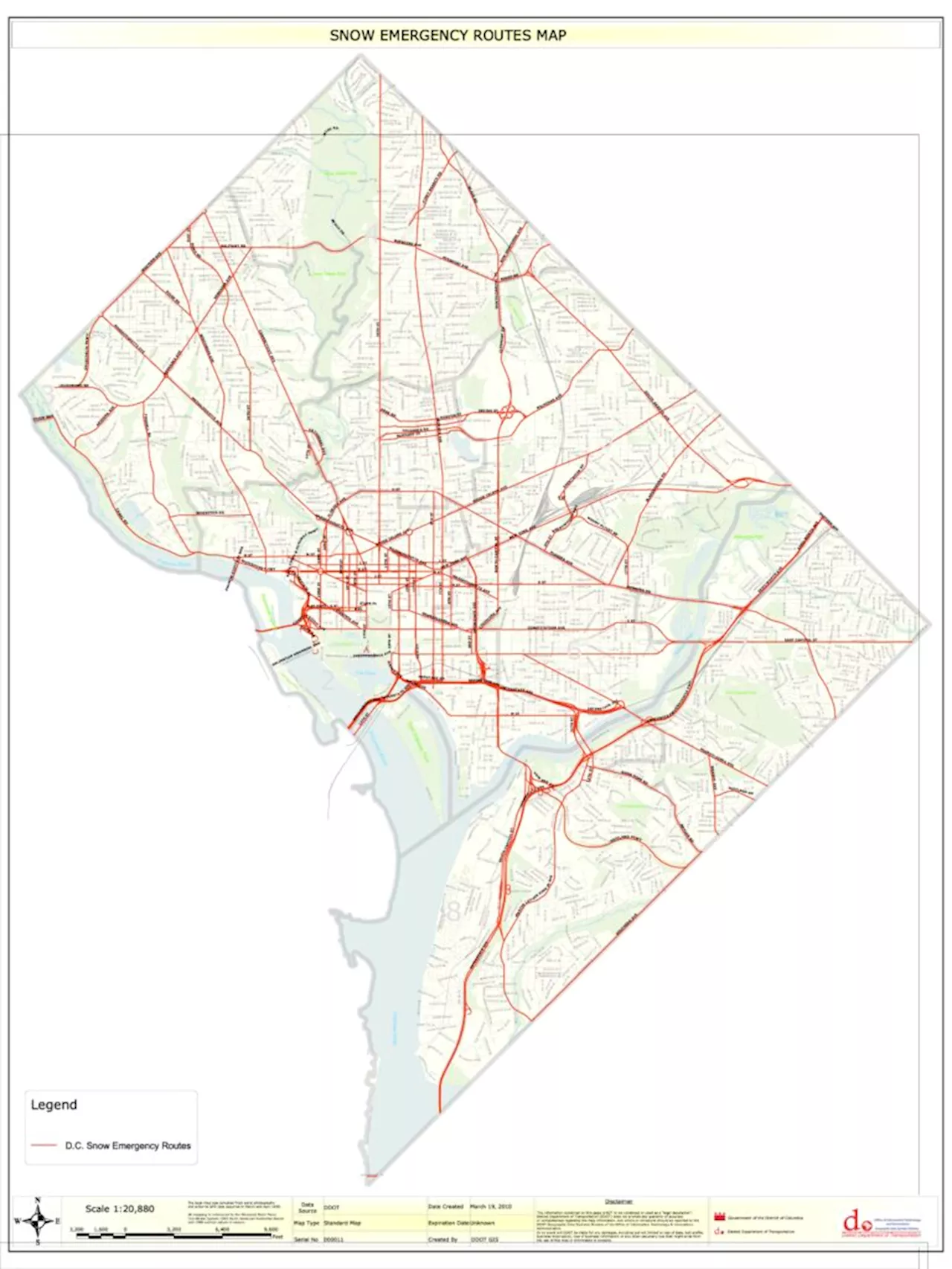

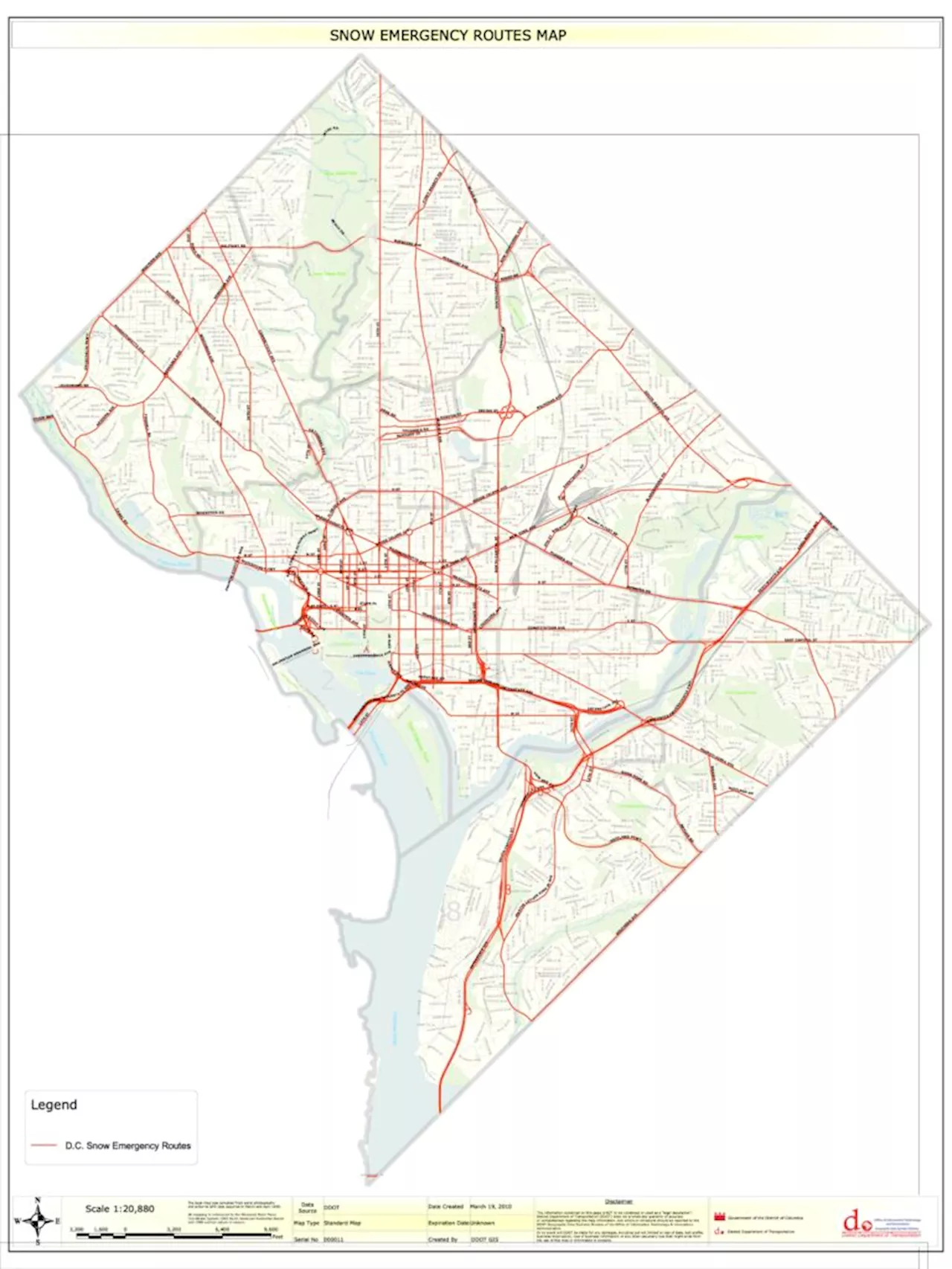

Snow Emergency Declared in Washington, DC, Cold Weather Emergency Remains in EffectMayor Muriel Bowser has declared a Snow Emergency for Washington, DC, as a winter storm is expected. The District Snow Team is deploying, and pre-treatment brining operations will begin. A Cold Weather Emergency remains in effect, with additional services provided to protect vulnerable residents.

Snow Emergency Declared in Washington, DC, Cold Weather Emergency Remains in EffectMayor Muriel Bowser has declared a Snow Emergency for Washington, DC, as a winter storm is expected. The District Snow Team is deploying, and pre-treatment brining operations will begin. A Cold Weather Emergency remains in effect, with additional services provided to protect vulnerable residents.

Read more »

DC Declares Snow Emergency, Cold Weather Emergency Still in EffectMayor Muriel Bowser has declared a Snow Emergency for Washington, DC, urging residents to move vehicles off snow emergency routes. A Cold Weather Emergency remains in effect, with the District providing additional services to protect vulnerable residents.

DC Declares Snow Emergency, Cold Weather Emergency Still in EffectMayor Muriel Bowser has declared a Snow Emergency for Washington, DC, urging residents to move vehicles off snow emergency routes. A Cold Weather Emergency remains in effect, with the District providing additional services to protect vulnerable residents.

Read more »

American Primeval: A Gritty Reimagining of the American WestAmerican Primeval, a new Netflix series, presents a raw and realistic depiction of the American West during the Utah War. While fictional characters drive the narrative, the series is deeply rooted in historical events, including the Mountain Meadows Massacre.

American Primeval: A Gritty Reimagining of the American WestAmerican Primeval, a new Netflix series, presents a raw and realistic depiction of the American West during the Utah War. While fictional characters drive the narrative, the series is deeply rooted in historical events, including the Mountain Meadows Massacre.

Read more »