Alphabet's stock took a significant hit after the company announced plans for a substantial increase in AI-related spending, despite a slowdown in revenue growth. Google CEO Sundar Pichai stated that the company would invest $75 billion in capital expenditures by 2025, raising concerns among investors.

Google parent Alphabet ’s stock plunged by more than 8% — wiping out more than $200 billlion in market value — after the search giant unveiled plans for a massive uptick in AI-related spending despite a slowdown in revenue. Alphabet shares in midday trades were recently off 7.6% at $190.70. If the stock selloff holds, it would erase all of Alphabet ’s stock gains since the start of the year.

Pichai said that DeepSeek had done “very, very good work” but asserted that Google’s AI products were “some of the most efficient models out there.” He also defended Google’s spending plans.Walmart axing hundreds of jobs, closing office as more white-collar workers asked to relocate“The cost of actually using is going to keep coming down, which will make more use cases feasible,” Pichai added. “And that’s the opportunity space.

Overall, the Google parent reported quarterly revenue rose 12% to $96.5 billion – its lowest growth rate since 2023.“While the Cloud segment delivered revenue growth of 30%+ for a second consecutive quarter, results were slightly below investor expectations,” Wedbush analyst Dan Ives said in a note to clients. “That said, management commentary was positive and indicated that demand outpaced available capacity in the quarter.

Google is one of several Big Tech giants that have teed up major investments in AI infrastructure as they race against China – and each other – to develop advanced models.

AI Investments Google Alphabet Revenue

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Alphabet Stock Climbs to $200 as Investors Bet on AIAlphabet Inc.'s stock surged to a new high of $200 per share on Friday, fueled by investor optimism surrounding the company's artificial intelligence (AI) capabilities. The stock's gain comes amidst regulatory challenges and increased competition in the AI landscape.

Alphabet Stock Climbs to $200 as Investors Bet on AIAlphabet Inc.'s stock surged to a new high of $200 per share on Friday, fueled by investor optimism surrounding the company's artificial intelligence (AI) capabilities. The stock's gain comes amidst regulatory challenges and increased competition in the AI landscape.

Read more »

Alphabet's Stock Soars on AI OptimismAlphabet's stock hit a new high, driven by investor confidence in the company's artificial intelligence (AI) capabilities. Despite regulatory hurdles and competition, analysts predict continued success for Google in the AI space.

Alphabet's Stock Soars on AI OptimismAlphabet's stock hit a new high, driven by investor confidence in the company's artificial intelligence (AI) capabilities. Despite regulatory hurdles and competition, analysts predict continued success for Google in the AI space.

Read more »

Alphabet Stock Dips After Revenue Miss and Hefty Capital Expenditure GuidanceAlphabet's shares fell sharply after hours Tuesday following a revenue shortfall in its latest quarter and a significantly higher-than-expected capital expenditure forecast for 2025. While earnings beat estimates, the sales miss and increased spending raise concerns about competition and Alphabet's ability to navigate the evolving technological landscape.

Alphabet Stock Dips After Revenue Miss and Hefty Capital Expenditure GuidanceAlphabet's shares fell sharply after hours Tuesday following a revenue shortfall in its latest quarter and a significantly higher-than-expected capital expenditure forecast for 2025. While earnings beat estimates, the sales miss and increased spending raise concerns about competition and Alphabet's ability to navigate the evolving technological landscape.

Read more »

Moderna stock plunges 20% after company lowers 2025 sales forecast by $1 billionModerna now expects 2025 revenue to come in between $1.5 billion and $2.5 billion, most of which will come in the second half of the year.

Moderna stock plunges 20% after company lowers 2025 sales forecast by $1 billionModerna now expects 2025 revenue to come in between $1.5 billion and $2.5 billion, most of which will come in the second half of the year.

Read more »

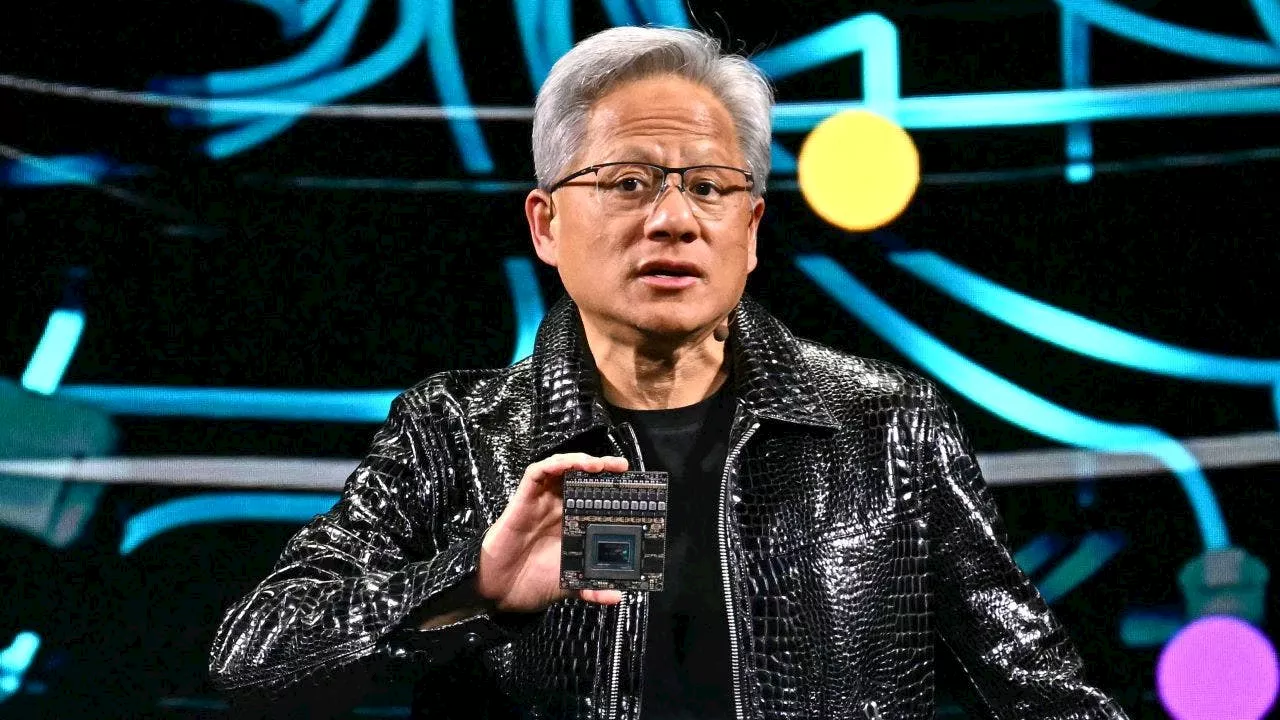

Nvidia Stock Plunges 17% on DeepSeek Competition FearsNvidia's shares plummeted 17% on Monday, wiping out nearly $600 billion in market value, the largest single-day loss for a U.S. company ever. The selloff, impacting the broader U.S. tech sector, was triggered by concerns about increased competition from Chinese AI lab DeepSeek. Data center companies reliant on Nvidia chips also experienced significant drops. Analysts believe DeepSeek's latest technology poses a challenge to Nvidia's dominance in the AI data center chip market.

Nvidia Stock Plunges 17% on DeepSeek Competition FearsNvidia's shares plummeted 17% on Monday, wiping out nearly $600 billion in market value, the largest single-day loss for a U.S. company ever. The selloff, impacting the broader U.S. tech sector, was triggered by concerns about increased competition from Chinese AI lab DeepSeek. Data center companies reliant on Nvidia chips also experienced significant drops. Analysts believe DeepSeek's latest technology poses a challenge to Nvidia's dominance in the AI data center chip market.

Read more »

Nvidia CEO's Fortune Plunges Amidst Tech Stock DownturnNvidia CEO Jensen Huang's net worth takes a significant hit as tech stocks, particularly in the AI sector, experience a sharp decline following the emergence of a competitive Chinese AI startup.

Nvidia CEO's Fortune Plunges Amidst Tech Stock DownturnNvidia CEO Jensen Huang's net worth takes a significant hit as tech stocks, particularly in the AI sector, experience a sharp decline following the emergence of a competitive Chinese AI startup.

Read more »