If you are looking for low risk, but hoping for some modest returns, high\u002Dinterest savings accounts (HISAs) may be just the

Introduced to Canadians more than two decades ago, HISAs offer higher interest rates than your standard day-to-day savings accounts. Rates for HISAs are higher than they have been in years and are expected to rise even more. This is a result of thefour times so far in 2022. On July 13, they announced the largest increase yet, bringing the overnight rate to 2.50 per cent with hopes of calming inflation, which hit 8.1 per cent in June.

Even though HISAs typically pay significantly more interest than a chequing or savings account from a traditional bank, many people are hesitant to set one up. Here’s what you need to know about HISAs, including how to set one up so you can start seeing your savings grow.The obvious reason to get a HISA is for the high interest that they pay. For example, digital banks such ascurrently offer HISAs that pay 1.65 per cent to 1.80 per cent interest.

With savings accounts, many traditional banks no longer charge a monthly fee, but you may have a limited number of transactions unless you keep a minimum balance.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

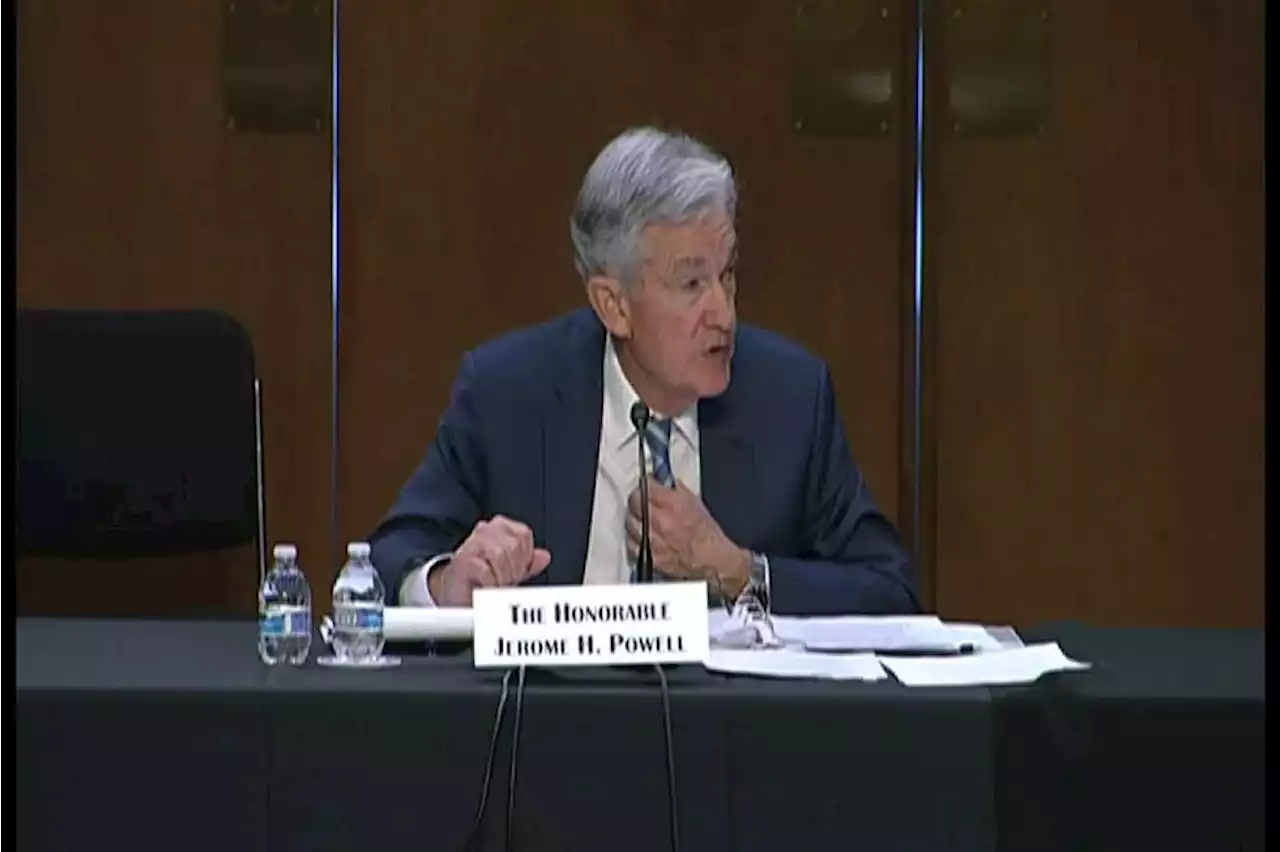

Fed set to impose another big rate hike to fight inflationFor now, the Fed is focused squarely on its inflation fight, and this week it’s set to announce another hefty hike in its benchmark interest rate.

Fed set to impose another big rate hike to fight inflationFor now, the Fed is focused squarely on its inflation fight, and this week it’s set to announce another hefty hike in its benchmark interest rate.

Read more »

The upper middle class is reeling from stock market tanking, inflationThe upper middle class is losing 2022 so far as the stock market tanks, inflation rages, and they take on more debt with high interest rates

Read more »

Jill On Money: Crypto gets crushed as the dollar delightsRising interest rates help bolster traditional currency

Jill On Money: Crypto gets crushed as the dollar delightsRising interest rates help bolster traditional currency

Read more »

Fed set to impose another big rate hike to fight inflationThis week it’s set to announce another hefty hike in its benchmark interest rate.

Fed set to impose another big rate hike to fight inflationThis week it’s set to announce another hefty hike in its benchmark interest rate.

Read more »

Gold Prices Hit by Renewed Bets on Higher Yields and Stronger DollarThe precious metal is on track for its fourth-consecutive monthly price decline, despite the surge in inflation.

Gold Prices Hit by Renewed Bets on Higher Yields and Stronger DollarThe precious metal is on track for its fourth-consecutive monthly price decline, despite the surge in inflation.

Read more »

Why Rising Inflation Means You Should Ditch Supermarkets for Your Local Farmers MarketGetting your produce from the farmers market is still worth it because of the health benefits and hospitality, even amid inflation, according to experts.

Why Rising Inflation Means You Should Ditch Supermarkets for Your Local Farmers MarketGetting your produce from the farmers market is still worth it because of the health benefits and hospitality, even amid inflation, according to experts.

Read more »