As inflation continues to impact consumers, more Americans are resorting to making hardship withdrawals from their 401(k) retirement plans to cover expenses. Bank of America's latest data reveals a growing number of individuals using their retirement savings to address financial emergencies.

Strategic Wealth Partners investment strategist Luke Lloyd on what to expect from the July PPI and discusses 2Q earnings.to cover a financial emergency amid chronically high inflation, according to new data from Bank of America.

About 15,950 workers taking part in employer-sponsored 401 plans made a "hardship" withdrawal during the first three months of 2023, according to Bank of America's analysis of clients' employee benefits programs, which tracks about 4 million accounts. Hardship withdrawals allow workers to tap their 401 for an "immediate and heavy financial need." on the money and could be hit with a 10% early withdrawal fee if they are under the age of 59½.

Someone who takes a hardship withdrawal also cannot pay it back to his 401 and cannot roll that money into another retirement savings account.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Is the Lack of a 401(k) Becoming a Deal Breaker for New Hires?According to an expert, a 401(k) is typically the first investment experience for workers. As a result, the absence of this benefit may be a significant factor for new hires. This article discusses the importance of starting to save early and suggests delaying debt payments to prioritize savings, especially for individuals facing financial challenges due to the COVID-19 pandemic.

Is the Lack of a 401(k) Becoming a Deal Breaker for New Hires?According to an expert, a 401(k) is typically the first investment experience for workers. As a result, the absence of this benefit may be a significant factor for new hires. This article discusses the importance of starting to save early and suggests delaying debt payments to prioritize savings, especially for individuals facing financial challenges due to the COVID-19 pandemic.

Read more »

Americans are pulling money out of their 401(k) plans at an alarming rateMore Americans are tapping their 401(k) accounts because of financial distress, according to Bank of America data released Tuesday. The number of people who made a hardship withdrawal during the second quarter marched higher from the first three months of the year to 15,950, an increase of 36% from the second quarter of 2022, according to Bank of America’s analysis of clients’ employee benefits programs, which are comprised of more than 4 million plan participants.

Americans are pulling money out of their 401(k) plans at an alarming rateMore Americans are tapping their 401(k) accounts because of financial distress, according to Bank of America data released Tuesday. The number of people who made a hardship withdrawal during the second quarter marched higher from the first three months of the year to 15,950, an increase of 36% from the second quarter of 2022, according to Bank of America’s analysis of clients’ employee benefits programs, which are comprised of more than 4 million plan participants.

Read more »

The Pros and Cons of Taking Out a 401(k) LoanConsumer Investigator Rachel DePompa discusses the advantages and disadvantages of taking out a loan from a 401(k) with the Virginia Credit Union. According to Dale from the credit union, it is generally recommended to opt for a loan rather than a withdrawal from your 401(k). Borrowers can typically borrow up to $50,000 or 50% of their 401(k) balance, and they have approximately five years to repay the loan.

The Pros and Cons of Taking Out a 401(k) LoanConsumer Investigator Rachel DePompa discusses the advantages and disadvantages of taking out a loan from a 401(k) with the Virginia Credit Union. According to Dale from the credit union, it is generally recommended to opt for a loan rather than a withdrawal from your 401(k). Borrowers can typically borrow up to $50,000 or 50% of their 401(k) balance, and they have approximately five years to repay the loan.

Read more »

Americans are pulling from their 401(k) at dramatic rate'The number of participants taking hardship distributions increased 36 percent year-over-year,' the report said. August 7, 2023 According to Investopedia, a hardship withdrawal from a 401(k) plan is used for an 'immediate and heavy financial need.' 'It is an authorized withdrawal—meaning the IRS can waive penalties—but it does not relieve you of your tax responsibilities,' Investopedia states.

Americans are pulling from their 401(k) at dramatic rate'The number of participants taking hardship distributions increased 36 percent year-over-year,' the report said. August 7, 2023 According to Investopedia, a hardship withdrawal from a 401(k) plan is used for an 'immediate and heavy financial need.' 'It is an authorized withdrawal—meaning the IRS can waive penalties—but it does not relieve you of your tax responsibilities,' Investopedia states.

Read more »

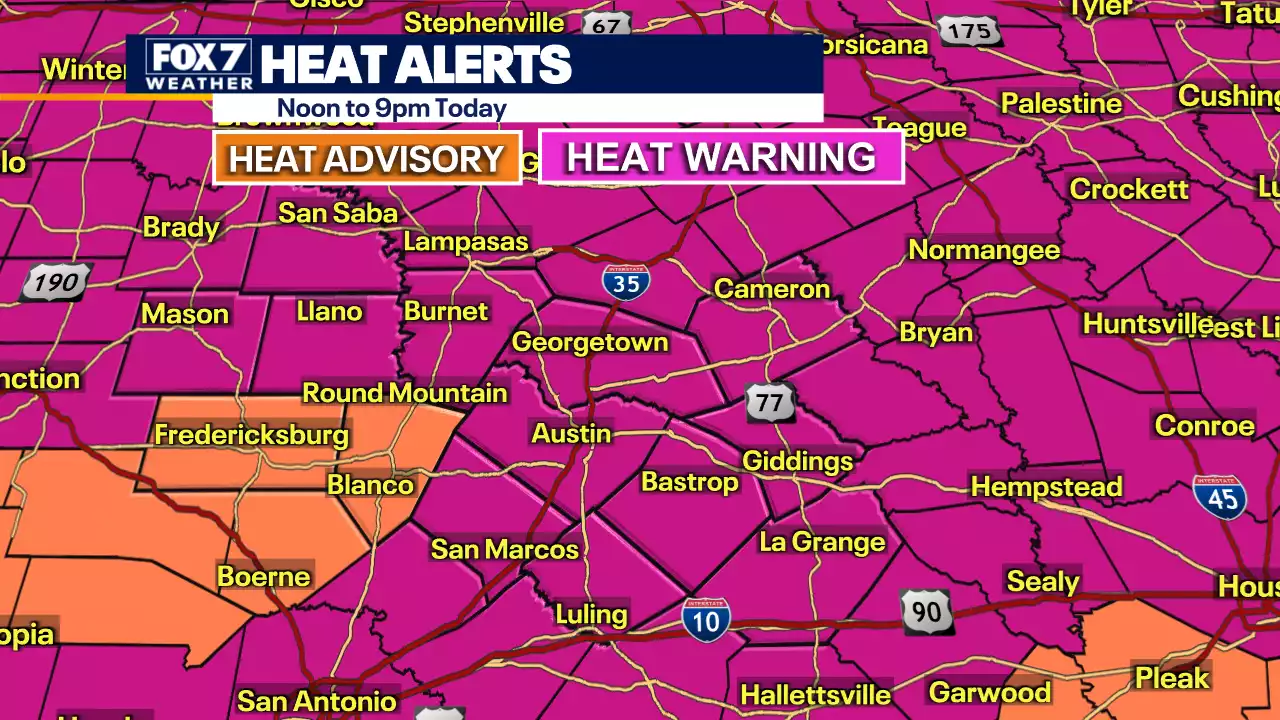

Austin weather: Hot and breezy weather Monday will increase wildfire riskAustin isn't just breaking the record for the longest triple-digit streak, we're shattering it. Zack Shields has the latest on this excessive heat.

Austin weather: Hot and breezy weather Monday will increase wildfire riskAustin isn't just breaking the record for the longest triple-digit streak, we're shattering it. Zack Shields has the latest on this excessive heat.

Read more »