Advanced Micro Devices (AMD) reported fourth-quarter results exceeding Wall Street's forecasts for sales and earnings. However, the company's stock declined after it fell short of estimates in its crucial data center segment. AMD anticipates $7.1 billion in first-quarter sales, with a projected gross margin of around 54%.

reported fourth-quarter results on Tuesday that beat Wall Street expectations for sales and earnings, but the stock fell about 6% in extended trading as the company missed estimates in its key data center segment. AMD said it expects $7.1 billion in sales in the first quarter, plus or minus $300 million. It projected its gross margin to be about 54%. Analysts expected AMD to guide for revenue of $7 billion.

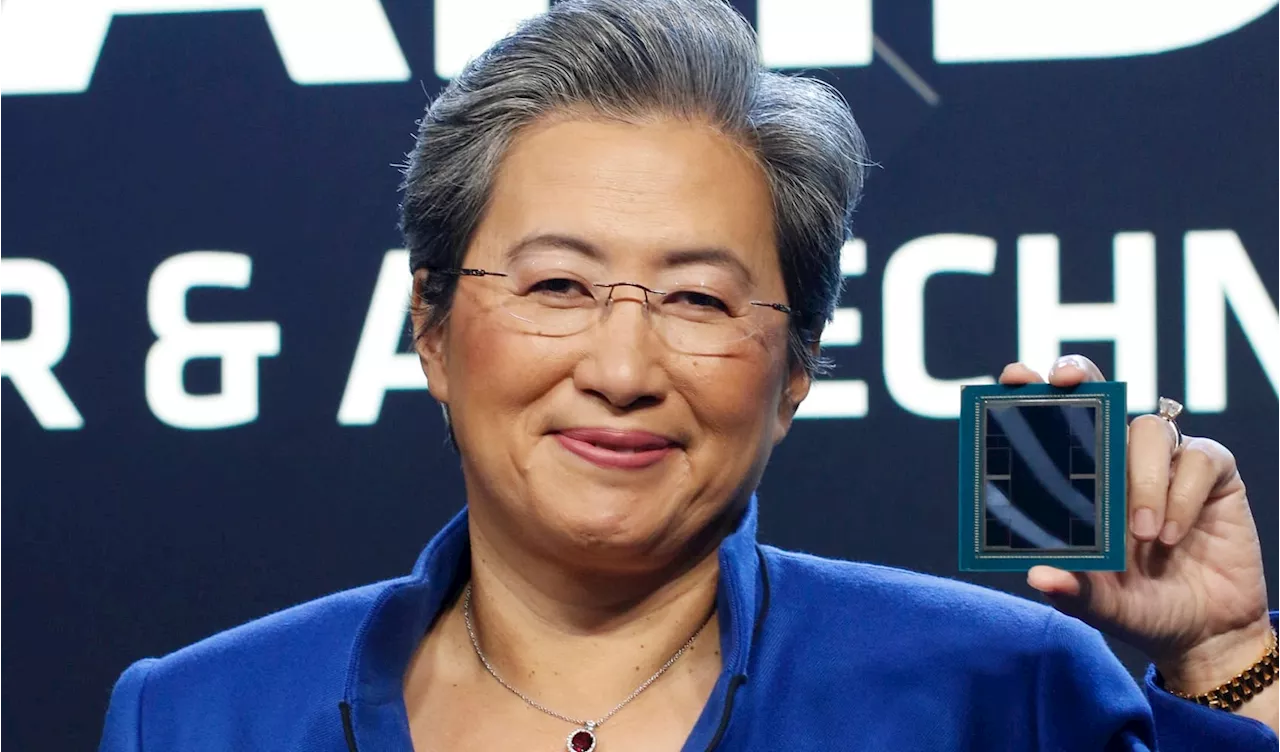

Su told investors on an earnings call that AMD believes it will report "strong double-digit percentage revenue and EPS growth" in 2025. AMD reported $3.86 billion in data center sales, which was up 69% on a year-over-year basis. The company said the increase was due to sales both in its Instinct GPUs and its EPYC CPUs, which compete with

For the full year, AMD's data center division revenue increased 94% to $12.6 billion. AMD said that $5 billion of those sales were from its Instinct GPUs for AI., it's released competitive data center GPUs in recent years such as the MI300X, that some big infrastructure buyers, including

AMD Data Center Earnings Revenue Artificial Intelligence

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

AMD Beats Quarterly Earnings Expectations But Misses Data Center TargetsAMD surpassed Wall Street's expectations for sales and earnings in the fourth quarter. However, the company's stock dipped after-hours as its data center segment fell short of projections. Although data center revenue grew significantly, it missed analysts' estimates.

AMD Beats Quarterly Earnings Expectations But Misses Data Center TargetsAMD surpassed Wall Street's expectations for sales and earnings in the fourth quarter. However, the company's stock dipped after-hours as its data center segment fell short of projections. Although data center revenue grew significantly, it missed analysts' estimates.

Read more »

Pfizer Beats Q4 Earnings Estimates, Fueled by Covid Sales and Seagen AcquisitionPfizer exceeded fourth-quarter earnings and revenue expectations, driven by strong sales of its Covid-19 products and the contribution of newly acquired cancer drugmaker Seagen. This positive result marks a significant step for Pfizer as it navigates a shift away from its Covid-19 business and focuses on long-term growth strategies.

Pfizer Beats Q4 Earnings Estimates, Fueled by Covid Sales and Seagen AcquisitionPfizer exceeded fourth-quarter earnings and revenue expectations, driven by strong sales of its Covid-19 products and the contribution of newly acquired cancer drugmaker Seagen. This positive result marks a significant step for Pfizer as it navigates a shift away from its Covid-19 business and focuses on long-term growth strategies.

Read more »

Starbucks Beats Earnings Estimates but Same-Store Sales Decline for Fourth Consecutive QuarterStarbucks surpasses Wall Street's expectations for earnings and revenue in its latest quarter, but experiences a fourth straight decline in same-store sales. CEO Brian Niccol attributes the progress to recent changes like removing charges for non-dairy milk and focusing on core coffee offerings. The company reports a 4% drop in same-store sales, outperforming analyst predictions of a 5.5% decline. Starbucks also cites ongoing efforts to revitalize its U.S. business and plans to control expansion and renovations to allocate resources for its turnaround strategy.

Starbucks Beats Earnings Estimates but Same-Store Sales Decline for Fourth Consecutive QuarterStarbucks surpasses Wall Street's expectations for earnings and revenue in its latest quarter, but experiences a fourth straight decline in same-store sales. CEO Brian Niccol attributes the progress to recent changes like removing charges for non-dairy milk and focusing on core coffee offerings. The company reports a 4% drop in same-store sales, outperforming analyst predictions of a 5.5% decline. Starbucks also cites ongoing efforts to revitalize its U.S. business and plans to control expansion and renovations to allocate resources for its turnaround strategy.

Read more »

Pfizer Beats Q4 Earnings and Revenue ExpectationsPfizer reported fourth-quarter earnings and revenue that surpassed analysts' predictions, driven by strong demand for its Covid-19 products and cost-cutting measures. The pharmaceutical giant also provided its outlook for 2025, forecasting sales between $61 billion and $64 billion.

Pfizer Beats Q4 Earnings and Revenue ExpectationsPfizer reported fourth-quarter earnings and revenue that surpassed analysts' predictions, driven by strong demand for its Covid-19 products and cost-cutting measures. The pharmaceutical giant also provided its outlook for 2025, forecasting sales between $61 billion and $64 billion.

Read more »

Pfizer tops earnings estimates as Covid product sales beat expectations and cost cuts pay offThe results cap off a critical year for Pfizer, which has been slashing costs as it recovers from the rapid decline of its Covid business and stock price.

Pfizer tops earnings estimates as Covid product sales beat expectations and cost cuts pay offThe results cap off a critical year for Pfizer, which has been slashing costs as it recovers from the rapid decline of its Covid business and stock price.

Read more »

Starbucks earnings top estimates, but same-store sales decline for fourth straight quarterStarbucks said its same-store sales fell 4%, fueled by a 6% decline in visits to its stores.

Starbucks earnings top estimates, but same-store sales decline for fourth straight quarterStarbucks said its same-store sales fell 4%, fueled by a 6% decline in visits to its stores.

Read more »