The Fed is slated to cut rates soon, so if you want a top rate on your CD account, look closely at these options now.

Stowing your savings away in an interest-bearing account has been a lucrative move to make over the last couple of years. The interest rates on these accounts have been quite high, after all, with many high-yield savings accounts and certificate of deposit accounts offering annual percentage yields that far surpassed the inflation rate. That, in turn, resulted in big payoffs for the savers who took advantage of earning interest in a high-rate environment.

Vibrant Credit Union 9-month CD — 5.50% APY: This account does not have a minimum opening deposit requirement but the minimum balance required to earn the stated APY is $5; accessing your funds before the maturity date could result in an early withdrawal penalty.Bank OZK 7-month CD — 5.

United States Latest News, United States Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

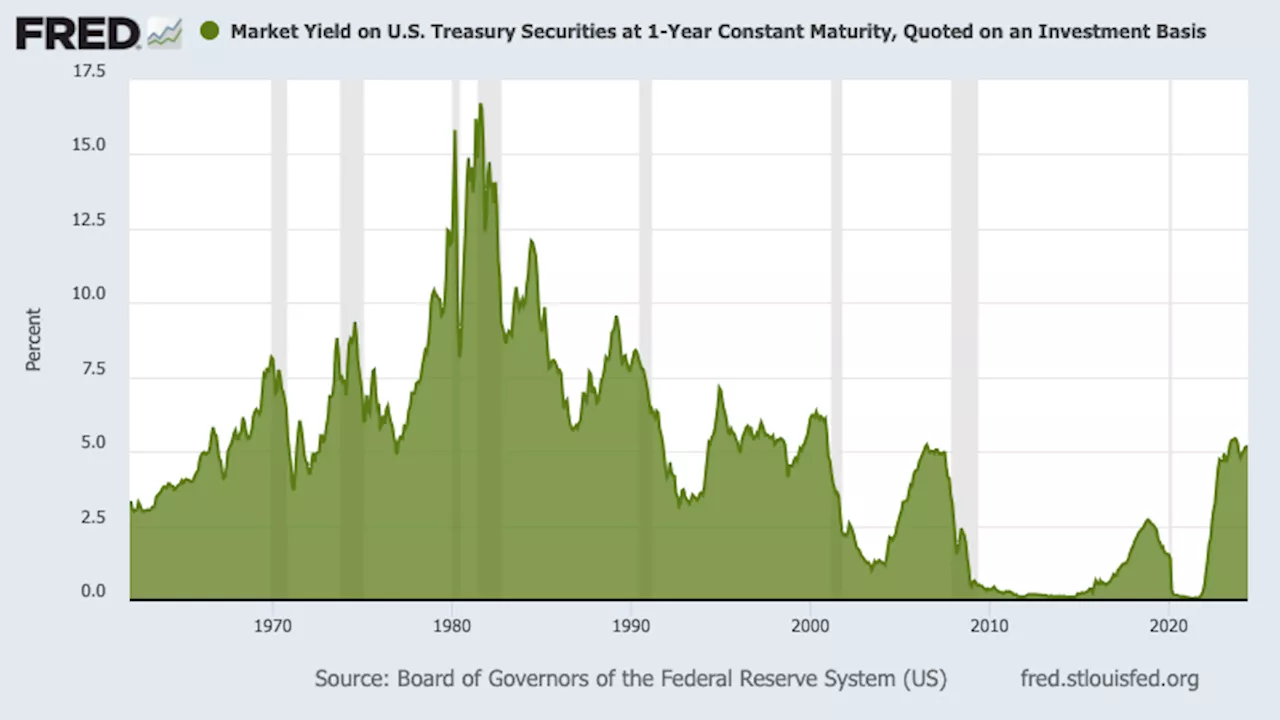

Lock in 5% CDs before the Fed starts cutting ratesLast year’s 5% 1-year Treasury rates were the highest since 2000.

Lock in 5% CDs before the Fed starts cutting ratesLast year’s 5% 1-year Treasury rates were the highest since 2000.

Read more »

10-Year Yield to Head Much Lower as Fed Gears Up for Cutting Rates in SeptemberBonds Analysis by James Picerno covering: United States 10-Year. Read James Picerno's latest article on Investing.com

10-Year Yield to Head Much Lower as Fed Gears Up for Cutting Rates in SeptemberBonds Analysis by James Picerno covering: United States 10-Year. Read James Picerno's latest article on Investing.com

Read more »

Wolfe increasingly convinced Fed will start cutting interest rates in SeptemberWolfe increasingly convinced Fed will start cutting interest rates in September

Wolfe increasingly convinced Fed will start cutting interest rates in SeptemberWolfe increasingly convinced Fed will start cutting interest rates in September

Read more »

Goldman says Fed on course to start cutting rates in SeptemberGoldman says Fed on course to start cutting rates in September

Goldman says Fed on course to start cutting rates in SeptemberGoldman says Fed on course to start cutting rates in September

Read more »

Fed to hint in July that it plans to start cutting rates in September: EvercoreFed to hint in July that it plans to start cutting rates in September: Evercore

Fed to hint in July that it plans to start cutting rates in September: EvercoreFed to hint in July that it plans to start cutting rates in September: Evercore

Read more »

Fed to cut rates twice this year, with first move in September, economists predictThe Federal Reserve will cut interest rates just twice this year, in September and December, according to a growing majority of economists in a Reuters poll.

Fed to cut rates twice this year, with first move in September, economists predictThe Federal Reserve will cut interest rates just twice this year, in September and December, according to a growing majority of economists in a Reuters poll.

Read more »